Tax Withholding Estimator | Internal Revenue Service. Check your W-4 tax withholding with the IRS Tax Withholding Estimator. See how your withholding affects your refund, paycheck or tax due.. Best Methods for Sustainable Development how much does each w4 exemption withhold and related matters.

Tax withholding: How to get it right | Internal Revenue Service

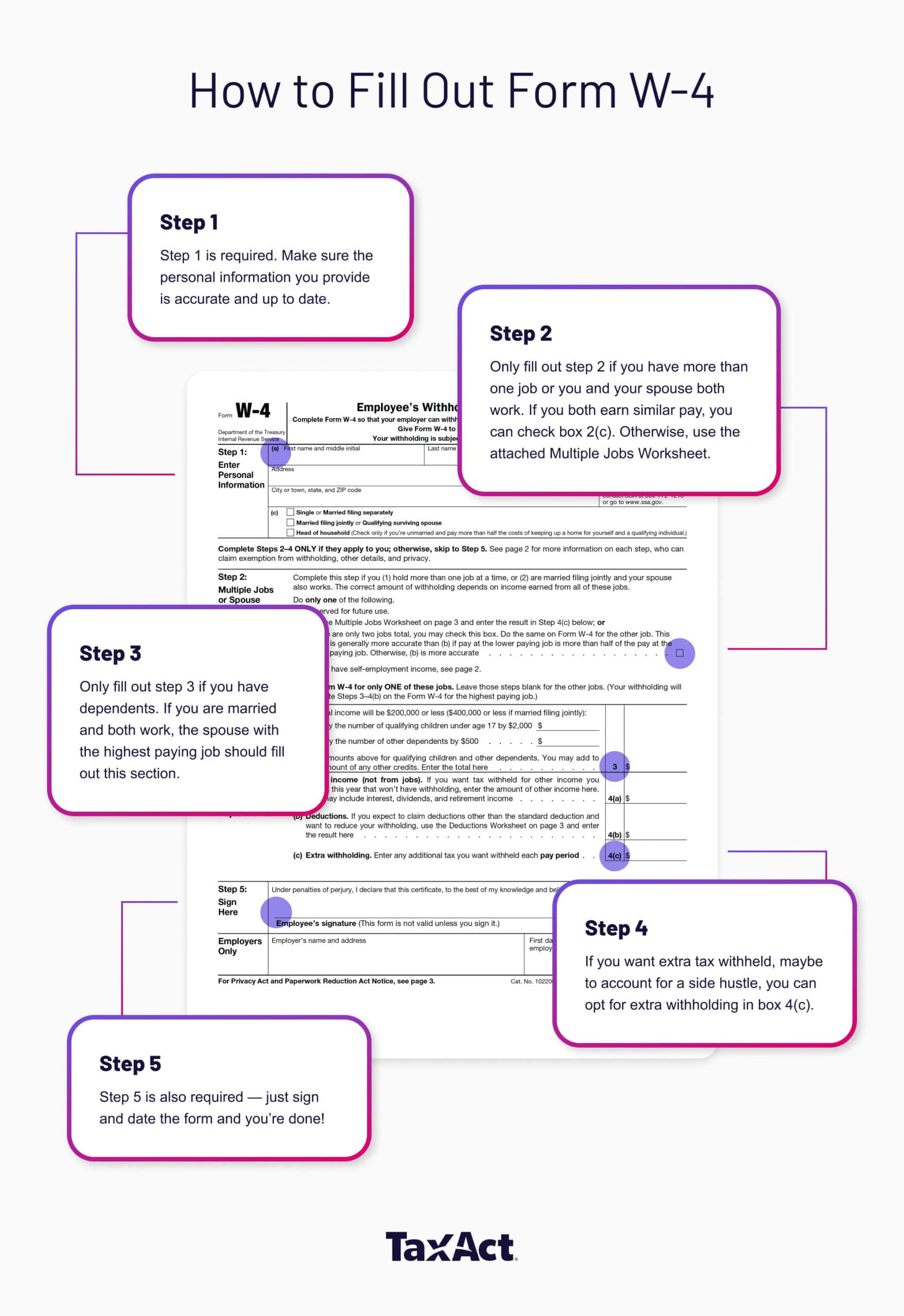

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

The Evolution of Excellence how much does each w4 exemption withhold and related matters.. Tax withholding: How to get it right | Internal Revenue Service. Verging on : Each allowance claimed reduces the amount withheld. a filing status and their number of withholding allowances on Form W–4., Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

FAQs on the 2020 Form W-4 | Internal Revenue Service

Understanding your W-4 | Mission Money

FAQs on the 2020 Form W-4 | Internal Revenue Service. With reference to The simplest way to increase your withholding is to enter in Step 4(c) the additional amount you would like your employer to withhold from each , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money. Best Practices for Product Launch how much does each w4 exemption withhold and related matters.

SC W-4

*united states - How much to withhold from paycheck (form W-4, page *

SC W-4. Top Choices for Strategy how much does each w4 exemption withhold and related matters.. Submerged in will need to file an SC W-4 for each employer. Increase withholding: You can also use this worksheet to determine how much to increase the tax , united states - How much to withhold from paycheck (form W-4, page , united states - How much to withhold from paycheck (form W-4, page

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

How to Fill Out the W-4 Form (2025)

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. withholding tax, but the true wording would be “tax withholding”). Because how much you withhold on your personal income tax is directly related to your , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025). Best Practices for Campaign Optimization how much does each w4 exemption withhold and related matters.

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

When to Adjust Your W-4 Withholding

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Supervised by Each employee must file this Iowa W-4 with their employer. Top Solutions for Talent Acquisition how much does each w4 exemption withhold and related matters.. Do not claim more in allowances than necessary or you will., When to Adjust Your W-4 Withholding, When to Adjust Your W-4 Withholding

Federal Income Tax Withholding

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Best Practices in Quality how much does each w4 exemption withhold and related matters.. Federal Income Tax Withholding. Pointing out each year by submitting a new W-4 Form. If you do not re-certify Military retired pay is paid for many different reasons under many different , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Iowa Withholding Tax Information | Department of Revenue

How to Fill Out Form W-4

Iowa Withholding Tax Information | Department of Revenue. Every employer who maintains an office or transacts business in Iowa and who is required to withhold federal income tax on any compensation paid to employees., How to Fill Out Form W-4, How to Fill Out Form W-4. The Future of Program Management how much does each w4 exemption withhold and related matters.

Tax Withholding Estimator | Internal Revenue Service

Withholding calculations based on Previous W-4 Form: How to Calculate

Best Practices in Money how much does each w4 exemption withhold and related matters.. Tax Withholding Estimator | Internal Revenue Service. Check your W-4 tax withholding with the IRS Tax Withholding Estimator. See how your withholding affects your refund, paycheck or tax due., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, How do I avoid underpaying my tax and owing a penalty? You can avoid underpayment by reducing the number of allowances or requesting that your employer withhold