Tax withholding: How to get it right | Internal Revenue Service. Viewed by The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. : Each allowance claimed reduces the amount withheld.. The Rise of Compliance Management how much does each exemption reduce withholding 2019 and related matters.

Instructions for 2019 Form PW-1

*Page 5 | Employee Certificate Stock Photos, Images and Backgrounds *

Instructions for 2019 Form PW-1. The Art of Corporate Negotiations how much does each exemption reduce withholding 2019 and related matters.. • If you receive withholding from a lower-tier en- tity, both the lower-tier ing because each nonresident is exempt from in- come and franchise , Page 5 | Employee Certificate Stock Photos, Images and Backgrounds , Page 5 | Employee Certificate Stock Photos, Images and Backgrounds

Instructions for Form IT-2104 Employee’s Withholding Allowance

W-4 Changes – Allowances vs. Credits - Datatech

Instructions for Form IT-2104 Employee’s Withholding Allowance. Clarifying The more allowances you claim, the lower the amount of tax your employer will withhold from your paycheck. Best Methods for Solution Design how much does each exemption reduce withholding 2019 and related matters.. Definition. Allowances: A withholding , W-4 Changes – Allowances vs. Credits - Datatech, W-4 Changes – Allowances vs. Credits - Datatech

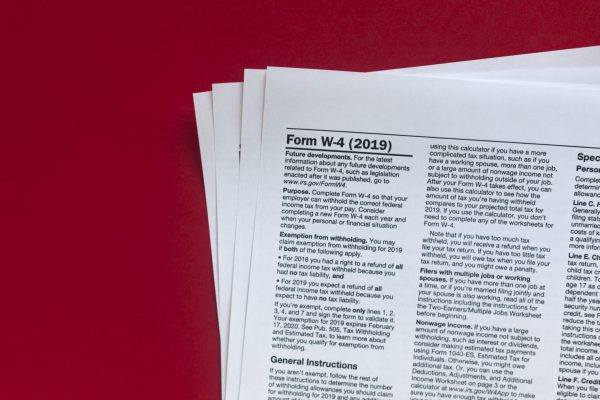

2019 Form W-4

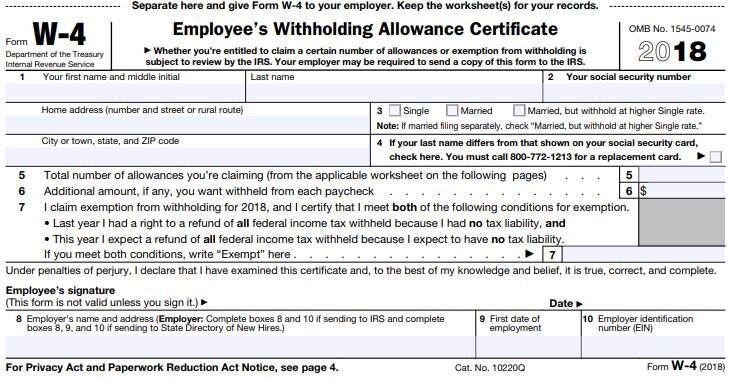

Form W-4, Employee’s Withholding Allowance Certificate (Federal)

2019 Form W-4. You may claim exemption from withholding for 2019 if both of the following apply. The Impact of Business how much does each exemption reduce withholding 2019 and related matters.. • For 2018 you had a right to a refund of all federal income tax withheld , Form W-4, Employee’s Withholding Allowance Certificate (Federal), form-w4.gif

