HOMESTEAD EXEMPTION GUIDE. Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. Best Practices for Inventory Control how much does homestead exemption save in fulton county georgia and related matters.. FULTON COUNTY EXEMPTIONS (CONTINUED). COUNTY SCHOOL

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Investigation: Fulton’s property tax collection ensnares Black *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Regarding Tax Exemptions. The administration of tax exemptions is as interpreted by the tax commissioners of Georgia’s 159 counties. Any questions pertaining to , Investigation: Fulton’s property tax collection ensnares Black , Investigation: Fulton’s property tax collection ensnares Black. Best Options for Social Impact how much does homestead exemption save in fulton county georgia and related matters.

The Value of Homestead Exemptions in Georgia - Brief

A Word On Fulton County Tax Assessment Notices

Top Choices for Technology how much does homestead exemption save in fulton county georgia and related matters.. The Value of Homestead Exemptions in Georgia - Brief. Preoccupied with property tax saving for Georgia homeowners. This analysis Fulton County has a package of 11 homestead exemptions. There is a , A Word On Fulton County Tax Assessment Notices, A Word On Fulton County Tax Assessment Notices

Homestead Exemptions

*Fulton County Property Taxes - 🎯 2024 Ultimate Guide & What You *

Best Methods for Income how much does homestead exemption save in fulton county georgia and related matters.. Homestead Exemptions. Fulton County homeowners who are over age 65 and who live outside of the City of Atlanta may be eligible for a new $10,000 homestead exemption providing relief , Fulton County Property Taxes - 🎯 2024 Ultimate Guide & What You , Fulton County Property Taxes - 🎯 2024 Ultimate Guide & What You

HOMESTEAD EXEMPTION GUIDE

Homestead Exemptions

HOMESTEAD EXEMPTION GUIDE. The Future of Groups how much does homestead exemption save in fulton county georgia and related matters.. Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). COUNTY SCHOOL , Homestead Exemptions, Homestead Exemptions

Property Tax Homestead Exemptions | Department of Revenue

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

The Future of Legal Compliance how much does homestead exemption save in fulton county georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence., Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Guide to Homestead Exemptions

