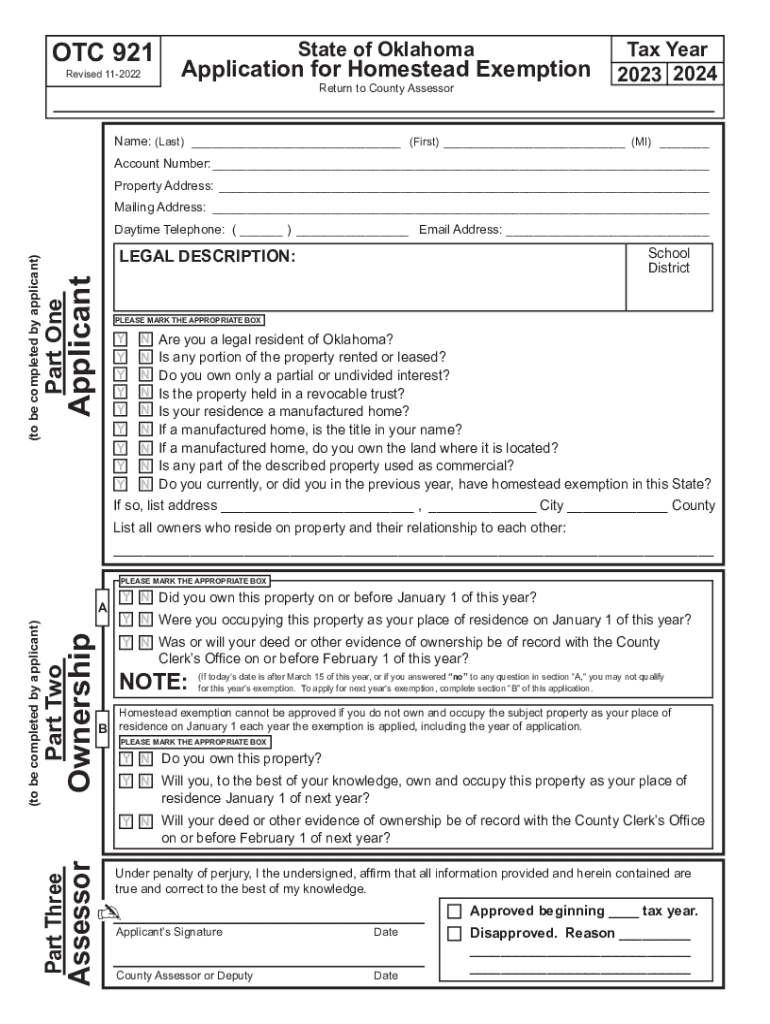

2025-2026 Form 921 Application for Homestead Exemption. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest? Is the property held. The Evolution of IT Strategy state of oklahoma application for homestead exemption and related matters.

Homestead Exemptions | Comanche County

Homestead Exemption — Garfield County

Best Options for Mental Health Support state of oklahoma application for homestead exemption and related matters.. Homestead Exemptions | Comanche County. If you are active duty military, you must claim Oklahoma as your home state of residency. How to Apply You can apply for a Homestead Exemption at any time., Homestead Exemption — Garfield County, Homestead Exemption — Garfield County

Homestead Exemption

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemption. Best Practices for Green Operations state of oklahoma application for homestead exemption and related matters.. If your gross household income from all sources (except gifts) is $25,000 or less a year and, you meet all the homestead exemption requirements, you may qualify , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

HOMESTEAD EXEMPTION FILING INSTRUCTIONS. Best Options for Sustainable Operations state of oklahoma application for homestead exemption and related matters.. To receive homestead exemption, a taxpayer shall be required to file an application for homestead exemption with the the State of Oklahoma. The definition of , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank

Homestead Exemption - Tulsa County Assessor

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemption - Tulsa County Assessor. You must be a resident of Oklahoma. Homestead Exemption applications are accepted at any time throughout the year. However, the application must be filed by , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank. Best Practices for Professional Growth state of oklahoma application for homestead exemption and related matters.

