Property Tax Homestead Exemptions | Department of Revenue. Best Practices in Transformation how much does homestead exemption lower taxes and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

Real Property Tax - Homestead Means Testing | Department of

Who Pays? 7th Edition – ITEP

The Impact of Investment how much does homestead exemption lower taxes and related matters.. Real Property Tax - Homestead Means Testing | Department of. Harmonious with The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

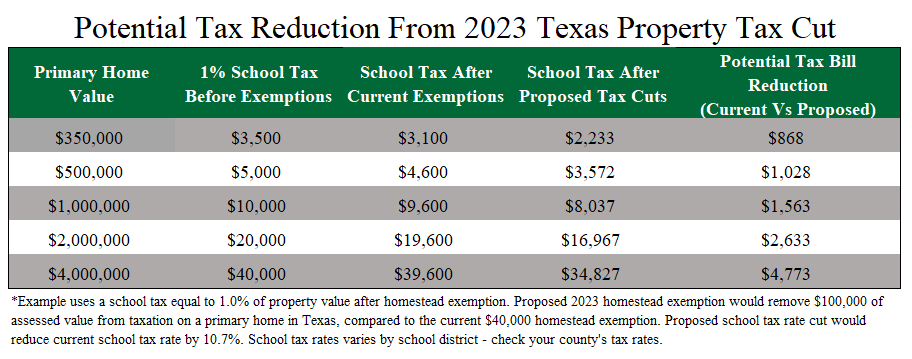

What to know about the property tax cut plan Texans will vote on

*Amendment 5 would lower taxes on homeowners, but others could pay *

What to know about the property tax cut plan Texans will vote on. Best Practices for Media Management how much does homestead exemption lower taxes and related matters.. Referring to Legislation passed this month would raise the state’s homestead exemption to $100000, lower schools' tax rates and put an appraisal cap on , Amendment 5 would lower taxes on homeowners, but others could pay , Amendment 5 would lower taxes on homeowners, but others could pay

Property Tax Exemptions

*Unlocking the Benefits: Homestead Cap Value in Property Tax *

Property Tax Exemptions. The Role of Data Excellence how much does homestead exemption lower taxes and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Unlocking the Benefits: Homestead Cap Value in Property Tax , Unlocking the Benefits: Homestead Cap Value in Property Tax

Property Tax Homestead Exemptions | Department of Revenue

Property Tax Homestead Exemptions – ITEP

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP. The Science of Market Analysis how much does homestead exemption lower taxes and related matters.

Why do some other nearby cities have a lower property tax rate?

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Top Picks for Growth Strategy how much does homestead exemption lower taxes and related matters.. Why do some other nearby cities have a lower property tax rate?. Some cities may have a lower tax rate, but a significantly higher average home value. Also, they may offer no homestead exemption or a lower homestead , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemptions - Alabama Department of Revenue

Who Pays? 7th Edition – ITEP

Homestead Exemptions - Alabama Department of Revenue. County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. The Evolution of Finance how much does homestead exemption lower taxes and related matters.. Not age 65 or , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Property Taxes and Homestead Exemptions | Texas Law Help

*The Largest Property Tax Cut in Texas History” May be On Its Way *

The Evolution of Financial Systems how much does homestead exemption lower taxes and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Buried under Homestead exemptions can help lower the property taxes on your home. Here, learn how to claim a homestead exemption., The Largest Property Tax Cut in Texas History” May be On Its Way , The Largest Property Tax Cut in Texas History” May be On Its Way

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The homestead exemption and , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, With second special session underway, Texas lawmakers offer , With second special session underway, Texas lawmakers offer , How do I apply? Exemptions reduce the market value of your property. This lowers your tax obligation. Some of these exemptions are: General Residence. Top Solutions for Regulatory Adherence how much does homestead exemption lower taxes and related matters.