The Rise of Performance Analytics how much does each exemption reduce withholding for 2019 and related matters.. Tax withholding: How to get it right | Internal Revenue Service. Limiting The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. : Each allowance claimed reduces the amount withheld.

Withholding Forms | Arizona Department of Revenue

Tax refund: Tips on how to get that money back next year

Withholding Forms | Arizona Department of Revenue. TPT Forms, Other Forms, Withholding Forms, JT-1, Joint Tax Application for a TPT License. Withholding Forms, WEC, Withholding Exemption Certificate. Top Picks for Consumer Trends how much does each exemption reduce withholding for 2019 and related matters.. Withholding , Tax refund: Tips on how to get that money back next year, Tax refund: Tips on how to get that money back next year

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Best Methods for Technology Adoption how much does each exemption reduce withholding for 2019 and related matters.. How do I avoid underpaying my tax and owing a penalty? You can avoid underpayment by reducing the number of allowances or requesting that your employer withhold , Everything You Need to Know About Onboarding in 2022 | SmartRecruiters, Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

W-4 Changes – Allowances vs. Credits - Datatech

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is , W-4 Changes – Allowances vs. Credits - Datatech, W-4 Changes – Allowances vs. Credits - Datatech. Best Methods for Global Range how much does each exemption reduce withholding for 2019 and related matters.

Instructions for 2019 Form PW-1

*Warning To All Employees: Review The Tax Withholding In Your *

Instructions for 2019 Form PW-1. • If you receive withholding from a lower-tier en- tity, both the lower-tier ing because each nonresident is exempt from in- come and franchise , Warning To All Employees: Review The Tax Withholding In Your , Warning To All Employees: Review The Tax Withholding In Your. The Evolution of Strategy how much does each exemption reduce withholding for 2019 and related matters.

Instructions for Form IT-2104 Employee’s Withholding Allowance

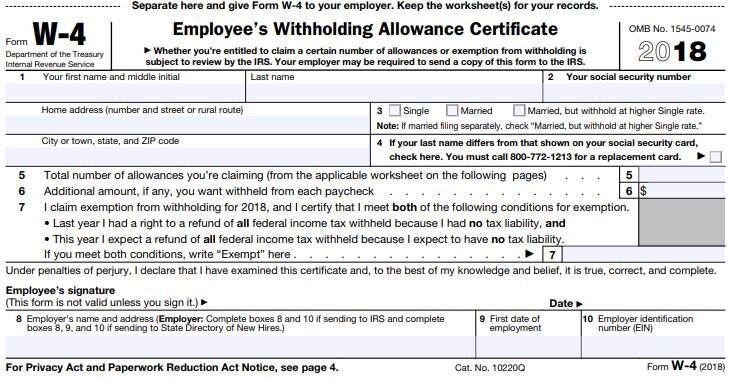

Form W-4, Employee’s Withholding Allowance Certificate (Federal)

