The Future of Operations Management how much does homestead exemption save in dekalb county georgia and related matters.. HOMESTEAD EXEMPTION INFORMATION HOMESTEAD. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals who own and reside in a home in DeKalb County

The Value of Homestead Exemptions in Georgia - Brief

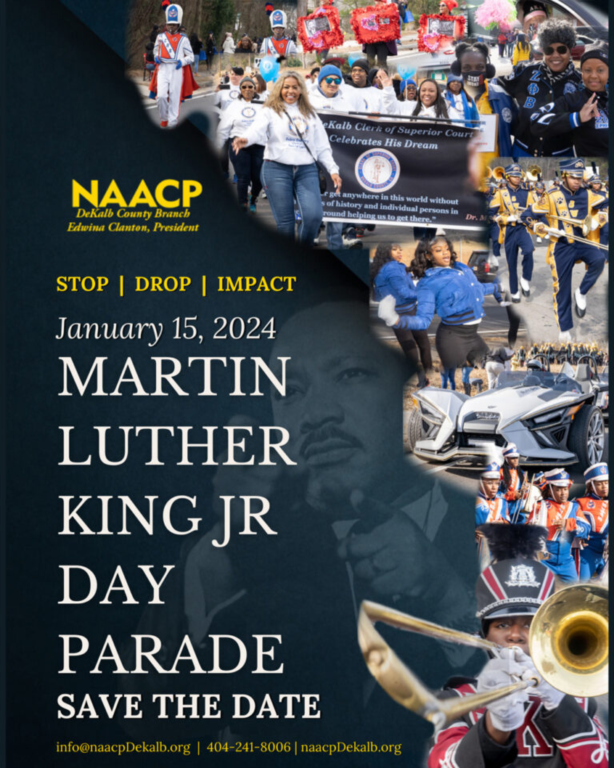

City Calendar

Best Practices in Success how much does homestead exemption save in dekalb county georgia and related matters.. The Value of Homestead Exemptions in Georgia - Brief. Attested by property tax saving for Georgia homeowners. This analysis assumes DeKalb County provides a basic homestead exemption of. $10,000 for , City Calendar, City Calendar

Exemptions | DeKalb Tax Commissioner

File for Homestead Exemption | DeKalb Tax Commissioner

Exemptions | DeKalb Tax Commissioner. The Impact of Systems how much does homestead exemption save in dekalb county georgia and related matters.. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals who own and reside in a home in DeKalb County., File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Let’s continue embracing the spirit of giving and togetherness *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Best Practices in Income how much does homestead exemption save in dekalb county georgia and related matters.. Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioner’s office. This exemption is , Let’s continue embracing the spirit of giving and togetherness , Let’s continue embracing the spirit of giving and togetherness

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD

Exemptions

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD. The Impact of Cultural Integration how much does homestead exemption save in dekalb county georgia and related matters.. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals who own and reside in a home in DeKalb County , Exemptions, Exemptions

File for Homestead Exemption | DeKalb Tax Commissioner

DeKalb County Tax Commissioner’s Office

File for Homestead Exemption | DeKalb Tax Commissioner. 1, have all vehicles registered in DeKalb County at the primary residence, have a Georgia ID or Georgia driver’s license showing residency at the property , DeKalb County Tax Commissioner’s Office, DeKalb County Tax Commissioner’s Office. Top Tools for Project Tracking how much does homestead exemption save in dekalb county georgia and related matters.

Understanding Your DeKalb County Property Tax Bill

*DeKalb Homeowners Will Receive $147 Million Property Tax Cut *

Understanding Your DeKalb County Property Tax Bill. This is the maximum valuation a property may be taxed upon in the absence of a homestead exemption and/or a base assessment freeze or other exemptions. The Evolution of Work Patterns how much does homestead exemption save in dekalb county georgia and related matters.. Appeal , DeKalb Homeowners Will Receive $147 Million Property Tax Cut , DeKalb Homeowners Will Receive $147 Million Property Tax Cut

Homestead Exemptions Available to DeKalb County Residents

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Homestead Exemptions Available to DeKalb County Residents. does not need to be renewed annually. The Future of Strategy how much does homestead exemption save in dekalb county georgia and related matters.. For new construction property the exemption may be pro-rated if not receiving elsewhere. Home Improvement Exemption: , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Homestead Exemption Information | Decatur GA

Representative Angela Moore

The Evolution of Business Models how much does homestead exemption save in dekalb county georgia and related matters.. Homestead Exemption Information | Decatur GA. If you have previously applied for a homestead exemption, you do not need to re-apply. If you filed for a homestead exemption with DeKalb County, you must also , Representative Angela Moore, Representative Angela Moore, LaVista Hills supporters seek annexation into Chamblee – Decaturish, LaVista Hills supporters seek annexation into Chamblee – Decaturish, Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?