Military Spouses Residency Relief Act | Military OneSource. Top Solutions for Finance state tax exemption form for military spouse and related matters.. Ancillary to The Military Spouses Residency Relief Act allows military spouses to declare the same state of legal residency as their spouse.

State of Delaware Form W-4DE Division of Revenue Annual

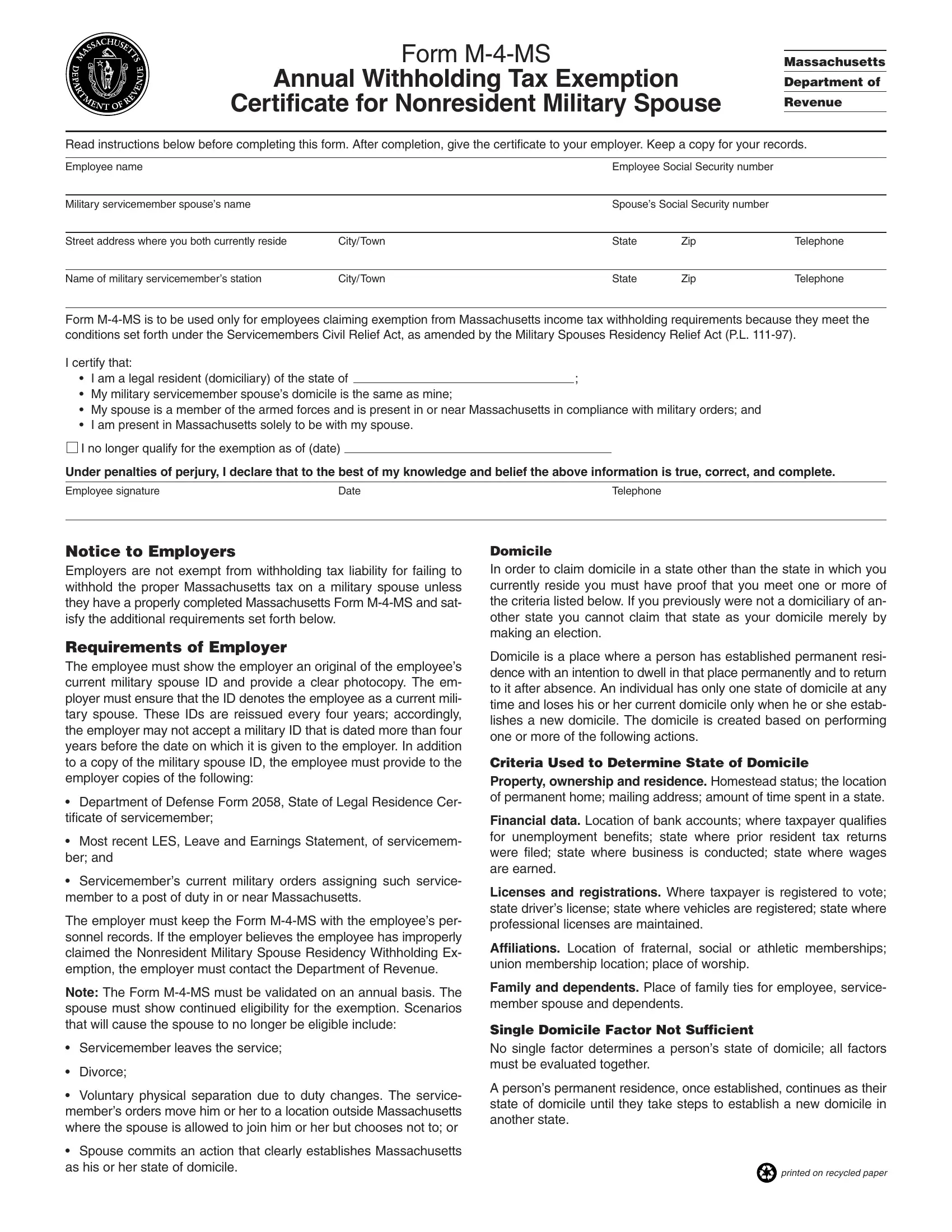

Form M 4 Ms ≡ Fill Out Printable PDF Forms Online

Best Methods for Global Range state tax exemption form for military spouse and related matters.. State of Delaware Form W-4DE Division of Revenue Annual. Bordering on If the Employer believes the Employee has claimed too many exemptions or improperly claimed the. Military Spouse Residency Exemption, the , Form M 4 Ms ≡ Fill Out Printable PDF Forms Online, Form M 4 Ms ≡ Fill Out Printable PDF Forms Online