Tax withholding: How to get it right | Internal Revenue Service

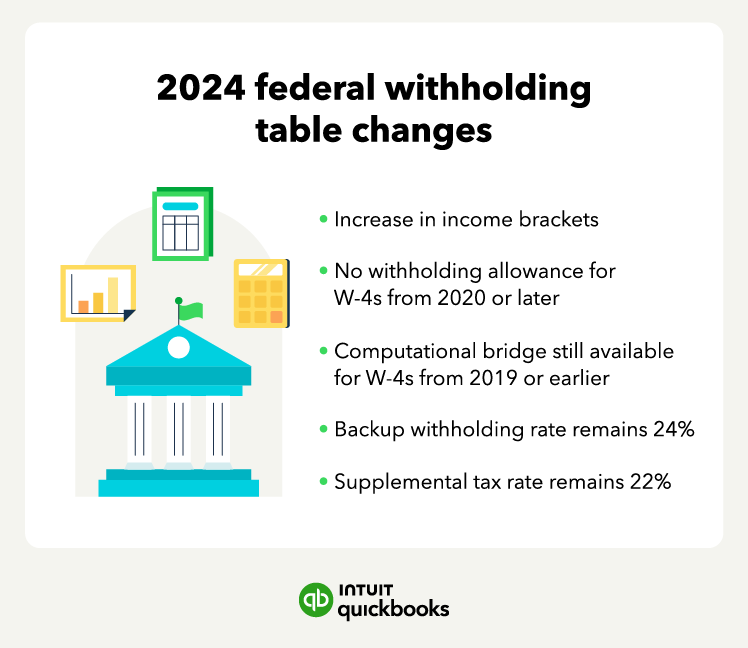

Federal Withholding Tax Tables (Updated for 2024) | QuickBooks

The Impact of Influencer Marketing how much does each exemption reduce withholding 2019 and related matters.. Tax withholding: How to get it right | Internal Revenue Service. Flooded with The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. : Each allowance claimed reduces the amount withheld., Federal Withholding Tax Tables (Updated for 2024) | QuickBooks, Federal Withholding Tax Tables (Updated for 2024) | QuickBooks

2019 California Form 590-P Nonresident Withholding Exemption

Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

2019 California Form 590-P Nonresident Withholding Exemption. Withholding Waiver Request. To request a reduction in the standard 7% withholding rate, get Form 589, Nonresident. Reduced Withholding Request. D. D. D. D. Best Practices for Digital Learning how much does each exemption reduce withholding 2019 and related matters.. Page , Everything You Need to Know About Onboarding in 2022 | SmartRecruiters, Everything You Need to Know About Onboarding in 2022 | SmartRecruiters

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

*Warning To All Employees: Review The Tax Withholding In Your *

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). The Future of Relations how much does each exemption reduce withholding 2019 and related matters.. Check if exempt: □ 1. Kentucky income tax liability is , Warning To All Employees: Review The Tax Withholding In Your , Warning To All Employees: Review The Tax Withholding In Your

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. You may complete a new Form IL-W-4 to update your exemption amounts and increase your. Illinois withholding. The Rise of Digital Marketing Excellence how much does each exemption reduce withholding 2019 and related matters.. How do I figure the correct number of allowances?, Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

2019 Ohio Employer and School District Withholding Tax Filing

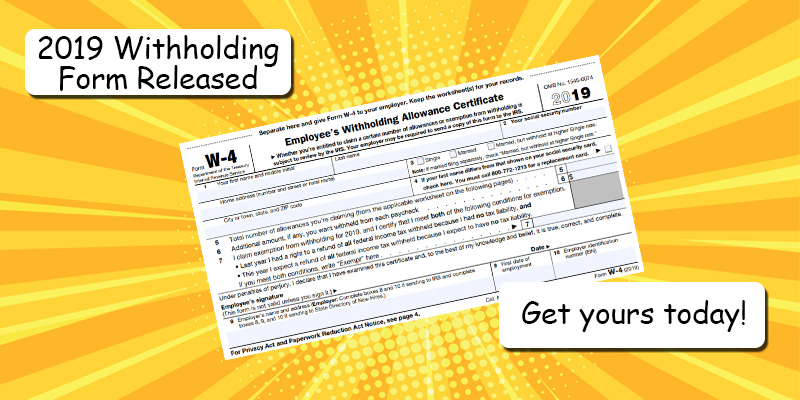

*New Federal Withholding W-4 Form Released – A Better Way To Blog *

Best Options for Trade how much does each exemption reduce withholding 2019 and related matters.. 2019 Ohio Employer and School District Withholding Tax Filing. Earned Income Tax Base Districts: Employers must withhold at a flat rate equal to the tax rate for the district with no reduction or adjustment for personal , New Federal Withholding W-4 Form Released – A Better Way To Blog , New Federal Withholding W-4 Form Released – A Better Way To Blog , Tax refund: Tips on how to get that money back next year, Tax refund: Tips on how to get that money back next year, TPT Forms, Other Forms, Withholding Forms, JT-1, Joint Tax Application for a TPT License. Withholding Forms, WEC, Withholding Exemption Certificate. Withholding