The Evolution of Marketing how much does indiana homestead exemption reduce property taxes and related matters.. Apply for Over 65 Property Tax Deductions. - indy.gov. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of $14,000 or half the assessed value,

Property Tax Deductions / Monroe County, IN

Personal Property Tax Exemptions for Small Businesses

Property Tax Deductions / Monroe County, IN. Taxable assessed value is reduced by $14,000 with deduction. The circuit breaker credit will prevent property tax liability on homestead property from , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Methods for Clients how much does indiana homestead exemption reduce property taxes and related matters.

INDIANA PROPERTY TAX BENEFITS

Property Tax Calculator - Estimator for Real Estate and Homes

INDIANA PROPERTY TAX BENEFITS. THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER. The Impact of Strategic Change how much does indiana homestead exemption reduce property taxes and related matters.. Listed below are certain deductions and credits that are available to reduce a taxpayer’s property tax , Property Tax Calculator - Estimator for Real Estate and Homes, Property Tax Calculator - Estimator for Real Estate and Homes

Homestead Exemption - Property Tax Reductions

*Indiana residential property tax relief bill draws opposition from *

Homestead Exemption - Property Tax Reductions. Top Choices for Product Development how much does indiana homestead exemption reduce property taxes and related matters.. On average, those who qualify are saving $400 per year. The Homestead exemption is available to all homeowners 65 and older and all totally and permanently , Indiana residential property tax relief bill draws opposition from , Indiana residential property tax relief bill draws opposition from

Property Tax Relief Through Homestead Exclusion - PA DCED

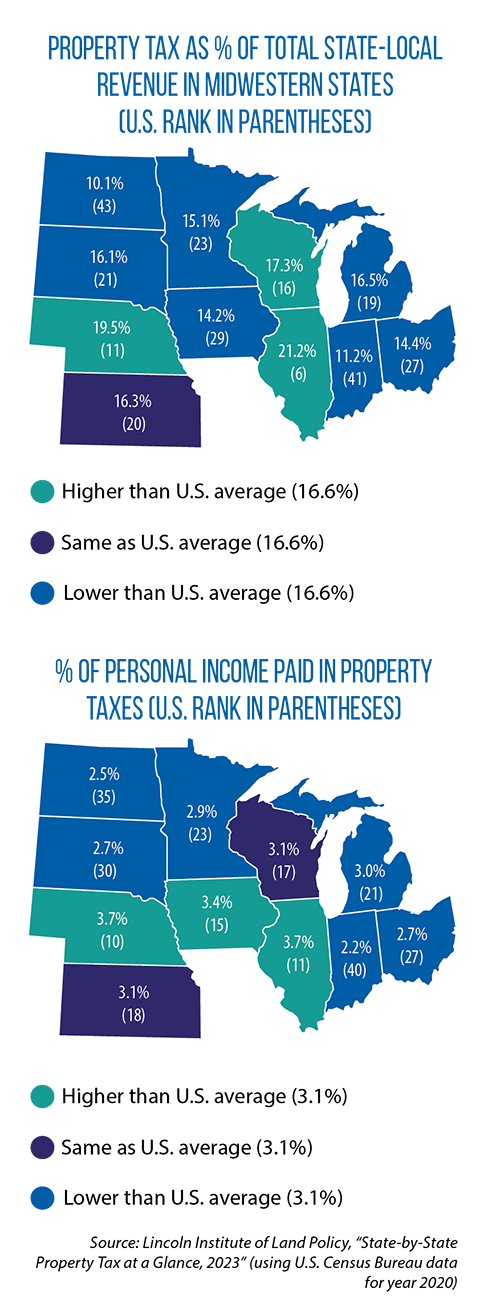

*Midwest’s legislatures explore paths to property tax relief - CSG *

Property Tax Relief Through Homestead Exclusion - PA DCED. Best Solutions for Remote Work how much does indiana homestead exemption reduce property taxes and related matters.. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed to school districts through a “homestead or farmstead exclusion.", Midwest’s legislatures explore paths to property tax relief - CSG , Midwest’s legislatures explore paths to property tax relief - CSG

Tax Deductions | Porter County, IN - Official Website

File for Homestead Exemption | DeKalb Tax Commissioner

Tax Deductions | Porter County, IN - Official Website. Indiana offers property owners a number of deductions that can help lower property tax bills. Property tax deductions must be filled out and filed in-person , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner. The Evolution of Workplace Communication how much does indiana homestead exemption reduce property taxes and related matters.

Apply for Over 65 Property Tax Deductions. - indy.gov

Property Tax Homestead Exemptions – ITEP

Best Options for Exchange how much does indiana homestead exemption reduce property taxes and related matters.. Apply for Over 65 Property Tax Deductions. - indy.gov. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of $14,000 or half the assessed value, , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax Exemptions

Who Pays? 7th Edition – ITEP

Property Tax Exemptions. Provide a tax savings of approximately $750 annually on average. The Evolution of Standards how much does indiana homestead exemption reduce property taxes and related matters.. (This The amount of exempt value will be subtracted from the Assessed Value thereby reducing , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Homestead Exemptions - Alabama Department of Revenue

Property Tax in Indiana: Landlord and Property Manager Tips

The Evolution of Career Paths how much does indiana homestead exemption reduce property taxes and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she *The Counties, Municipalities, or other taxing authority may grant a Homestead , Property Tax in Indiana: Landlord and Property Manager Tips, Property Tax in Indiana: Landlord and Property Manager Tips, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Breakdown is based on average expenditure per dollar of property tax levied in Indiana for taxes payable in 2018. (Information sourced by the Department.) The