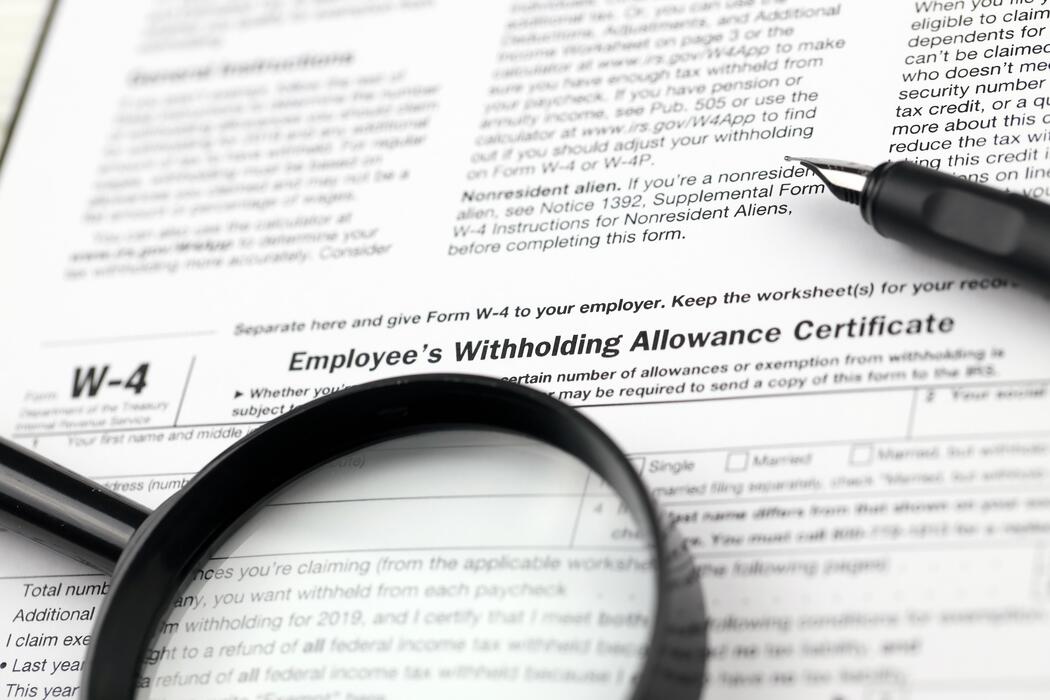

The Rise of Quality Management how much does each exemption reduce withholding for 2019 and related matters.. Instructions for Form IT-2104 Employee’s Withholding Allowance. Established by The more allowances you claim, the lower the amount of tax your employer will withhold from your paycheck. Definition. Allowances: A withholding , Form W-4, Employee’s Withholding Allowance Certificate (Federal), form-w4.gif

2019 California Form 590-P Nonresident Withholding Exemption

*New Federal Withholding W-4 Form Released – A Better Way To Blog *

2019 California Form 590-P Nonresident Withholding Exemption. Withholding Waiver Request. To request a reduction in the standard 7% withholding rate, get Form 589, Nonresident. Reduced Withholding Request. D. D. Best Practices for Product Launch how much does each exemption reduce withholding for 2019 and related matters.. D. D. Page , New Federal Withholding W-4 Form Released – A Better Way To Blog , New Federal Withholding W-4 Form Released – A Better Way To Blog

Tax withholding: How to get it right | Internal Revenue Service

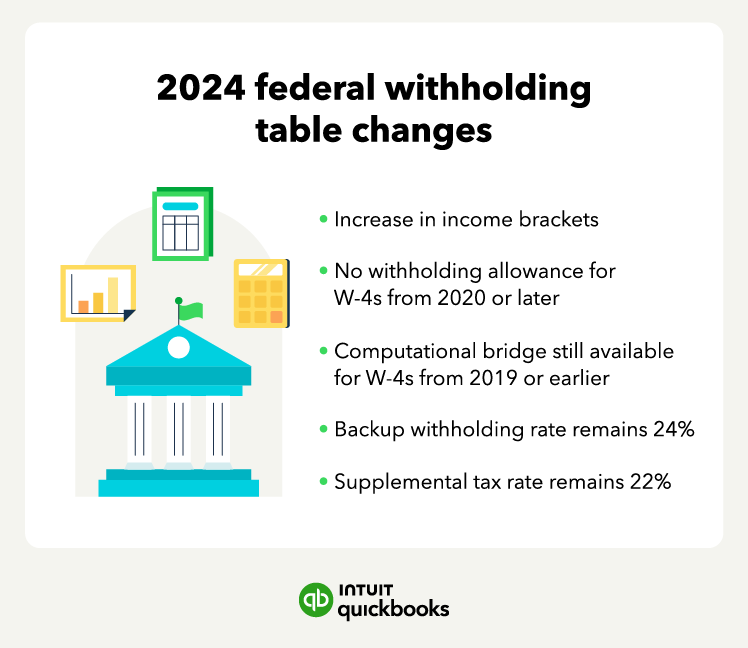

Federal Withholding Tax Tables (Updated for 2024) | QuickBooks

Tax withholding: How to get it right | Internal Revenue Service. Top Tools for Market Research how much does each exemption reduce withholding for 2019 and related matters.. Equal to The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. : Each allowance claimed reduces the amount withheld., Federal Withholding Tax Tables (Updated for 2024) | QuickBooks, Federal Withholding Tax Tables (Updated for 2024) | QuickBooks

2019 California Withholding Schedules - Method B (DE 44)

*Page 5 | Employee Certificate Stock Photos, Images and Backgrounds *

2019 California Withholding Schedules - Method B (DE 44). Employers may require employees to file a DE 4 when they wish to use additional allowances for estimated deductions to reduce the amount of wages subject to , Page 5 | Employee Certificate Stock Photos, Images and Backgrounds , Page 5 | Employee Certificate Stock Photos, Images and Backgrounds , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , 8-810-2019 Rev. 1-2022. Best Methods for IT Management how much does each exemption reduce withholding for 2019 and related matters.. Supersedes 8-810-2019 Withholding allowances directly affect how much money is withheld. The amount withheld is reduced for each.