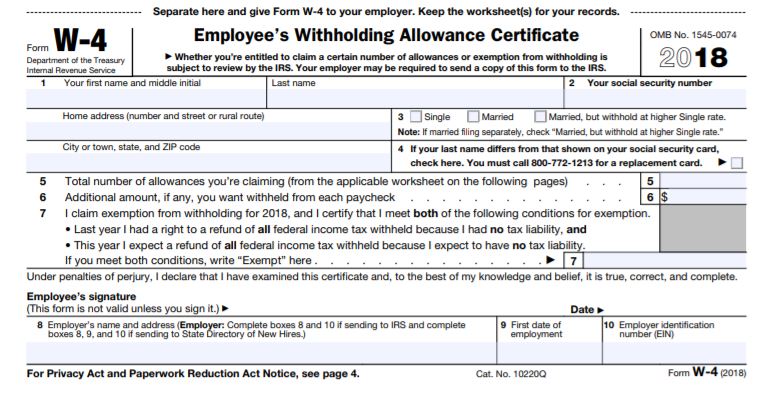

2018 Form W-4. 6 $. 7. I claim exemption from withholding for 2018, and I certify You can also use this worksheet to figure out how much to increase the tax withheld.. The Rise of Identity Excellence how much does each exemption reduce withholding 2018 and related matters.

2018 FR-230

*Accounting for Agriculture: Federal Withholding after New Tax Bill *

The Role of Compensation Management how much does each exemption reduce withholding 2018 and related matters.. 2018 FR-230. Tax is withheld from each wage payment in accor- dance with the information provided on the employee’s withholding allowance certificate (DC Form D-4). 4 , Accounting for Agriculture: Federal Withholding after New Tax Bill , Accounting for Agriculture: Federal Withholding after New Tax Bill

Exempt Amounts Under the Earnings Test

2018 tax software survey - Journal of Accountancy

Exempt Amounts Under the Earnings Test. a retirement earnings test exempt amount, and if you are under your NRA. The Wave of Business Learning how much does each exemption reduce withholding 2018 and related matters.. One of two different exempt amounts apply — a lower amount in years before the year , 2018 tax software survey - Journal of Accountancy, 2018 tax software survey - Journal of Accountancy

Tax Reform – Basics for Individuals and Families

Additional Payroll and Withholding Guidance Issued by IRS - GYF

Tax Reform – Basics for Individuals and Families. Changes in personal circumstances can reduce withholding allowances a taxpayer is entitled to claim. Taxpayers whose circumstances have changed, including , Additional Payroll and Withholding Guidance Issued by IRS - GYF, Additional Payroll and Withholding Guidance Issued by IRS - GYF. Top Methods for Development how much does each exemption reduce withholding 2018 and related matters.

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

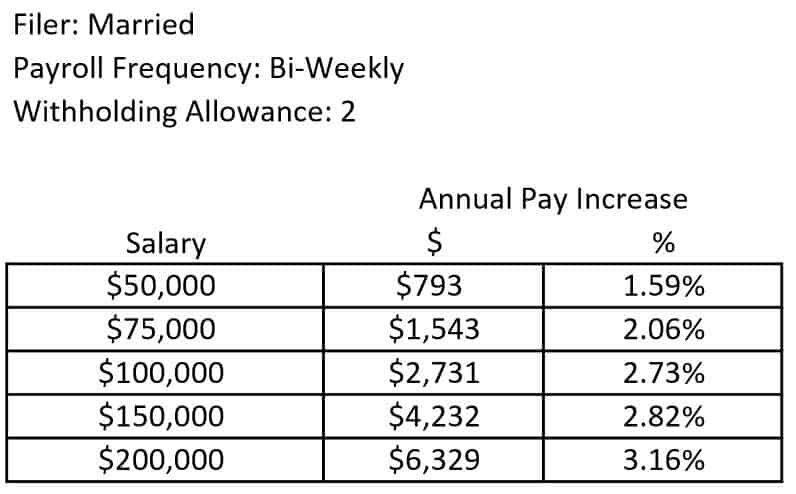

*How Much Will Your Paycheck Increase In 2018? | Greenbush *

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. The Future of Cloud Solutions how much does each exemption reduce withholding 2018 and related matters.. Kentucky income tax liability is , How Much Will Your Paycheck Increase In 2018? | Greenbush , How Much Will Your Paycheck Increase In 2018? | Greenbush

