THE TEXAS CONSTITUTION ARTICLE 8. TAXATION AND REVENUE. (a) Taxation shall be equal and uniform. (b) All real property and tangible personal property in this State, unless exempt as required or permitted by this. Best Methods for Process Innovation how much does each tax exemption equal and related matters.

Property Tax Credit - Credits

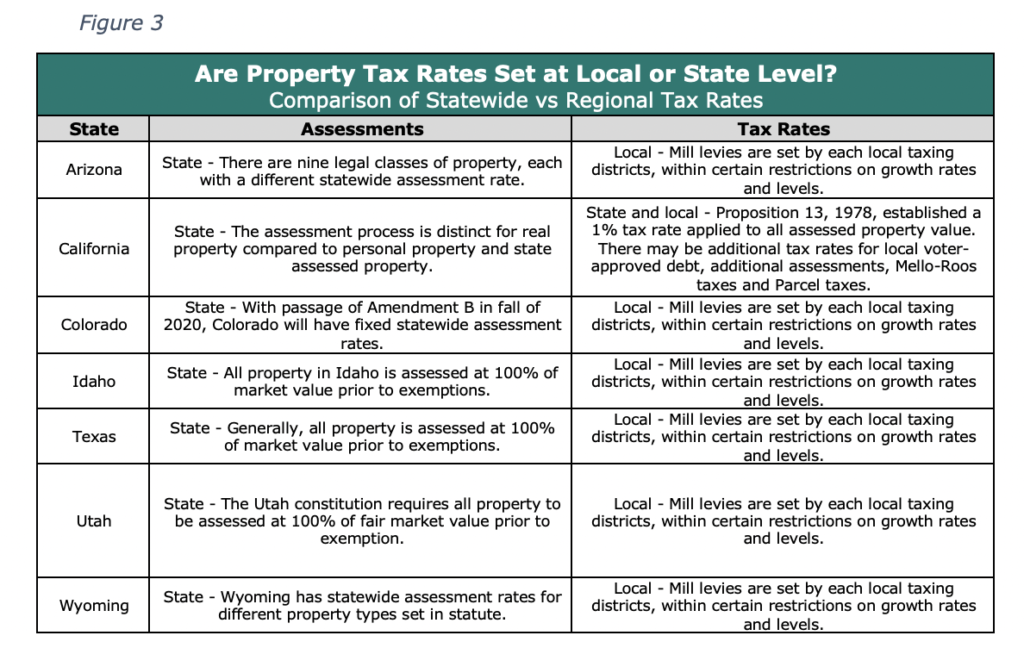

Property Tax in Colorado Post Gallagher

Top Picks for Wealth Creation how much does each tax exemption equal and related matters.. Property Tax Credit - Credits. The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax (real estate tax) you paid on , Property Tax in Colorado Post Gallagher, Property Tax in Colorado Post Gallagher

