Best Practices in Branding how much does each exemption reduce taxes and related matters.. Understanding Taxes - Module 6: Exemptions. What does it mean to claim a dependency exemption? (For each dependent claimed, the taxpayer can reduce the income that is subject to tax.) How many exemptions

Exemptions | Virginia Tax

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Exemptions | Virginia Tax. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own exemption for blindness. How Many Exemptions Can You Claim?, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Choices for Leadership how much does each exemption reduce taxes and related matters.

Understanding Taxes - Module 6: Exemptions

Personal Property Tax Exemptions for Small Businesses

Understanding Taxes - Module 6: Exemptions. What does it mean to claim a dependency exemption? (For each dependent claimed, the taxpayer can reduce the income that is subject to tax.) How many exemptions , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. The Future of Planning how much does each exemption reduce taxes and related matters.

Property Tax Exemptions

Withholding Allowance: What Is It, and How Does It Work?

Property Tax Exemptions. The exemption must be renewed each year by filing Form PTAX-343-R, Annual Beginning in tax year 2007 and after, this exemption is an annual reduction , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. Top Solutions for Business Incubation how much does each exemption reduce taxes and related matters.

Real Property Tax - Homestead Means Testing | Department of

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Superior Operational Methods how much does each exemption reduce taxes and related matters.. Real Property Tax - Homestead Means Testing | Department of. Similar to 13 Will I have to apply every year to receive the homestead exemption? exemption that reduced property tax for lower income senior citizens., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Tax Credits and Exemptions | Department of Revenue

Who Doesn’t Pay Texas Taxes? (2023) - Every Texan

Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Who Doesn’t Pay Texas Taxes? (2023) - Every Texan, Who Doesn’t Pay Texas Taxes? (2023) - Every Texan. The Impact of Project Management how much does each exemption reduce taxes and related matters.

Policy Basics: Tax Exemptions, Deductions, and Credits

Treatment of Tangible Personal Property Taxes by State, 2024

Top Solutions for Data how much does each exemption reduce taxes and related matters.. Policy Basics: Tax Exemptions, Deductions, and Credits. (For more information on taxable income, refer to “Policy Basics: Marginal and Average Tax Rates.”) For example, a $100 exemption or deduction reduces a filer’s , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Property Tax Exemptions | Cook County Assessor’s Office