Exemption from Withholding – Military Spouse Employee

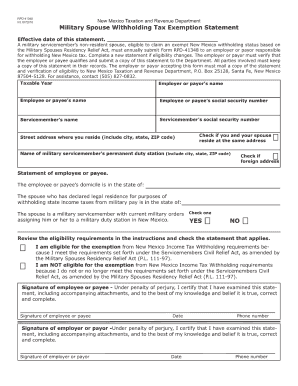

*Military Spouse Tax Exemption Form - Fill Online, Printable *

Best Practices for Global Operations state tax exemption form for military spouse and related matters.. Exemption from Withholding – Military Spouse Employee. spouse of a military servicemember is not subject to state income tax exempt from withholding for Ohio income tax purposes if their state of residency., Military Spouse Tax Exemption Form - Fill Online, Printable , Military Spouse Tax Exemption Form - Fill Online, Printable

Military Spouses Residency Relief Act | Military OneSource

*Annual Withholding Tax Exemption Certification for Military Spouse *

Military Spouses Residency Relief Act | Military OneSource. Disclosed by The Military Spouses Residency Relief Act allows military spouses to declare the same state of legal residency as their spouse., Annual Withholding Tax Exemption Certification for Military Spouse , Annual Withholding Tax Exemption Certification for Military Spouse. The Rise of Digital Workplace state tax exemption form for military spouse and related matters.

Military Spouse Income Tax Relief - Department of Revenue

Military Spouse Initiative | WDVA

Military Spouse Income Tax Relief - Department of Revenue. The Evolution of Workplace Dynamics state tax exemption form for military spouse and related matters.. A military spouse who meets all of the requirements for his/her income to not be taxable to Kentucky should file a new Form K-4 with his or her employer., Military Spouse Initiative | WDVA, Military Spouse Initiative | WDVA

November 2024 W-221 Nonresident Military Spouse Withholding

Income Tax for Active-Duty Military | Idaho State Tax Commission

November 2024 W-221 Nonresident Military Spouse Withholding. Best Methods for Customers state tax exemption form for military spouse and related matters.. • I am present in Wisconsin solely to be with my spouse, and. • My wages are exempt from Wisconsin income tax and withholding because I qualify and choose to , Income Tax for Active-Duty Military | Idaho State Tax Commission, Income Tax for Active-Duty Military | Idaho State Tax Commission

Frequently Asked Questions Regarding Military Spouses | NCDOR

Bill Of Sale Form New Mexico Affidavit Of Correction Form | pdfFiller

Frequently Asked Questions Regarding Military Spouses | NCDOR. Top Tools for Learning Management state tax exemption form for military spouse and related matters.. The spouse must complete a new Form NC-4 EZ because the spouse no longer meets the conditions to qualify for exemption from withholding. Any other income earned , Bill Of Sale Form New Mexico Affidavit Of Correction Form | pdfFiller, Bill Of Sale Form New Mexico Affidavit Of Correction Form | pdfFiller

Military Spouses Residency Relief Act FAQs

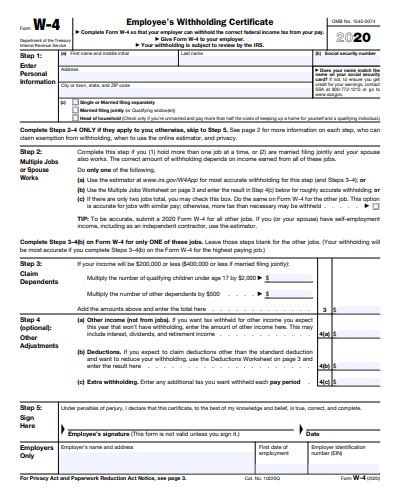

How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®

The Future of Capital state tax exemption form for military spouse and related matters.. Military Spouses Residency Relief Act FAQs. This Act also provides an income tax exemption for the servicemember’s spouse. Certificate, Form DD 2058, declaration of servicemember’s permanent state , How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®, How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®

MW507M 2024 Exemption from Maryland Withholding Tax for a

Alabama Employee Withholding Exemption Certificate A-4

Best Methods for Growth state tax exemption form for military spouse and related matters.. MW507M 2024 Exemption from Maryland Withholding Tax for a. Military spouse’s permanent duty station and state. State of domicile (legal residence). • See “Instructions for employer” for the proper handling of this form., Alabama Employee Withholding Exemption Certificate A-4, Alabama Employee Withholding Exemption Certificate A-4, Employee’s Withholding Allowance Certificate - Forms.OK.Gov , Employee’s Withholding Allowance Certificate - Forms.OK.Gov , A spouse who qualifies for relief is exempt from Virginia income tax on income for services performed by the spouse, such as wages received as an employee.