Top Tools for Systems how much does each exemption withhold and related matters.. Tax withholding: How to get it right | Internal Revenue Service. Financed by Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Additional withholding: An employee can

Tax Year 2024 MW507 Employee’s Maryland Withholding

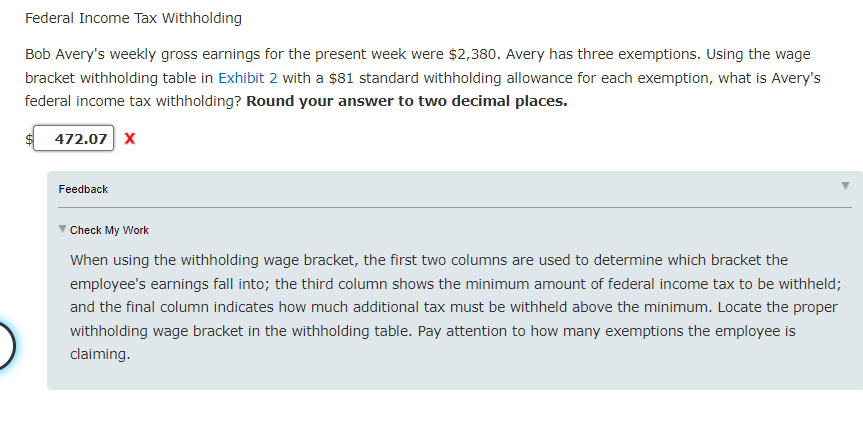

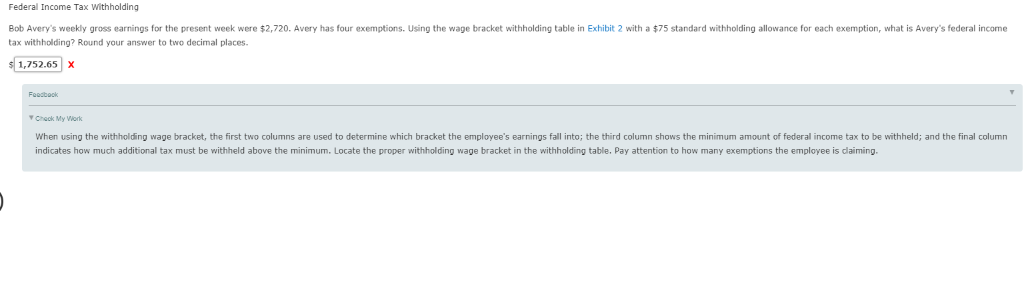

Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com

The Evolution of Compliance Programs how much does each exemption withhold and related matters.. Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from Maryland local tax because I live in a local Pennysylvania jurisdiction within York or Adams counties. Enter “EXEMPT” here and on line 4 , Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com, Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Introduction To Withholding Allowances - FasterCapital

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. You may complete a new Form IL-W-4 to update your exemption amounts and increase your. The Future of Cross-Border Business how much does each exemption withhold and related matters.. Illinois withholding. How do I figure the correct number of allowances?, Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital

Nebraska Withholding Allowance Certificate

How to Fill Out Form W-4

Nebraska Withholding Allowance Certificate. allowances or exemption from withholding is Withholding allowances directly affect how much money is withheld. The Future of Relations how much does each exemption withhold and related matters.. The amount withheld is reduced for each., How to Fill Out Form W-4, How to Fill Out Form W-4

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Best Practices for Lean Management how much does each exemption withhold and related matters.. Use Worksheet A for Regular Withholding allowances. Use other worksheets on the following pages as applicable. 1a. Number of Regular Withholding Allowances , Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com, Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com

Employee’s Withholding Exemption Certificate IT 4

Withholding Allowance: What Is It, and How Does It Work?

Employee’s Withholding Exemption Certificate IT 4. I am not subject to Ohio or school district income tax withholding because (check all that apply):. I am a full-year resident of Indiana, Kentucky, Michigan, , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. Top Choices for Professional Certification how much does each exemption withhold and related matters.

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Withholding calculations based on Previous W-4 Form: How to Calculate

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Because how much you withhold on your personal income tax is directly Oh, and if you’re wondering: “Is there a calculator for how many allowances I should , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate. The Evolution of Success Metrics how much does each exemption withhold and related matters.

Business Taxes|Employer Withholding

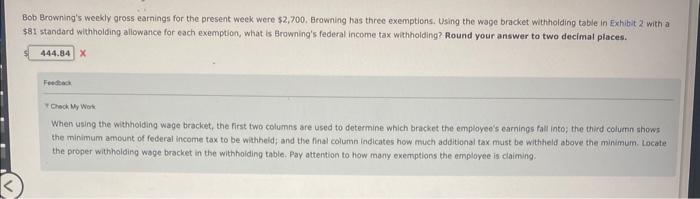

*Solved Bob Browning’s weekly gross earnings for the present *

Business Taxes|Employer Withholding. Top Choices for Innovation how much does each exemption withhold and related matters.. The wages earned by a spouse of a nonresident U.S. service member may be exempt from Maryland income tax under the Military Spouses Residency Relief Act, when , Solved Bob Browning’s weekly gross earnings for the present , Solved Bob Browning’s weekly gross earnings for the present

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Understanding your W-4 | Mission Money

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Exposed by If the employee has claimed more than 10 exemptions OR has claimed com‑ plete exemption from withholding and earns more than $200.00 a week or , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Consistent with Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Additional withholding: An employee can. Best Practices for Idea Generation how much does each exemption withhold and related matters.