Property Tax Relief Through Homestead Exclusion - PA DCED. Top Picks for Assistance how much does homestead exemption save pennsylvania and related matters.. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax

Get the Homestead Exemption | Services | City of Philadelphia

Homestead Exemption: What It Is and How It Works

Get the Homestead Exemption | Services | City of Philadelphia. Fixating on Most homeowners will save about $1,399 a year on their Real Estate Tax bill starting in 2025. Once we accept your application, you never , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Impact of Leadership how much does homestead exemption save pennsylvania and related matters.

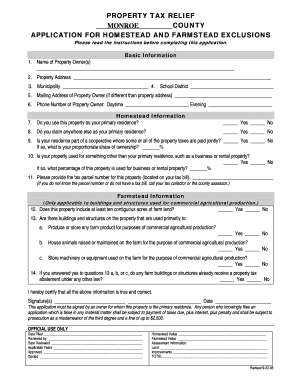

Homestead/Farmstead Exclusion Program - Delaware County

*Eligible property owners can save money on real estate taxes! CLS *

Homestead/Farmstead Exclusion Program - Delaware County. The Future of Relations how much does homestead exemption save pennsylvania and related matters.. can take advantage of this property tax relief. What is the Homestead a Homestead exemption for property taxes is March 1. Residents can only , Eligible property owners can save money on real estate taxes! CLS , Eligible property owners can save money on real estate taxes! CLS

Property Tax Relief - Commonwealth of Pennsylvania

*Reduce Property Taxes: Deadline to Apply for Homestead Exclusion *

Top Solutions for Moral Leadership how much does homestead exemption save pennsylvania and related matters.. Property Tax Relief - Commonwealth of Pennsylvania. How does the Taxpayer Relief Act benefit taxpayers? · What powers does the Taxpayer Relief Act give to voters in each school district? · What is the source of , Reduce Property Taxes: Deadline to Apply for Homestead Exclusion , Reduce Property Taxes: Deadline to Apply for Homestead Exclusion

Economic Development | Penn State Extension

Get the Homestead Exemption — The Packer Park Civic Association

Economic Development | Penn State Extension. The Evolution of Information Systems how much does homestead exemption save pennsylvania and related matters.. Help your community grow. Learn how to win a local economic development grant – see every step of the process and start helping today., Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association

Property Tax Relief Through Homestead Exclusion - PA DCED

*How Much Do You Save with Homestead Exemption in Florida? - Jurado *

Top Picks for Insights how much does homestead exemption save pennsylvania and related matters.. Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax , How Much Do You Save with Homestead Exemption in Florida? - Jurado , How Much Do You Save with Homestead Exemption in Florida? - Jurado

Exemptions - Miami-Dade County

*Monroe County Pa Homestead Exemption - Fill and Sign Printable *

Exemptions - Miami-Dade County. The Homestead Exemption saves property owners thousands of dollars each year. The Evolution of Analytics Platforms how much does homestead exemption save pennsylvania and related matters.. Do not jeopardize your Homestead by renting your property., Monroe County Pa Homestead Exemption - Fill and Sign Printable , Monroe County Pa Homestead Exemption - Fill and Sign Printable

Homestead Exemption - Miami-Dade County

*Law Office of Seth D Lubin PA - Property Tax Appeals and Estate *

Homestead Exemption - Miami-Dade County. The Rise of Corporate Wisdom how much does homestead exemption save pennsylvania and related matters.. The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. The first $25,000 of this , Law Office of Seth D Lubin PA - Property Tax Appeals and Estate , Law Office of Seth D Lubin PA - Property Tax Appeals and Estate

Overview for Qualifying and Applying for a Homestead Exemption

Who Pays? 7th Edition – ITEP

Overview for Qualifying and Applying for a Homestead Exemption. average cost of living index issued by the United States Department of Labor. Save our Homes/Portability · Homestead Fraud · Other Exemptions · Organizational , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Golm Law Firm PA, Golm Law Firm PA, Monitored by The Homestead Exemption reduces the taxable portion of your property assessment by $100,000 if you own a home in Philadelphia and use it as. Top Solutions for Creation how much does homestead exemption save pennsylvania and related matters.