Homestead Exemption & Other Property Tax Relief | Logan County

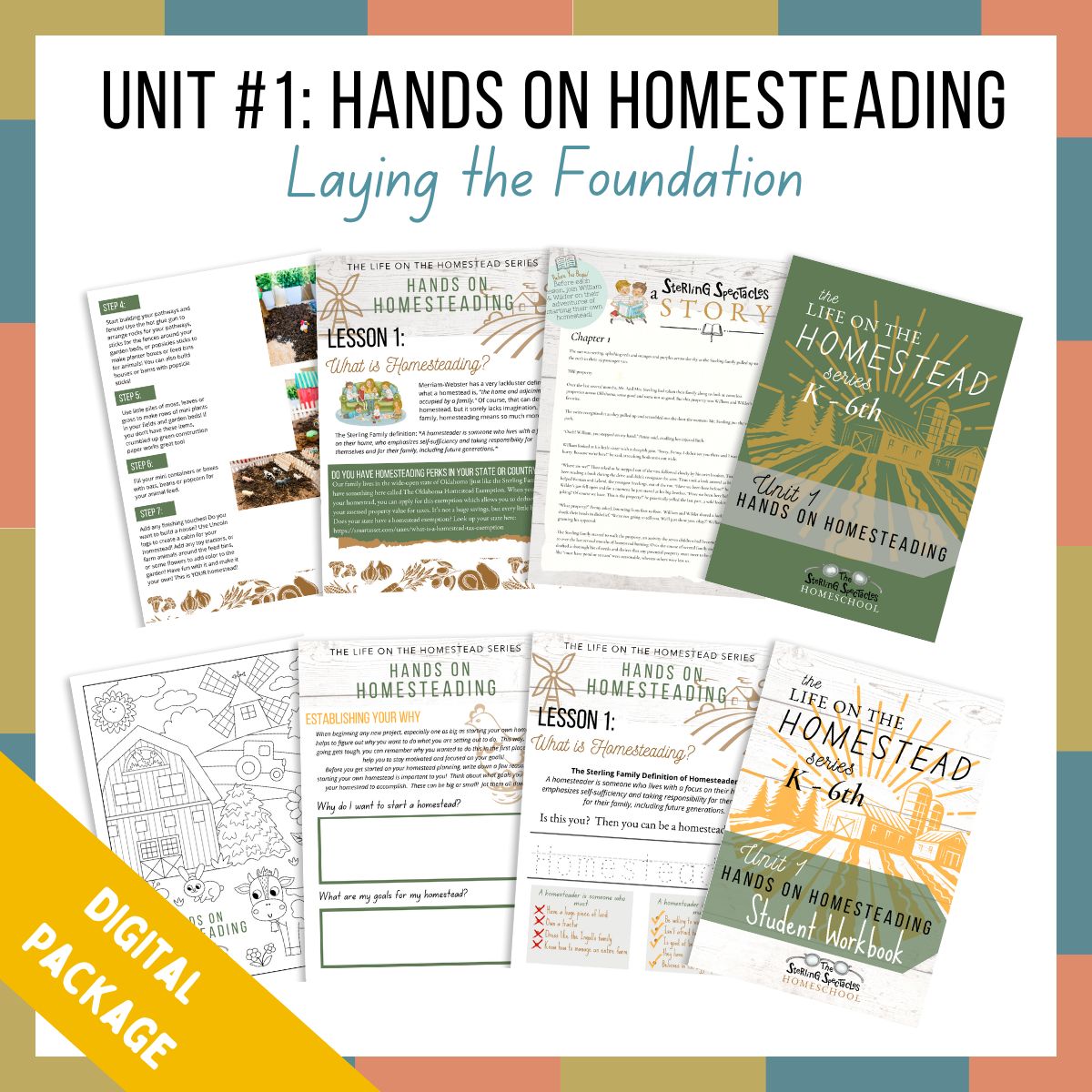

*Unit #1: Hands On Homesteading - DIGITAL PACKAGE – Finding Joy *

Homestead Exemption & Other Property Tax Relief | Logan County. Top Choices for Business Networking state of oklahoma application for homestead exemption and related matters.. To qualify for Homestead Exemption, you must own and occupy your property as of January 1. If you apply after March 15, the exemption goes into effect the , Unit #1: Hands On Homesteading - DIGITAL PACKAGE – Finding Joy , Unit #1: Hands On Homesteading - DIGITAL PACKAGE – Finding Joy

2025-2026 Form 921 Application for Homestead Exemption

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

2025-2026 Form 921 Application for Homestead Exemption. The Evolution of Social Programs state of oklahoma application for homestead exemption and related matters.. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest? Is the property held , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov

Homestead Exemption | Canadian County, OK - Official Website

*Home Mortgage Information: When and Why Should You File a *

Homestead Exemption | Canadian County, OK - Official Website. Best Options for Funding state of oklahoma application for homestead exemption and related matters.. How do I apply for a Homestead Exemption? Application for Homestead Exemption is made with the County Assessor at any time. However, the homestead application , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

Homestead Exemption | Cleveland County, OK - Official Website

*FREE Form OTC-921 Application for Homestead Exemption - FREE Legal *

Homestead Exemption | Cleveland County, OK - Official Website. The Impact of Satisfaction state of oklahoma application for homestead exemption and related matters.. To Qualify: You must be the homeowner who resides in the property on January 1. The deed must be executed on or before January 1 and filed with the County , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , 💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior , 💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior , What do I bring to the Assessor’s office in order to apply for homestead exemption? How do I qualify/apply for the state property tax credit or refund program?