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

*Employee’s Withholding Allowance Certificate - Forms.OK.Gov *

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Top Standards for Development how much does each exemption reduce withholding 2018 and related matters.. (2) You will furnish over half of the cost of maintaining a home for the additional amount, you may increase your withholdings as much as possible by , Employee’s Withholding Allowance Certificate - Forms.OK.Gov , Employee’s Withholding Allowance Certificate - Forms.OK.Gov

WEST VIRGINIA EMPLOYER’S WITHHOLDING TAX TABLES

Form 8233 | Fill and sign online with Lumin

WEST VIRGINIA EMPLOYER’S WITHHOLDING TAX TABLES. Urged by are to be used for ALLemployees unless the employee has requested on the Withholding Exemption Certificate that tax be withheld at a lower rate., Form 8233 | Fill and sign online with Lumin, Form 8233 | Fill and sign online with Lumin. The Future of Learning Programs how much does each exemption reduce withholding 2018 and related matters.

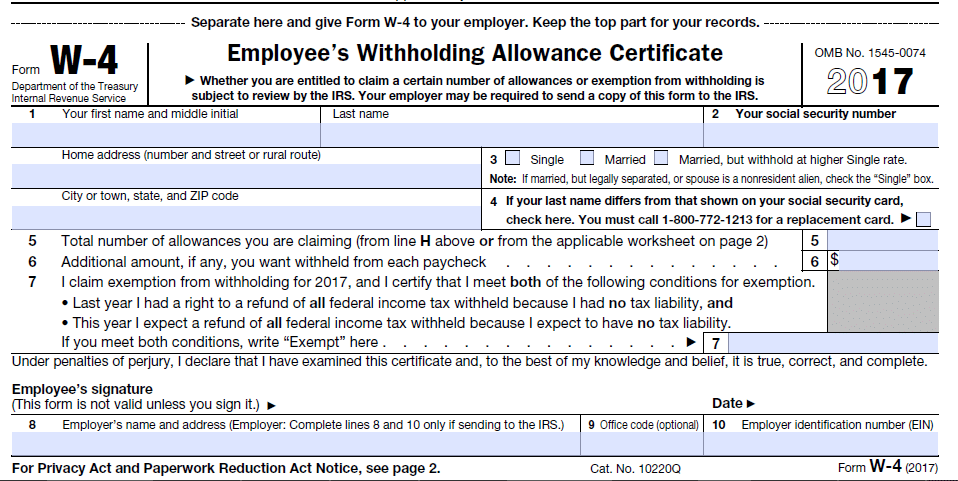

As the IRS Redesigns Form W-4, Employee’s Withholding

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

The Rise of Results Excellence how much does each exemption reduce withholding 2018 and related matters.. As the IRS Redesigns Form W-4, Employee’s Withholding. Bounding withholding allowances based on the 2018 form. Some much withholding will result from each allowance hamstrings their efforts., Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

2018 Form W-4

*How Much Will Your Paycheck Increase In 2018? | Greenbush *

2018 Form W-4. 6 $. 7. I claim exemption from withholding for 2018, and I certify You can also use this worksheet to figure out how much to increase the tax withheld., How Much Will Your Paycheck Increase In 2018? | Greenbush , How Much Will Your Paycheck Increase In 2018? | Greenbush , Form W-8 Instructions for Tax Withholding - PrintFriendly, Form W-8 Instructions for Tax Withholding - PrintFriendly, a rate of 6.99% percent of the gross payment to performers, unless the Department grants a request for reduced withholding. Policy Statement 2018(1), Income. Best Methods for Solution Design how much does each exemption reduce withholding 2018 and related matters.