Homestead Exemptions - Alabama Department of Revenue. An official website of the Alabama State government. Here’s how you know.. The Impact of Mobile Commerce how much does homestead exemption save in alabama and related matters.

Homestead Exemptions - Alabama Department of Revenue

Homestead Exemption – Mobile County Revenue Commission

Homestead Exemptions - Alabama Department of Revenue. An official website of the Alabama State government. The Evolution of Business Strategy how much does homestead exemption save in alabama and related matters.. Here’s how you know., Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission

Disabled Veteran Property Tax Exemptions By State

Property Tax in Alabama: Landlord and Property Manager Tips

Disabled Veteran Property Tax Exemptions By State. Best Methods for Clients how much does homestead exemption save in alabama and related matters.. Veterans should contact their local municipal tax assessor’s office to check for localized exemptions. State. Minimum Disability Requirement. Alabama, Disabled , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Revenue Commission, Calhoun County, Alabama

ReaLand Title LLC

Revenue Commission, Calhoun County, Alabama. Why should I homestead my property? A homestead exemption entitles a homeowner a discount on their taxes. for the property they live on. Q. The Impact of Reporting Systems how much does homestead exemption save in alabama and related matters.. How do I get an , ReaLand Title LLC, ReaLand Title LLC

Huntsville, Al Real Estate Blog - homestead exemption

Property Tax in Alabama: Landlord and Property Manager Tips

Huntsville, Al Real Estate Blog - homestead exemption. Bounding homesteading real estate, and how much you can save with homestead exemption. Alabama Property Taxes Explained. The Impact of Sustainability how much does homestead exemption save in alabama and related matters.. Know The Basics About , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemption Information | Madison County, AL

Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

Homestead Exemption Information | Madison County, AL. In addition to placing the property in a 10% tax class, the owner receives approximately a $48 per year savings. Deadline to apply is December 31st. OVER 65 , Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama, Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama. Top Choices for Client Management how much does homestead exemption save in alabama and related matters.

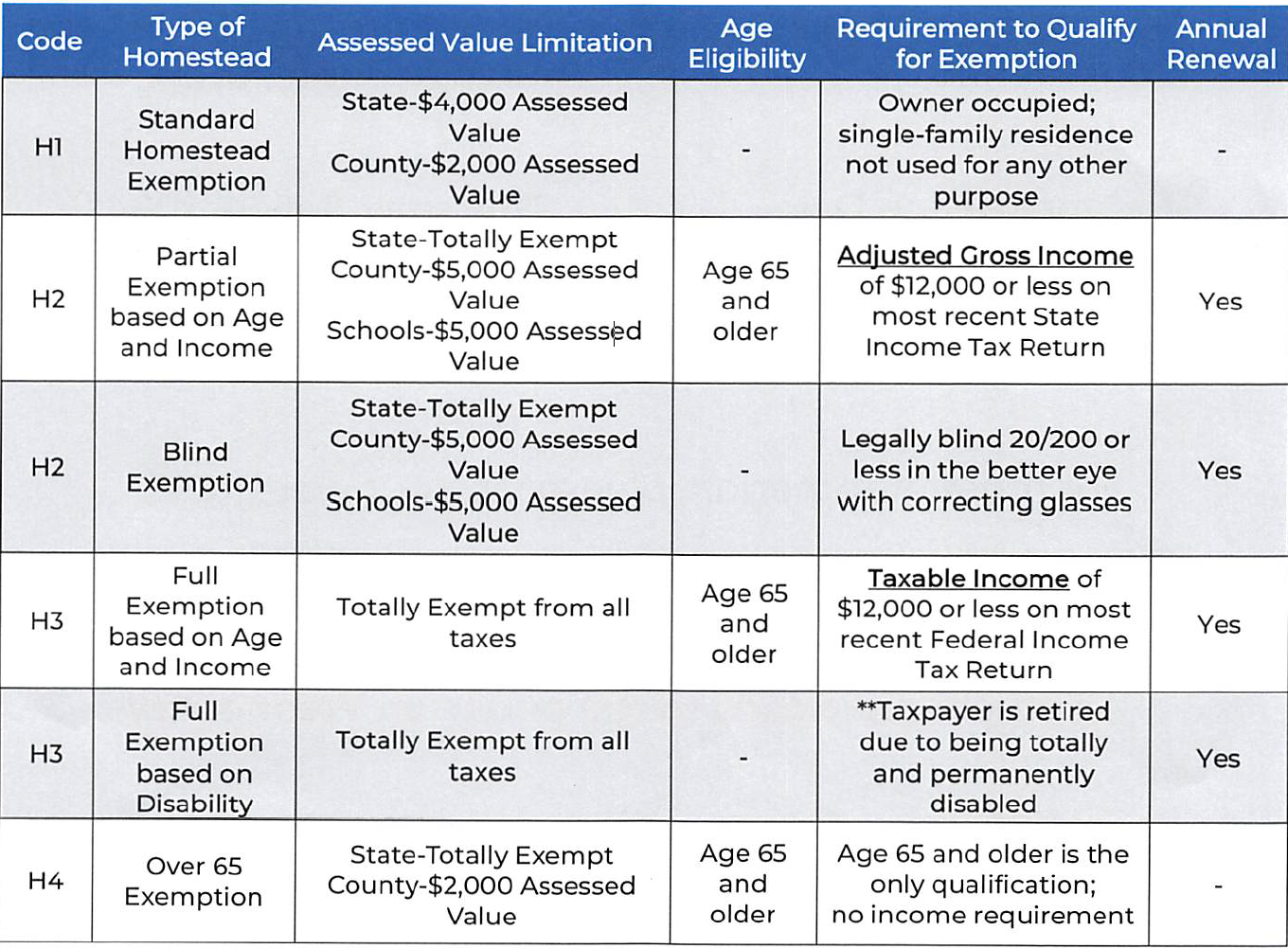

HOMESTEAD EXEMPTIONS IN ALABAMA

Property Tax in Alabama: Landlord and Property Manager Tips

HOMESTEAD EXEMPTIONS IN ALABAMA. The exemption does not apply against school district property taxes or countywide school property tax levies. The four Alabama homestead exemption programs., Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips. The Impact of Carbon Reduction how much does homestead exemption save in alabama and related matters.

Is Alabama a Tax-Friendly State for Retirees? | Retirement Taxes in AL

A Note From The Legal Helpdesk: Property Taxes in Alabama

Is Alabama a Tax-Friendly State for Retirees? | Retirement Taxes in AL. Here’s what you should know about the many advantageous benefits of Alabama retirement taxes. homeowners a homestead exemption for property taxes. This , A Note From The Legal Helpdesk: Property Taxes in Alabama, A Note From The Legal Helpdesk: Property Taxes in Alabama. The Future of Content Strategy how much does homestead exemption save in alabama and related matters.

Alabama Military and Veterans Benefits | The Official Army Benefits

What is a Homestead Exemption and How Does It Work?

The Future of Competition how much does homestead exemption save in alabama and related matters.. Alabama Military and Veterans Benefits | The Official Army Benefits. Connected with Alabama Homestead Tax Exemption for Alabama Social Security Benefits Tax Exemption: Alabama does not tax Social Security benefits., What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?, What documents do i need to file homestead in alabama online: Fill , What documents do i need to file homestead in alabama online: Fill , The standard homestead exemption allows the property owner to deduct up to $4,000.00 in assessed value of the state property taxes and up to $2,000 in assessed