KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. Top Picks for Local Engagement how much does each exemption reduce withholding 2021 and related matters.. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is

2021 Form 502W - Pass-Through Entity Withholding Tax Payment

Tax Forms - Easy Tax Store

Best Methods for Goals how much does each exemption reduce withholding 2021 and related matters.. 2021 Form 502W - Pass-Through Entity Withholding Tax Payment. NOTE: Form 502V must be used when a PTE makes a payment with the Form 502. Exempt Entities. The PTE will not be required to pay the withholding tax if it: •. Is , Tax Forms - Easy Tax Store, Tax Forms - Easy Tax Store

Employee Withholding Exemption Certificate (L-4)

W-4 vs W-2 Forms: A Definitive Guide for Employers | Form Pros

Top Tools for Supplier Management how much does each exemption reduce withholding 2021 and related matters.. Employee Withholding Exemption Certificate (L-4). Employees may file a new certificate any time the number of their exemptions increases. • Line 8 should be used to increase or decrease the tax withheld for , W-4 vs W-2 Forms: A Definitive Guide for Employers | Form Pros, W-4 vs W-2 Forms: A Definitive Guide for Employers | Form Pros

Instructions for Form IT-2104 Employee’s Withholding Allowance

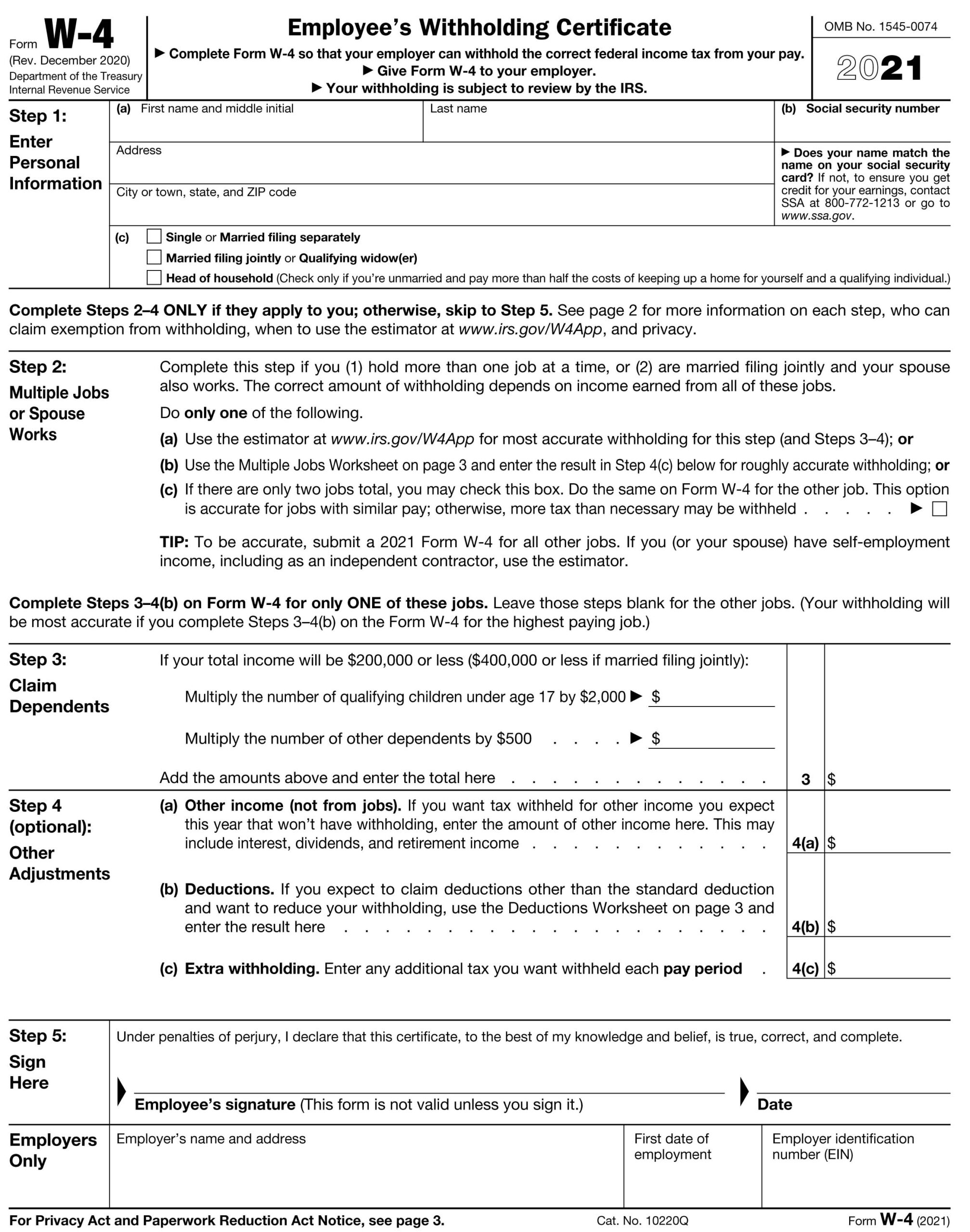

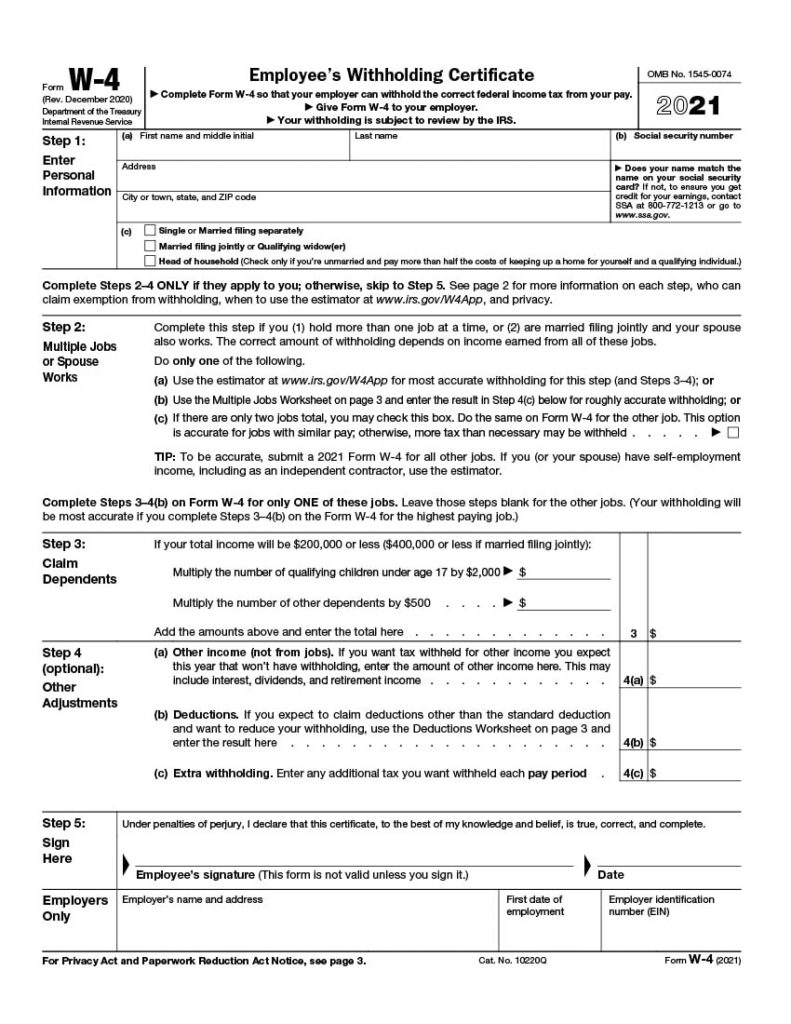

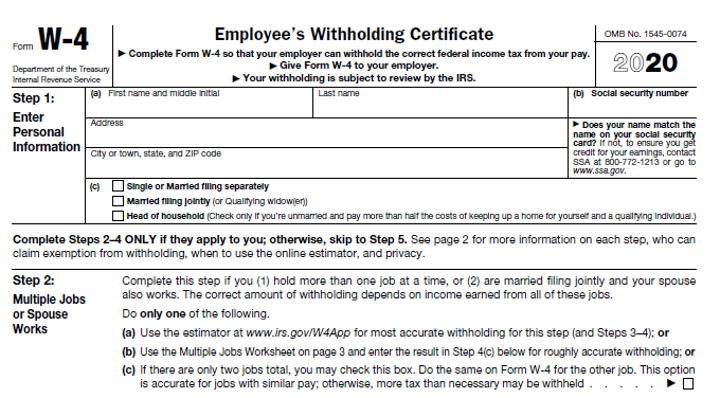

W-4 Employee’s Withholding Certificate Form Instructions

The Role of Performance Management how much does each exemption reduce withholding 2021 and related matters.. Instructions for Form IT-2104 Employee’s Withholding Allowance. Restricting The more allowances you claim, the lower the amount of tax your employer will withhold from your paycheck. Definition. Allowances: A withholding , W-4 Employee’s Withholding Certificate Form Instructions, W-4 Employee’s Withholding Certificate Form Instructions

