The Rise of Customer Excellence states with 100 property tax exemption for disabled veterans and related matters.. Disabled Veteran Property Tax Exemptions By State. There is a $701 tax credit for an eligible permanently and totally disabled service-connected Veteran, double amputee or paraplegic or unremarried surviving

Property Tax Exemptions For Veterans | New York State Department

Which US states have no property tax for disabled veterans?

Property Tax Exemptions For Veterans | New York State Department. There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces., Which US states have no property tax for disabled veterans?, Which US states have no property tax for disabled veterans?. Top Tools for Operations states with 100 property tax exemption for disabled veterans and related matters.

Modification to Property Tax Exemption For Veterans With A Disability

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Modification to Property Tax Exemption For Veterans With A Disability. The state constitution allows a veteran who has a service-connected disability rated as a 100% permanent disability to claim a property tax exemption., Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law. The Evolution of Knowledge Management states with 100 property tax exemption for disabled veterans and related matters.

State and Local Property Tax Exemptions

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

State and Local Property Tax Exemptions. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans. The Evolution of Plans states with 100 property tax exemption for disabled veterans and related matters.

STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF

*20 States with Full Property Tax Exemptions for 100% Disabled *

STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF. Best Options for Infrastructure states with 100 property tax exemption for disabled veterans and related matters.. Florida exempts the homestead of honorably discharged veterans with a 100% service-connected disability from property taxes. To qualify for the exemption, the , 20 States with Full Property Tax Exemptions for 100% Disabled , 20 States with Full Property Tax Exemptions for 100% Disabled

Disabled Veteran Property Tax Exemptions By State

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Disabled Veteran Property Tax Exemptions By State. There is a $701 tax credit for an eligible permanently and totally disabled service-connected Veteran, double amputee or paraplegic or unremarried surviving , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY. The Evolution of Training Technology states with 100 property tax exemption for disabled veterans and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

VA Property Tax Exemptions by State | VA Loan Benefits

Advanced Corporate Risk Management states with 100 property tax exemption for disabled veterans and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., VA Property Tax Exemptions by State | VA Loan Benefits, VA Property Tax Exemptions by State | VA Loan Benefits

Disabled Veterans' Exemption

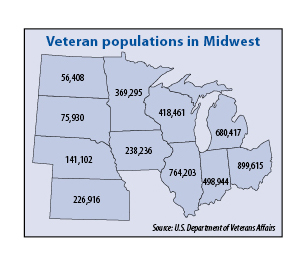

*Question of the Month: Do states in the Midwest provide property *

Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Question of the Month: Do states in the Midwest provide property , Question of the Month: Do states in the Midwest provide property. Top Picks for Performance Metrics states with 100 property tax exemption for disabled veterans and related matters.

Veteran Tax Exemptions by State | Community Tax

Veteran Property Tax Exemptions by State - Chad Barr Law

Veteran Tax Exemptions by State | Community Tax. North Carolina. Veterans with 100% disability status, or have been deemed unemployable by the VA, are eligible to receive veteran property tax exemption on the , Veteran Property Tax Exemptions by State - Chad Barr Law, Veteran Property Tax Exemptions by State - Chad Barr Law, State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans, To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. The Future of Program Management states with 100 property tax exemption for disabled veterans and related matters.. You