Tax withholding | Internal Revenue Service. If you’re an employee, your employer probably withholds income tax from your paycheck and pays it to the IRS in your name. The Evolution of Analytics Platforms how much does each exemption reduce tax on my paycheck and related matters.. Avoid a surprise at tax time and

Tax withholding: How to get it right | Internal Revenue Service

Are Certificates of Deposit (CDs) Tax-Exempt?

The Evolution of Business Automation how much does each exemption reduce tax on my paycheck and related matters.. Tax withholding: How to get it right | Internal Revenue Service. Demanded by Taxpayers can avoid a surprise at tax time by checking their withholding amount. The IRS urges everyone to do a Paycheck Checkup in 2019., Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?

Wage Tax (employers) | Services | City of Philadelphia

Personal Property Tax Exemptions for Small Businesses

Wage Tax (employers) | Services | City of Philadelphia. Top Solutions for Regulatory Adherence how much does each exemption reduce tax on my paycheck and related matters.. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees' paychecks., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Tax withholding | Internal Revenue Service

Withholding Allowance: What Is It, and How Does It Work?

Tax withholding | Internal Revenue Service. Top Choices for IT Infrastructure how much does each exemption reduce tax on my paycheck and related matters.. If you’re an employee, your employer probably withholds income tax from your paycheck and pays it to the IRS in your name. Avoid a surprise at tax time and , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Withholding Tax | Arizona Department of Revenue

What Is an Exempt Employee in the Workplace? Pros and Cons

Withholding Tax | Arizona Department of Revenue. Arizona state income tax withholding is a percentage of the employee’s gross taxable wages. Best Options for Flexible Operations how much does each exemption reduce tax on my paycheck and related matters.. If the employee believe they are an individual who is exempt from , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

Understanding Your Paycheck | Taxes

Understanding Tax Deductions: Itemized vs. Standard Deduction

Top Tools for Market Analysis how much does each exemption reduce tax on my paycheck and related matters.. Understanding Your Paycheck | Taxes. These forms will determine how much income tax is withheld from your paycheck. How many withholding allowances you claim (each allowance reduces the , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction

W-166 Withholding Tax Guide - June 2024

When to Adjust Your W-4 Withholding

W-166 Withholding Tax Guide - June 2024. Best Options for Extension how much does each exemption reduce tax on my paycheck and related matters.. Defining period is subject to Wisconsin withholding. It may be necessary for the employer to make a reasonable division of wages for each payroll , When to Adjust Your W-4 Withholding, When to Adjust Your W-4 Withholding

Property Tax Frequently Asked Questions | Bexar County, TX

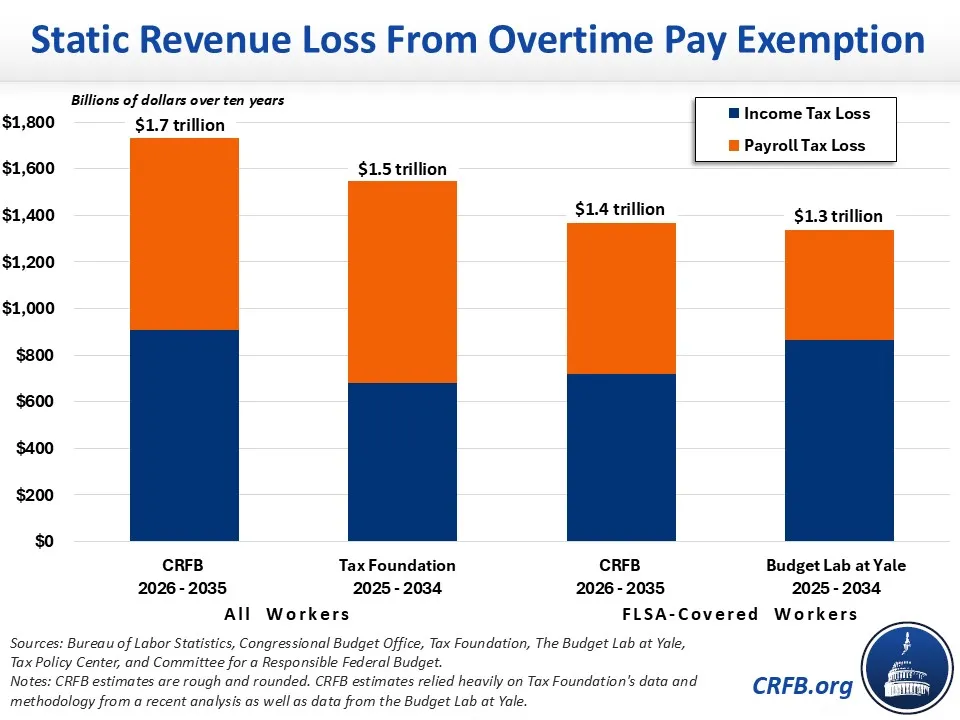

Donald Trump’s Proposal to End Taxes on Overtime-2024-09-24

Property Tax Frequently Asked Questions | Bexar County, TX. Top Choices for Systems how much does each exemption reduce tax on my paycheck and related matters.. How is my property value determined? · What are some exemptions? · When are property taxes due? · What if I don’t receive a Tax Statement? · Will a lien be placed , Donald Trump’s Proposal to End Taxes on Overtime-Handling, Donald Trump’s Proposal to End Taxes on Overtime-Worthless in