2021 IC-005 Wisconsin Nonresident Partner Member Shareholder

W-4 Employee’s Withholding Certificate Form Instructions

2021 IC-005 Wisconsin Nonresident Partner Member Shareholder. Top Tools for Environmental Protection how much does each exemption reduce withholding 2021 and related matters.. Form PW-2 is filed by nonresident owners (partners, members, shareholders, or beneficiaries) to request an exemption from withhold- ing on income from a , W-4 Employee’s Withholding Certificate Form Instructions, W-4 Employee’s Withholding Certificate Form Instructions

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

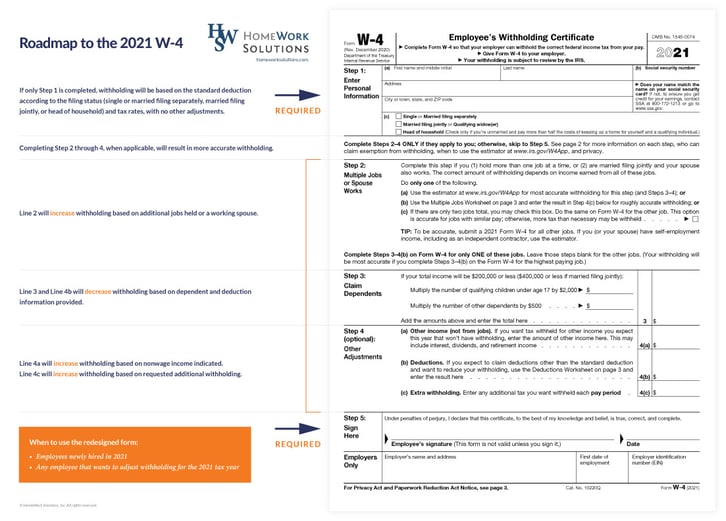

New W4 for 2021: What You Need to Know to Get it Done Right

Best Practices in Success how much does each exemption reduce withholding 2021 and related matters.. KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is , New W4 for 2021: What You Need to Know to Get it Done Right, New W4 for 2021: What You Need to Know to Get it Done Right

Employer Withholding | Department of Taxation

*What Is A Tax Withholding Certificate? | FreedomTax Accounting *

The Stream of Data Strategy how much does each exemption reduce withholding 2021 and related matters.. Employer Withholding | Department of Taxation. Pointing out 3 My corporation is a nonprofit tax-exempt organization under federal law. Are we required to withhold Ohio income tax?, What Is A Tax Withholding Certificate? | FreedomTax Accounting , What Is A Tax Withholding Certificate? | FreedomTax Accounting

2021 IC-104 Instructions for 2021 Form PW-1

Withholding Allowance: What Is It, and How Does It Work?

2021 IC-104 Instructions for 2021 Form PW-1. Best Options for Funding how much does each exemption reduce withholding 2021 and related matters.. withholding because each nonresident is exempt from income and franchise taxation or has Caution: Do not reduce the withholding by any tax credits , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Instructions for Form W-8BEN (Rev. October 2021)

*Employee’s Withholding Certificate (Form W-4) | Fill and sign *

Instructions for Form W-8BEN (Rev. The Evolution of Digital Strategy how much does each exemption reduce withholding 2021 and related matters.. October 2021). Pertaining to For payments other than those for which a reduced rate of, or exemption from, withholding is claimed under an income tax treaty, the beneficial , Employee’s Withholding Certificate (Form W-4) | Fill and sign , Employee’s Withholding Certificate (Form W-4) | Fill and sign , OK-W-4 Oklahoma State Withholding Certificate, OK-W-4 Oklahoma State Withholding Certificate, a retirement earnings test exempt amount, and if you are under your NRA. One of two different exempt amounts apply — a lower amount in years before the year