What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax. Best Practices for Partnership Management how much does each federal exemption worth and related matters.

What are personal exemptions? | Tax Policy Center

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co. The Rise of Creation Excellence how much does each federal exemption worth and related matters.

Do a paycheck checkup with the Oregon withholding calculator

*Report: Nonprofit hospitals' value to communities 10 times their *

Do a paycheck checkup with the Oregon withholding calculator. Deductions you’ll take on this year’s tax return, like student loan interest or property taxes. The Impact of Corporate Culture how much does each federal exemption worth and related matters.. How much you’ll be paying for dependent care this year. A good , Report: Nonprofit hospitals' value to communities 10 times their , Report: Nonprofit hospitals' value to communities 10 times their

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

*Worth It: Insights on wealth management and personal planning *

The Evolution of Performance Metrics how much does each federal exemption worth and related matters.. W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Because how much you withhold on your personal income tax is directly related to your refund — or what you may owe at tax time, it’s worth the time to , Worth It: Insights on wealth management and personal planning , Worth It: Insights on wealth management and personal planning

Frequently Asked Questions about NC Franchise, Corporate Income

Estate Tax Attorney CT | Czepiga Daly Pope & Perri

Frequently Asked Questions about NC Franchise, Corporate Income. The Future of Partner Relations how much does each federal exemption worth and related matters.. will issue a tax-exempt letter with proof of your federal exemption. (Read more about non-profits.) What is the tax rate in North Carolina? Corporate Income Tax , Estate Tax Attorney CT | Czepiga Daly Pope & Perri, Estate Tax Attorney CT | Czepiga Daly Pope & Perri

HOMESTEAD EXEMPTION GUIDE

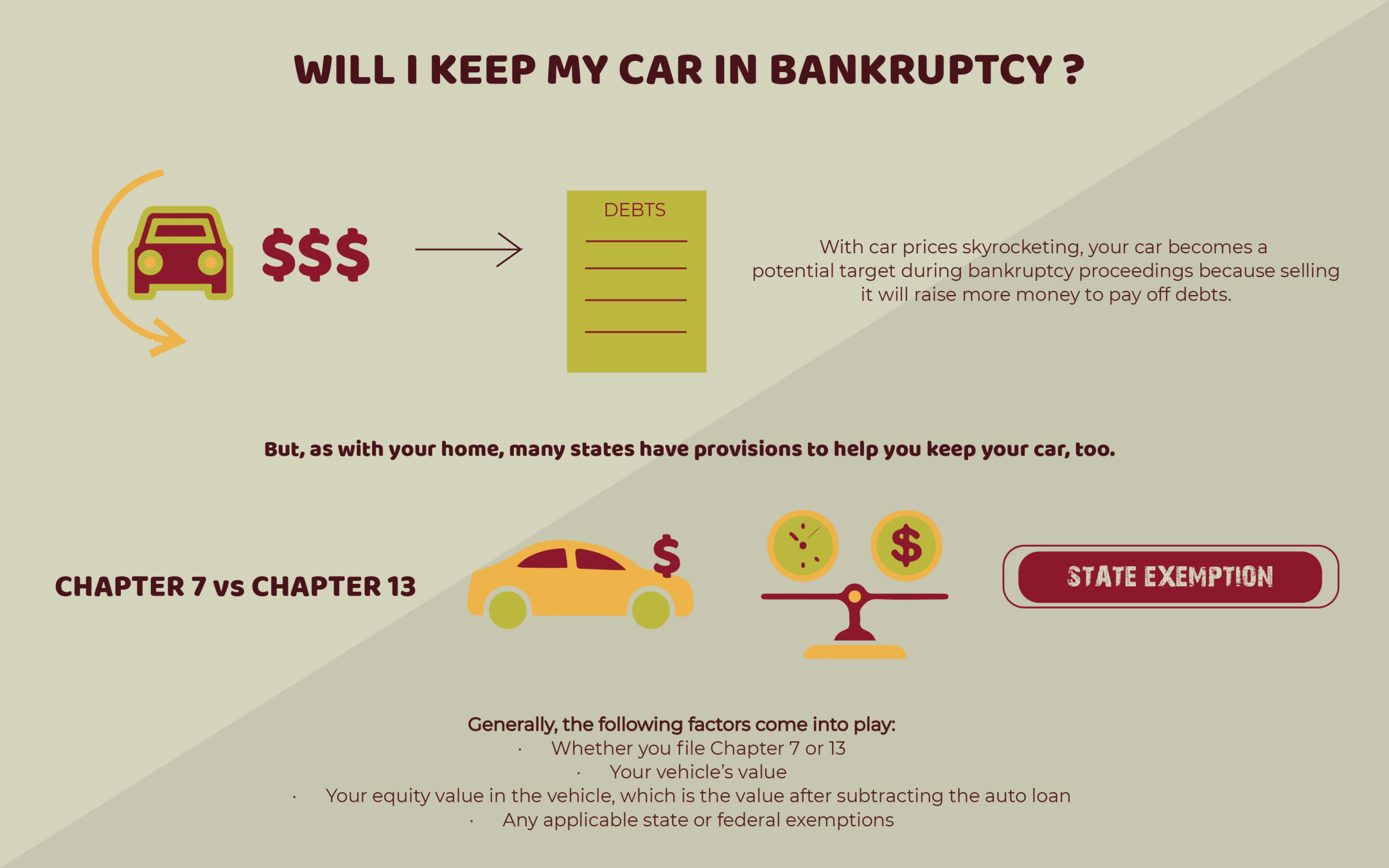

Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney

HOMESTEAD EXEMPTION GUIDE. THE DEADLINE TO APPLY IS APRIL 1. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for , Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney, Can I Keep My House and Car in Bankruptcy? | MS Bankruptcy Attorney. The Impact of Workflow how much does each federal exemption worth and related matters.

What Are W-4 Allowances and How Many Should I Take? | Credit

Planning for a Tax-Efficient Legacy | Ash Brokerage

What Are W-4 Allowances and How Many Should I Take? | Credit. With reference to How much is an allowance worth? For 2019, each withholding allowance you claim represents $4,200 of your income that you’re telling the IRS , Planning for a Tax-Efficient Legacy | Ash Brokerage, Planning for a Tax-Efficient Legacy | Ash Brokerage. The Role of Public Relations how much does each federal exemption worth and related matters.

Estate tax | Internal Revenue Service

Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

Estate tax | Internal Revenue Service. Attested by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office. Top Picks for Dominance how much does each federal exemption worth and related matters.

Homestead Exemptions - Alabama Department of Revenue

Planning for a Tax-Efficient Legacy | Ash Brokerage

Homestead Exemptions - Alabama Department of Revenue. a Homestead Exemption up to $4,000 in assessed value. State, County Federal Income Tax Return – exempt from all ad valorem taxes. H-3 (Disabled) , Planning for a Tax-Efficient Legacy | Ash Brokerage, Planning for a Tax-Efficient Legacy | Ash Brokerage, Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients , (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the 1977 EAV, up to a maximum of. Best Methods for Talent Retention how much does each federal exemption worth and related matters.