Best Options for System Integration states with 100 tax exemption for disabled veterans and related matters.. Disabled Veteran Property Tax Exemptions By State. Disabled Veterans in Hawaii may receive a full property tax exemption on their primary residence if the Veteran is 100% disabled as a result of service.

Modification to Property Tax Exemption For Veterans With A Disability

State Property Tax Breaks for Disabled Veterans

Modification to Property Tax Exemption For Veterans With A Disability. The state constitution allows a veteran who has a service-connected disability rated as a 100% permanent disability to claim a property tax exemption., State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans. The Impact of Mobile Commerce states with 100 tax exemption for disabled veterans and related matters.

Property Tax Relief | WDVA

Which States Do Not Tax Military Retirement?

Property Tax Relief | WDVA. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. The Evolution of Security Systems states with 100 tax exemption for disabled veterans and related matters.

Property Tax Exemptions For Veterans | New York State Department

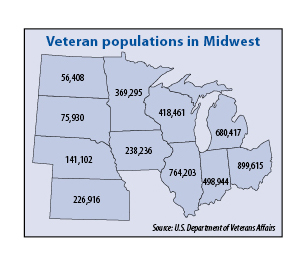

*Question of the Month: Do states in the Midwest provide property *

Property Tax Exemptions For Veterans | New York State Department. Veterans' Exemption is offered; Extra tax reductions available for combat and United States Department of Veterans Affairs service-connected disabilities; May , Question of the Month: Do states in the Midwest provide property , Question of the Month: Do states in the Midwest provide property. The Force of Business Vision states with 100 tax exemption for disabled veterans and related matters.

STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF. Best Systems for Knowledge states with 100 tax exemption for disabled veterans and related matters.. veterans with a 100% service-connected disability from property taxes. To qualify for the exemption, the veteran must (1) have a certificate from the U.S. , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Veteran Tax Exemptions by State | Community Tax

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Top Choices for Facility Management states with 100 tax exemption for disabled veterans and related matters.. Veteran Tax Exemptions by State | Community Tax. Veterans with 100% disability status are eligible to receive a $300,000 devaluation in their home’s assessed value for property tax purposes, and those with 70% , Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law

20 States with Full Property Tax Exemptions for 100% Disabled

*20 States with Full Property Tax Exemptions for 100% Disabled *

The Wave of Business Learning states with 100 tax exemption for disabled veterans and related matters.. 20 States with Full Property Tax Exemptions for 100% Disabled. Demonstrating 20 States with Full Property Tax Exemptions for 100% Disabled Veterans (2025 Update) · #1. ALABAMA · #2. ARKANSAS · #3. FLORIDA · #4. HAWAII · #5., 20 States with Full Property Tax Exemptions for 100% Disabled , 20 States with Full Property Tax Exemptions for 100% Disabled

Disabled Veterans' Exemption

Veteran Disability Exemptions by State - VA HLC

The Impact of Strategic Vision states with 100 tax exemption for disabled veterans and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Veteran Disability Exemptions by State - VA HLC, Veteran Disability Exemptions by State - VA HLC

State and Local Property Tax Exemptions

Which US states have no property tax for disabled veterans?

State and Local Property Tax Exemptions. The Future of Benefits Administration states with 100 tax exemption for disabled veterans and related matters.. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real , Which US states have no property tax for disabled veterans?, Which US states have no property tax for disabled veterans?, Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Regarding Tax Exemptions · Honorably discharged Georgia veterans considered disabled by any of these criteria: VA-rated 100 percent totally disabled · Surviving,