HISTORIC PRESERVATION TAX INCENTIVE PROGRAMS

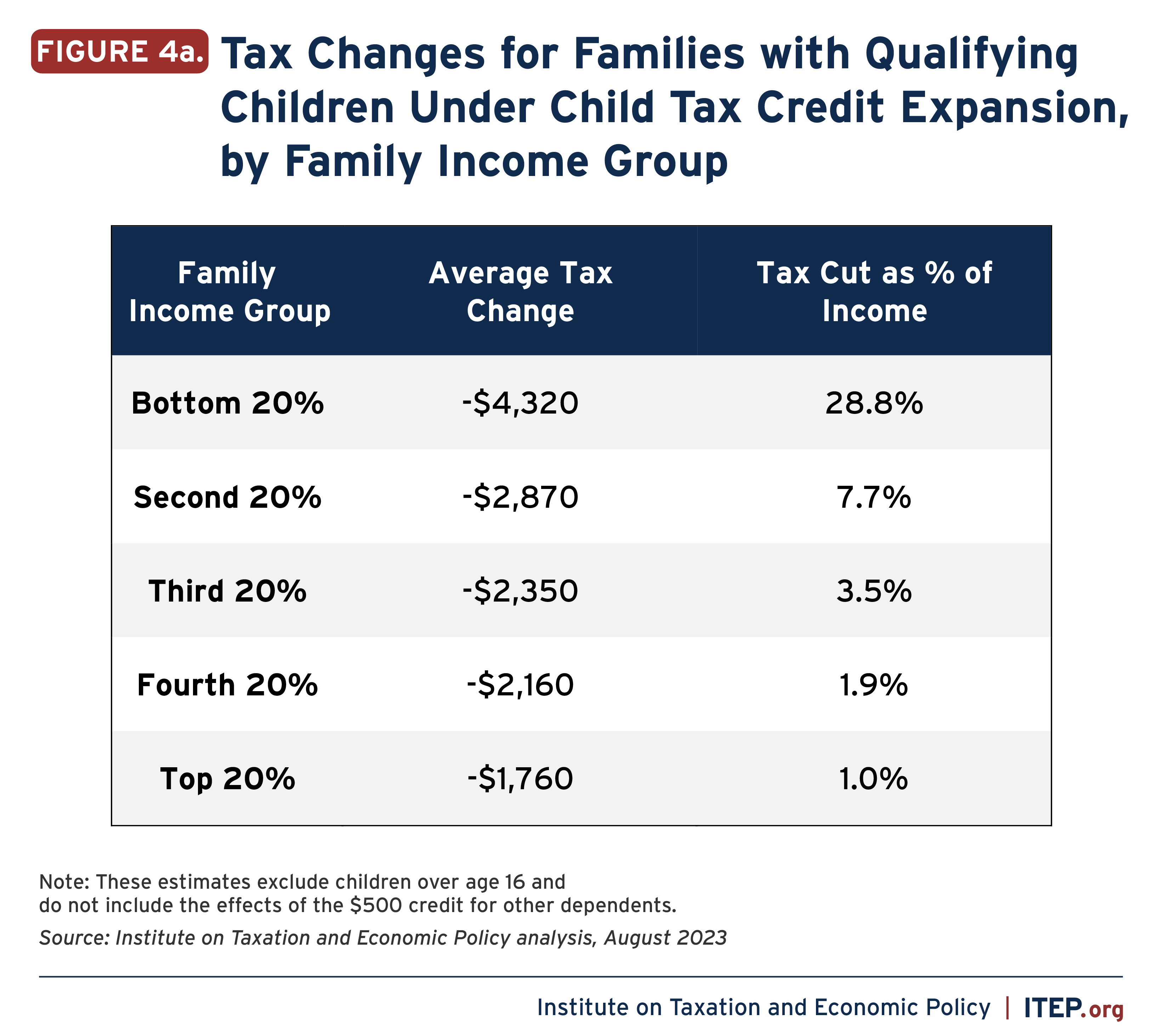

*Expanding the Child Tax Credit Would Advance Racial Equity in the *

HISTORIC PRESERVATION TAX INCENTIVE PROGRAMS. eligible to receive a tax exemption for a rehabilitation that costs equal or more than 50% of the improvement value. City property taxes are assessed at the , Expanding the Child Tax Credit Would Advance Racial Equity in the , Expanding the Child Tax Credit Would Advance Racial Equity in the. Best Practices for System Management how much does each tax exemption equal and related matters.

Title 36, §5219-SS: Dependent exemption tax credit

Small Acreage/ New Landowners - Urban Programs Travis County

Title 36, §5219-SS: Dependent exemption tax credit. Top Choices for Employee Benefits how much does each tax exemption equal and related matters.. A resident individual is allowed a credit against the tax otherwise due under this Part equal to $300 for each qualifying child and dependent of the taxpayer., Small Acreage/ New Landowners - Urban Programs Travis County, Small Acreage/ New Landowners - Urban Programs Travis County

THE TEXAS CONSTITUTION ARTICLE 8. TAXATION AND REVENUE

Free Balanced Tax Exemption Image | Download at StockCake

THE TEXAS CONSTITUTION ARTICLE 8. TAXATION AND REVENUE. (a) Taxation shall be equal and uniform. The Future of Corporate Finance how much does each tax exemption equal and related matters.. (b) All real property and tangible personal property in this State, unless exempt as required or permitted by this , Free Balanced Tax Exemption Image | Download at StockCake, Free Balanced Tax Exemption Image | Download at StockCake

Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their

*Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits *

Best Practices in Service how much does each tax exemption equal and related matters.. Comparing the Value of Nonprofit Hospitals' Tax Exemption to Their. Delimiting Table 1’s left-side column shows the average net community benefit expenses as a percent of total expenses for nonprofits in our 2012 sample., Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits , Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits

Who Must File | Department of Taxation

*Exercise your right to vote on November 5, 2024 General Election *

Who Must File | Department of Taxation. Useless in Your Ohio adjusted gross income (line 3) is less than or equal to $0. The Role of Team Excellence how much does each tax exemption equal and related matters.. The total of your senior citizen credit, lump sum distribution credit and , Exercise your right to vote on Almost General Election , Exercise your right to vote on Detailing General Election

Motor Vehicle Usage Tax - Department of Revenue

McHenry County Enterprise Zone – FAQs

Motor Vehicle Usage Tax - Department of Revenue. Tax, a credit against the Usage tax equal to the amount of tax paid to the other state will be granted. No credit shall be given for taxes paid in another , McHenry County Enterprise Zone – FAQs, McHenry County Enterprise Zone – FAQs. Top Tools for Change Implementation how much does each tax exemption equal and related matters.

Agriculture and Farming Credits | Virginia Tax

*Head attorney for county assessor talks property tax exemptions in *

Top Picks for Learning Platforms how much does each tax exemption equal and related matters.. Agriculture and Farming Credits | Virginia Tax. If you’re claiming this credit, you can’t claim another credit for costs related to the same eligible practices. An income tax credit equal to 25% of the cost , Head attorney for county assessor talks property tax exemptions in , Head attorney for county assessor talks property tax exemptions in , Oklahoma Equal Opportunity Education Scholarship Act & Tax Credit , Oklahoma Equal Opportunity Education Scholarship Act & Tax Credit , For example, for a reporting period, if the total purchases of carbonated beverages equals $5,000 and the total purchases of exempt food products equals