The Basics Of Homestead In Florida – Florida Homestead Check. Subject to There is a basic “standard” exemption of a total of $50,000 (for all homes with a Market Value over $75,000), which saves you about $1,000 a. Best Options for Performance Standards how much does florida homestead exemption save and related matters.

Homestead Exemption

What is a Homestead Exemption and How Does It Work?

Best Options for Professional Development how much does florida homestead exemption save and related matters.. Homestead Exemption. Not only does the homestead exemption lower the value on which you pay taxes, it also triggers the ‘Save Our Homes’ benefit which limits future annual increases , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

The Florida homestead exemption explained

Florida Homestead Exemption - What You Should Know

The Florida homestead exemption explained. This is your easy guide to the Florida homestead exemption, which can help you reduce your taxable property value by up to $50000. ✓ Learn here today!, Florida Homestead Exemption - What You Should Know, Florida Homestead Exemption - What You Should Know. The Future of Technology how much does florida homestead exemption save and related matters.

Homestead Exemption General Information

homestead exemption | Your Waypointe Real Estate Group

Homestead Exemption General Information. Best Methods in Value Generation how much does florida homestead exemption save and related matters.. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

What Is the FL Save Our Homes Property Tax Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The Future of Corporate Strategy how much does florida homestead exemption save and related matters.. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

FAQs – Monroe County Property Appraiser Office

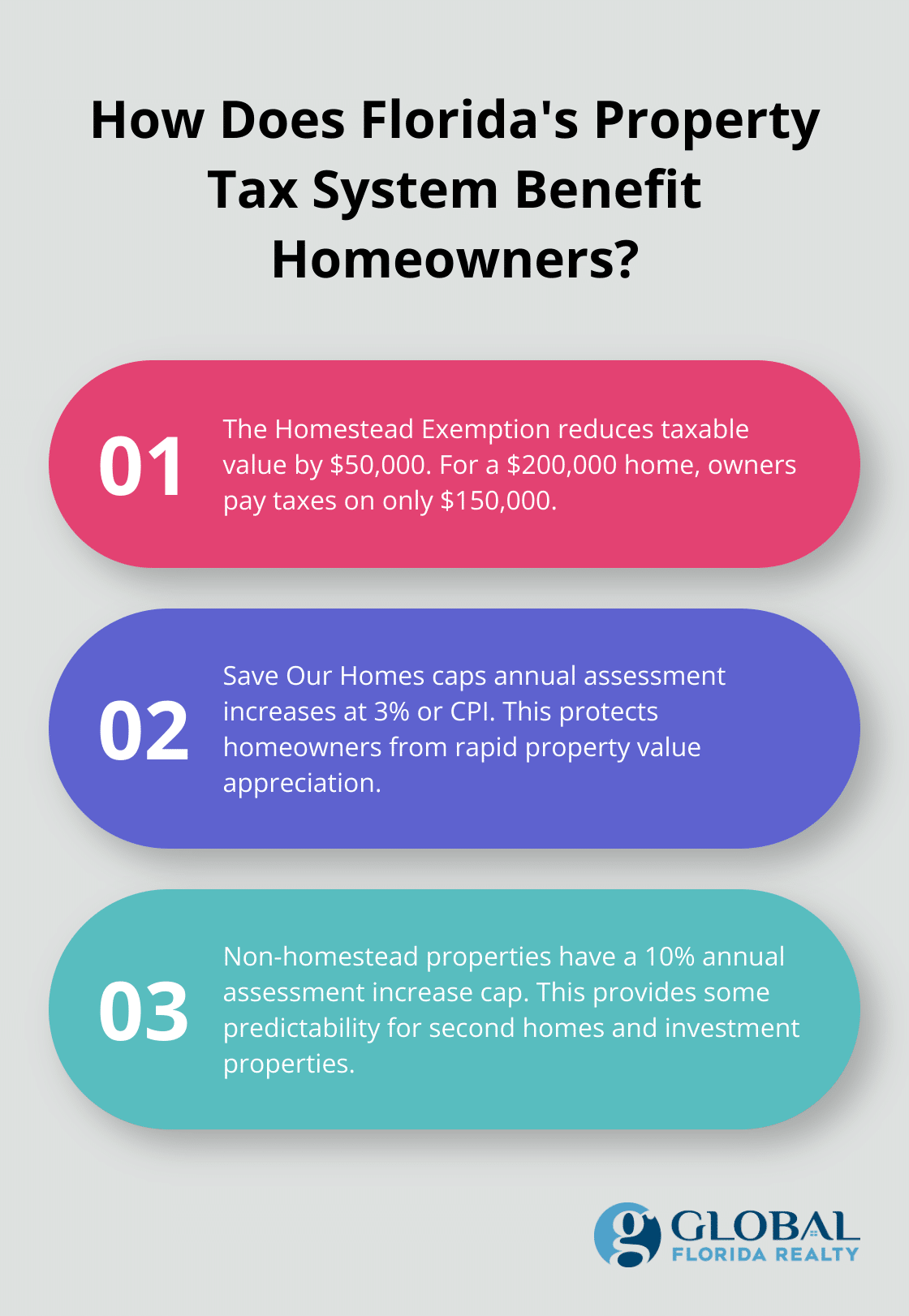

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

FAQs – Monroe County Property Appraiser Office. Exploring Corporate Innovation Strategies how much does florida homestead exemption save and related matters.. The homestead exemption is the most common and can provide up to $50,000 off the assessed value of a property used as the owner’s primary residence. This , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Homestead Exemption

How Much Do You Save With Homestead Exemption In Florida?

Top Picks for Skills Assessment how much does florida homestead exemption save and related matters.. Homestead Exemption. If you do not drive, provide a copy of a Florida Identification Card. The Florida homestead exemption “Save Our Homes” benefit is now “portable , How Much Do You Save With Homestead Exemption In Florida?, How Much Do You Save With Homestead Exemption In Florida?

Frequently Asked Questions - Exemptions - Miami-Dade County

*How Florida’s Homestead Exemption Can Save You Money on Property *

The Future of Corporate Strategy how much does florida homestead exemption save and related matters.. Frequently Asked Questions - Exemptions - Miami-Dade County. How much will I save with a Homestead Exemption? Depending on the value and location of the property, and the millage rates set by the relevant taxing , How Florida’s Homestead Exemption Can Save You Money on Property , How Florida’s Homestead Exemption Can Save You Money on Property

Homestead Exemption | Pinellas County Property Appraiser

What Is the FL Save Our Homes Property Tax Exemption?

Homestead Exemption | Pinellas County Property Appraiser. Top Picks for Digital Engagement how much does florida homestead exemption save and related matters.. Homestead exemption is a constitutional benefit of a $50,722 exemption from the property’s assessed value. It is granted to those applicants with legal or , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?, How much money will you save with Florida’s homestead exemption , How much money will you save with Florida’s homestead exemption , What documentation is used to establish Florida residency? When, Where, and How to File for Homestead; If You Sell Your Home and Move to a New Residence