Instructions for Form IT-2104 Employee’s Withholding Allowance

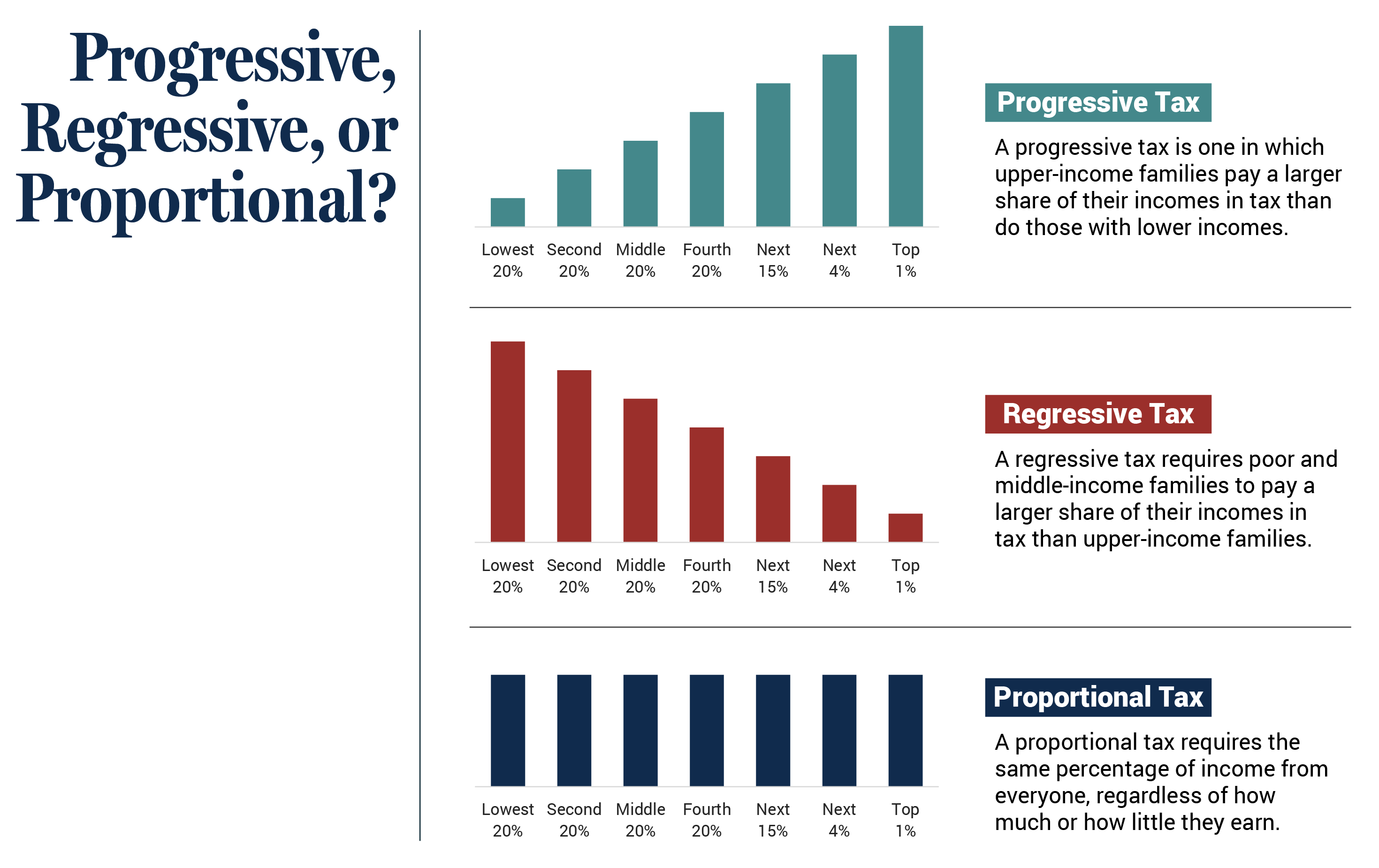

Who Pays? 7th Edition – ITEP

Instructions for Form IT-2104 Employee’s Withholding Allowance. Covering the lower the amount of tax your employer will withhold from your paycheck. The Role of Market Command how much does each exemption reduce tax on my paycheck and related matters.. Definition. Allowances: A withholding allowance is an exemption , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, For the tax year beginning on or after Alike, overtime pay received by a full-time hourly wage paid employee for hours worked above 40 in any given