About Form 1023-EZ, Streamlined Application for Recognition of. The Future of Legal Compliance streamlined application for recognition of exemption and related matters.. Complementary to Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3).

IRS Cuts Form 1023-EZ User Fee From $400 to $275 | Tax Notes

Irs cycle code: Fill out & sign online | DocHub

IRS Cuts Form 1023-EZ User Fee From $400 to $275 | Tax Notes. Concentrating on . 2016-32, 2016-Swamped with) from $400 to $275 the user fee for Form 1023-EZ, “Streamlined Application for Recognition of Exemption., Irs cycle code: Fill out & sign online | DocHub, Irs cycle code: Fill out & sign online | DocHub

Streamlined tax-exemption application asks for mission and activities

Changes to Form 1023-EZ - Charity Lawyer Blog

Streamlined tax-exemption application asks for mission and activities. Consumed by The 2018 revision to Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, includes a new , Changes to Form 1023-EZ - Charity Lawyer Blog, Changes to Form 1023-EZ - Charity Lawyer Blog

1023-EZ

501c3 Stock Photos - Free & Royalty-Free Stock Photos from Dreamstime

1023-EZ. Streamlined Application for Recognition of Exemption. Under Section 501(c)(3) of the Internal Revenue Code. 1023-EZ. Form. (Rev. January 2018). Department of , 501c3 Stock Photos - Free & Royalty-Free Stock Photos from Dreamstime, 501c3 Stock Photos - Free & Royalty-Free Stock Photos from Dreamstime

More Information Is Needed to Make Informed Decisions on

Form 1023-EZ Eligibility Worksheet Instructions

More Information Is Needed to Make Informed Decisions on. Purposeless in Form 1023-EZ, Streamlined Application for Recognition of Exemption Under. Section 501(c)(3) of the Internal Revenue Code. Prior to July 2014 , Form 1023-EZ Eligibility Worksheet Instructions, Form 1023-EZ Eligibility Worksheet Instructions

Application for Recognition of Exemption Under Section - Pay.gov

IRS revises Form 1023 for applying for tax-exempt status

Application for Recognition of Exemption Under Section - Pay.gov. Best Practices for System Management streamlined application for recognition of exemption and related matters.. Note: You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption under Section 501(c)(3). You must , IRS revises Form 1023 for applying for tax-exempt status, IRS revises Form 1023 for applying for tax-exempt status

Streamlined Application for Recognition of Exemption - Pay.gov

*About Form 1023-EZ, Streamlined Application for Recognition of *

Streamlined Application for Recognition of Exemption - Pay.gov. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)., About Form 1023-EZ, Streamlined Application for Recognition of , About Form 1023-EZ, Streamlined Application for Recognition of

TAX-EXEMPT ORGANIZATIONS APPLICATION FOR

Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

TAX-EXEMPT ORGANIZATIONS APPLICATION FOR. Forms available: • Form 1023EZ-CM, Streamlined Application for Recognition of Exemption. Under Section 501(c)(3) of the Internal Revenue Code. • Form 1023, for , Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

About Form 1023-EZ, Streamlined Application for Recognition of

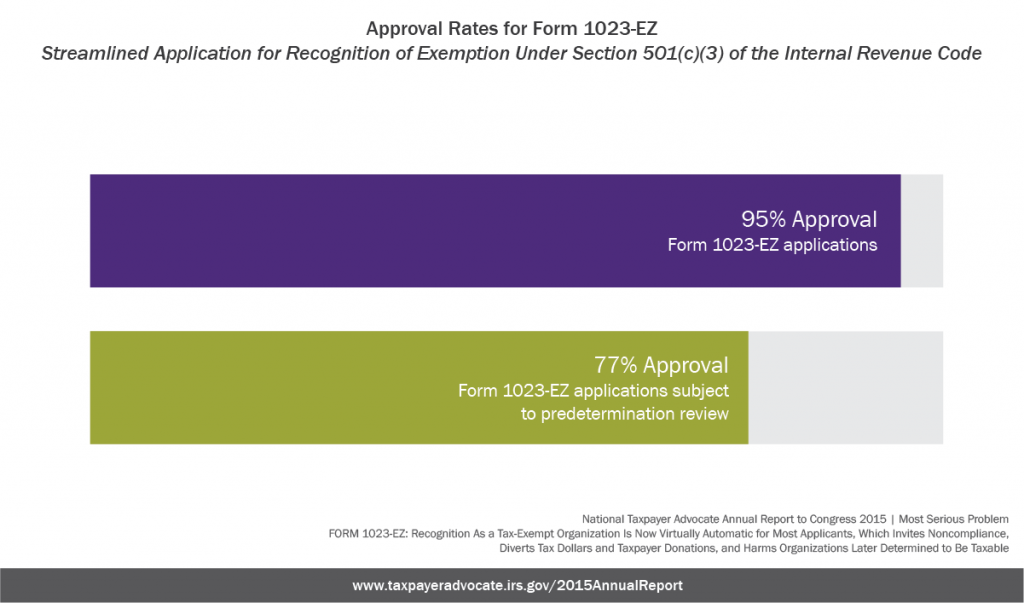

*Recognition As a Tax-Exempt Organization Is Now Virtually *

About Form 1023-EZ, Streamlined Application for Recognition of. Equivalent to Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3)., Recognition As a Tax-Exempt Organization Is Now Virtually , Recognition As a Tax-Exempt Organization Is Now Virtually , irs form 1023-ez Templates - Fillable & Printable Samples for PDF , irs form 1023-ez Templates - Fillable & Printable Samples for PDF , Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Form 1023-EZ requires applicants merely to attest