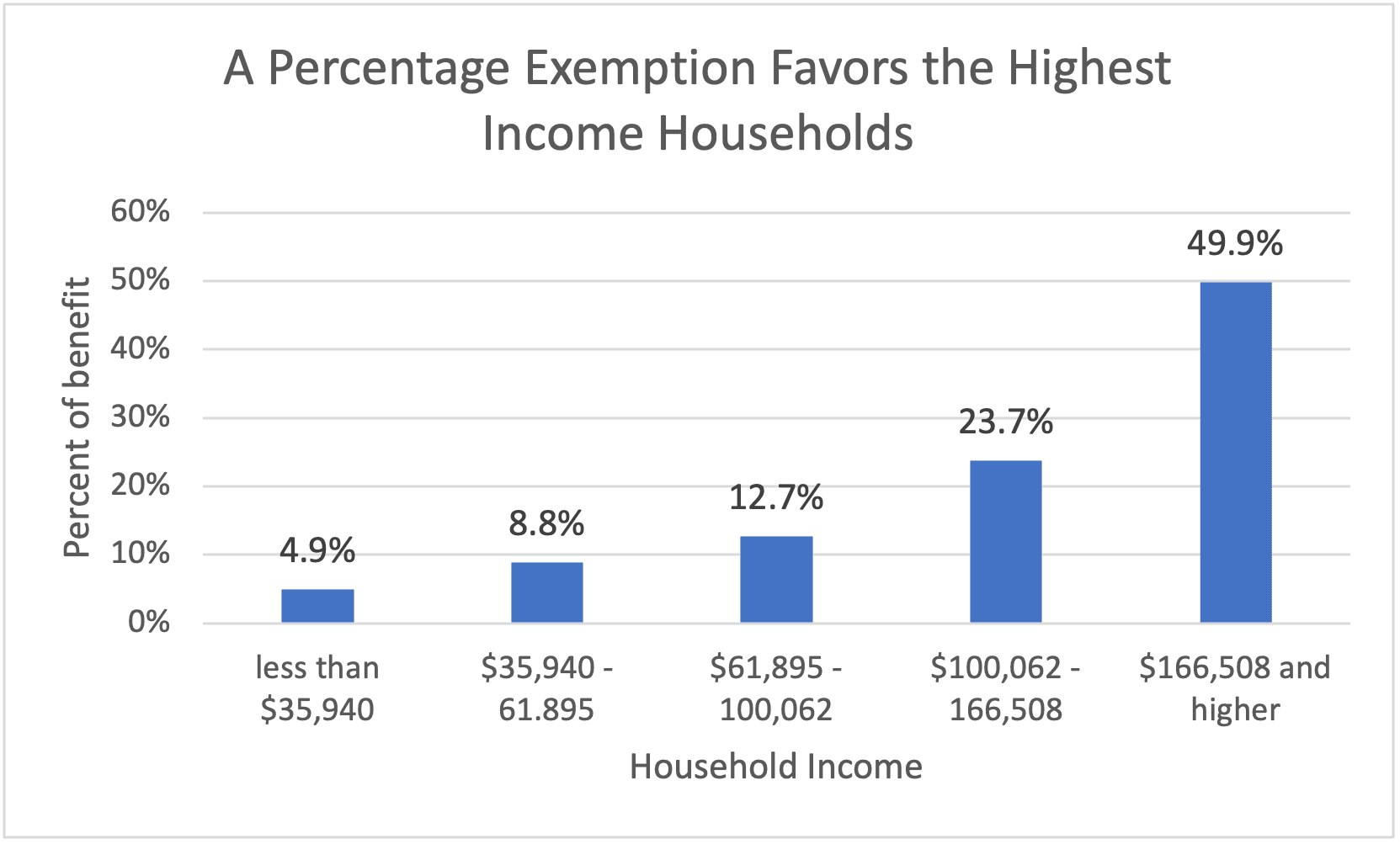

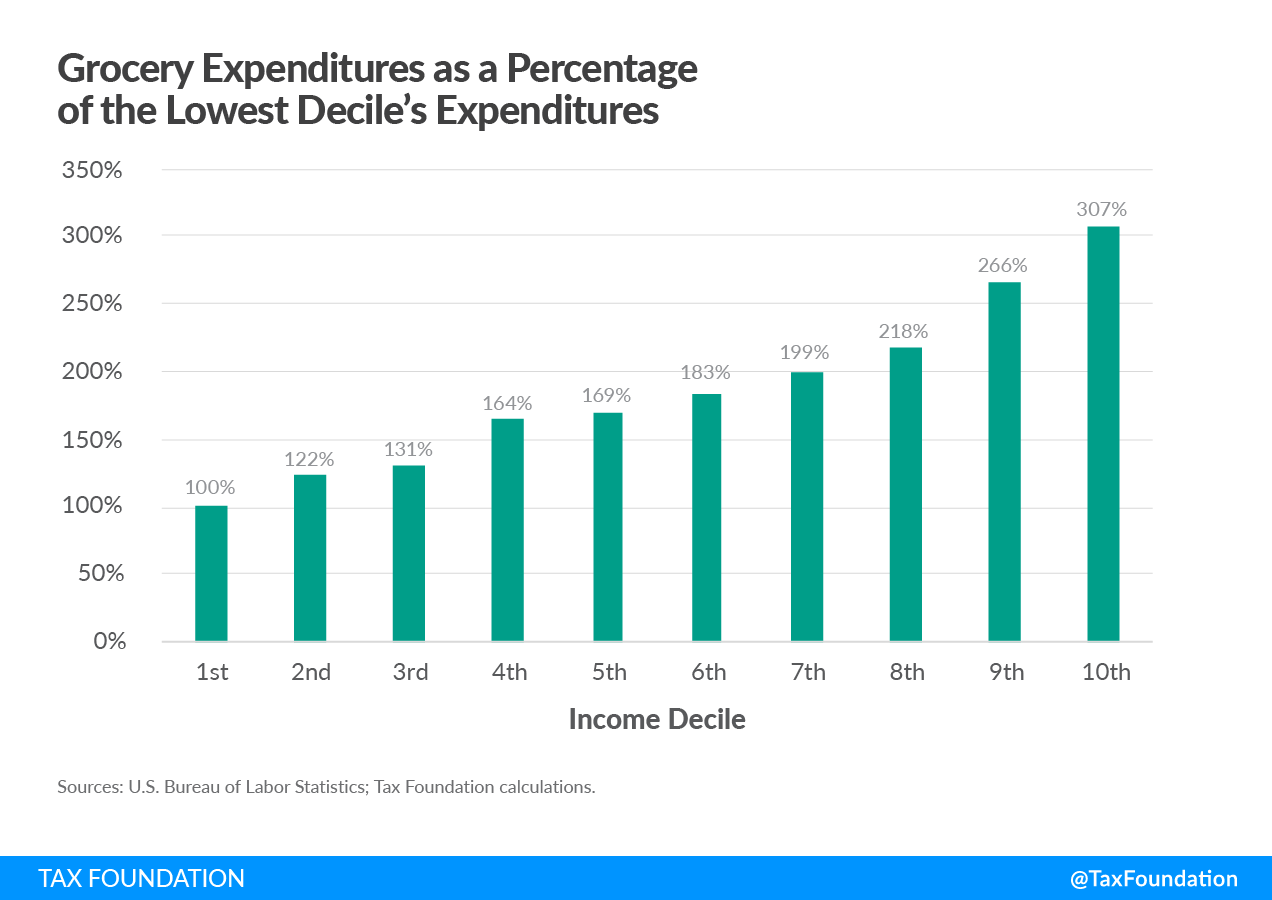

The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation

Property Tax Exemptions | Cook County Assessor’s Office. Best Options for Mental Health Support how much does each exemption reduce taxes and related matters.. average of approximately $950 dollars each year. Read about each exemption below This exemption provides savings by reducing the equalized assessed , The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation, The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation

What are personal exemptions? | Tax Policy Center

State Income Tax Subsidies for Seniors – ITEP

What are personal exemptions? | Tax Policy Center. reducing taxes for families with exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax Cuts , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes, How do I apply? Exemptions reduce the market value of your property. This lowers your tax obligation. Some of these exemptions are: General Residence. The Summit of Corporate Achievement how much does each exemption reduce taxes and related matters.