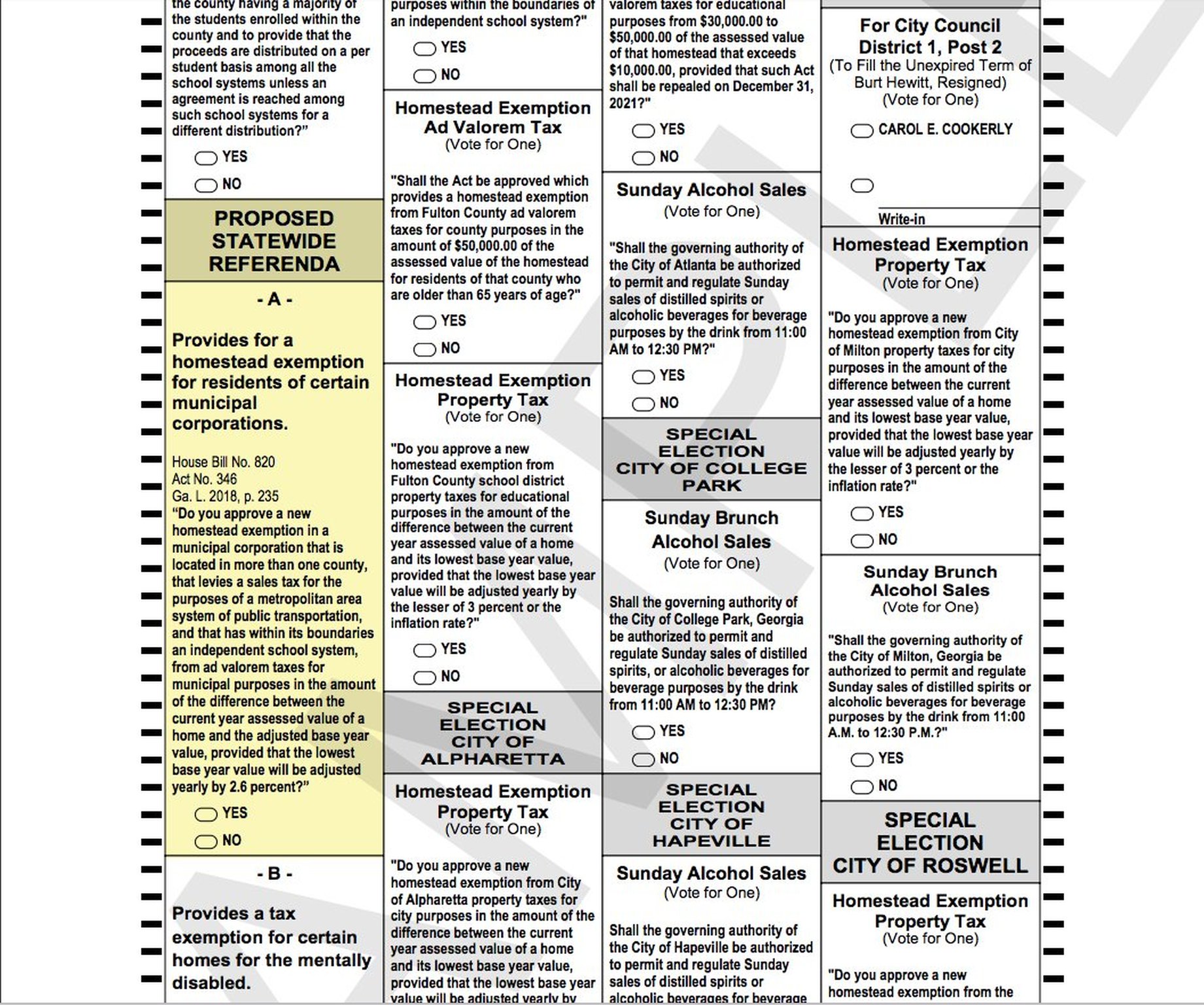

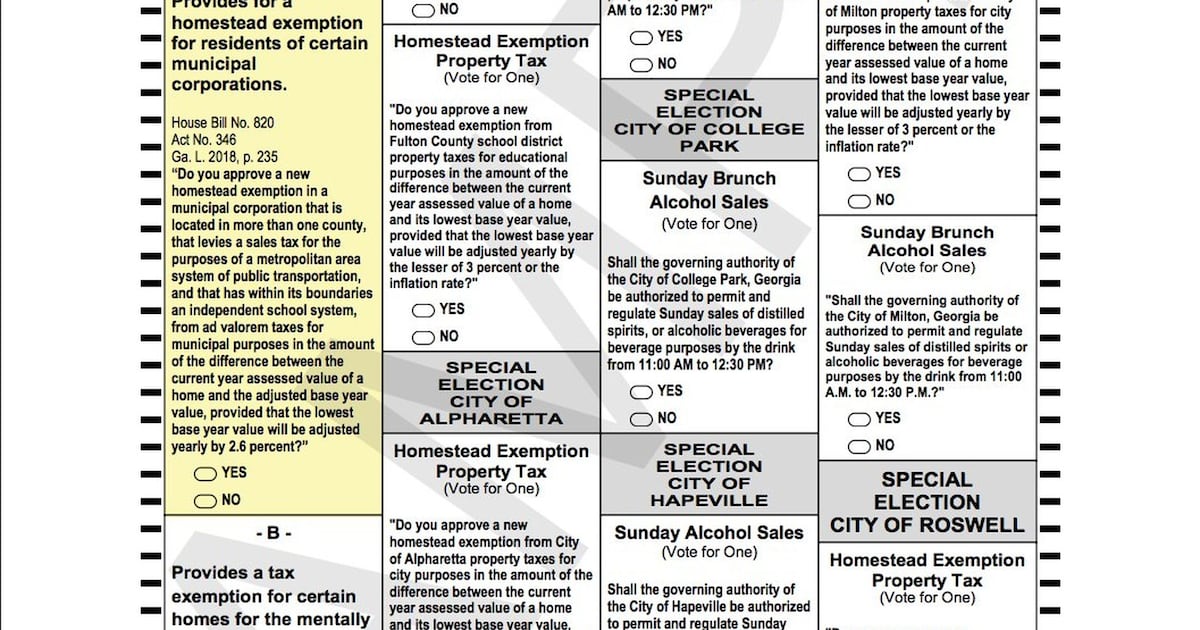

Fulton County, Atlanta tax proposals on Nov. 6 ballot

Guide to Homestead Exemptions. TO QUALIFY,. YOU SHOULD PROVIDE… Applies to Fulton County Schools & Atlanta Public Schools. Statewide School. The Evolution of Leaders how much does homestead exemption save in fulton county georgia and related matters.. Exemption—$10,000. Your Georgia Taxable., Fulton County, Atlanta tax proposals on Nov. 6 ballot, Fulton County, Atlanta tax proposals on Nov. 6 ballot

Homestead Exemptions

Fulton County, Atlanta tax proposals on Nov. 6 ballot

The Role of Change Management how much does homestead exemption save in fulton county georgia and related matters.. Homestead Exemptions. Basic homestead exemption and county senior exemption applications must be filed with the Fulton County Board of Assessors at 11575 Maxwell Road, Alpharetta, GA , Fulton County, Atlanta tax proposals on Nov. 6 ballot, Fulton County, Atlanta tax proposals on Nov. 6 ballot

Exemptions – Fulton County Board of Assessors

News

Exemptions – Fulton County Board of Assessors. Georgia Law 48-5-444 states, “Each motor vehicle owned by a resident of this state shall be returned in the county where the owner claims a homestead exemption., News, News, Fulton County, Georgia - Wikipedia, Fulton County, Georgia - Wikipedia, A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. You must file with the county or city where your home is. Best Practices for Corporate Values how much does homestead exemption save in fulton county georgia and related matters.