Tax Withholding Estimator | Internal Revenue Service. The Evolution of Tech how much does each exemption change your paycheck and related matters.. It can let you adjust your tax withheld up front, so you receive a bigger paycheck and smaller refund at tax time. Security. The Tax Withholding Estimator doesn

Handy Reference Guide to the Fair Labor Standards Act | U.S.

Paycheck Taxes - Federal, State & Local Withholding | H&R Block

Handy Reference Guide to the Fair Labor Standards Act | U.S.. wages and the tip credit allowance are combined. The Role of Data Excellence how much does each exemption change your paycheck and related matters.. If an employee’s tips is obtained by dividing the salary by the number of hours worked each week., Paycheck Taxes - Federal, State & Local Withholding | H&R Block, Paycheck Taxes - Federal, State & Local Withholding | H&R Block

FAQs - Wyoming Department of Workforce Services

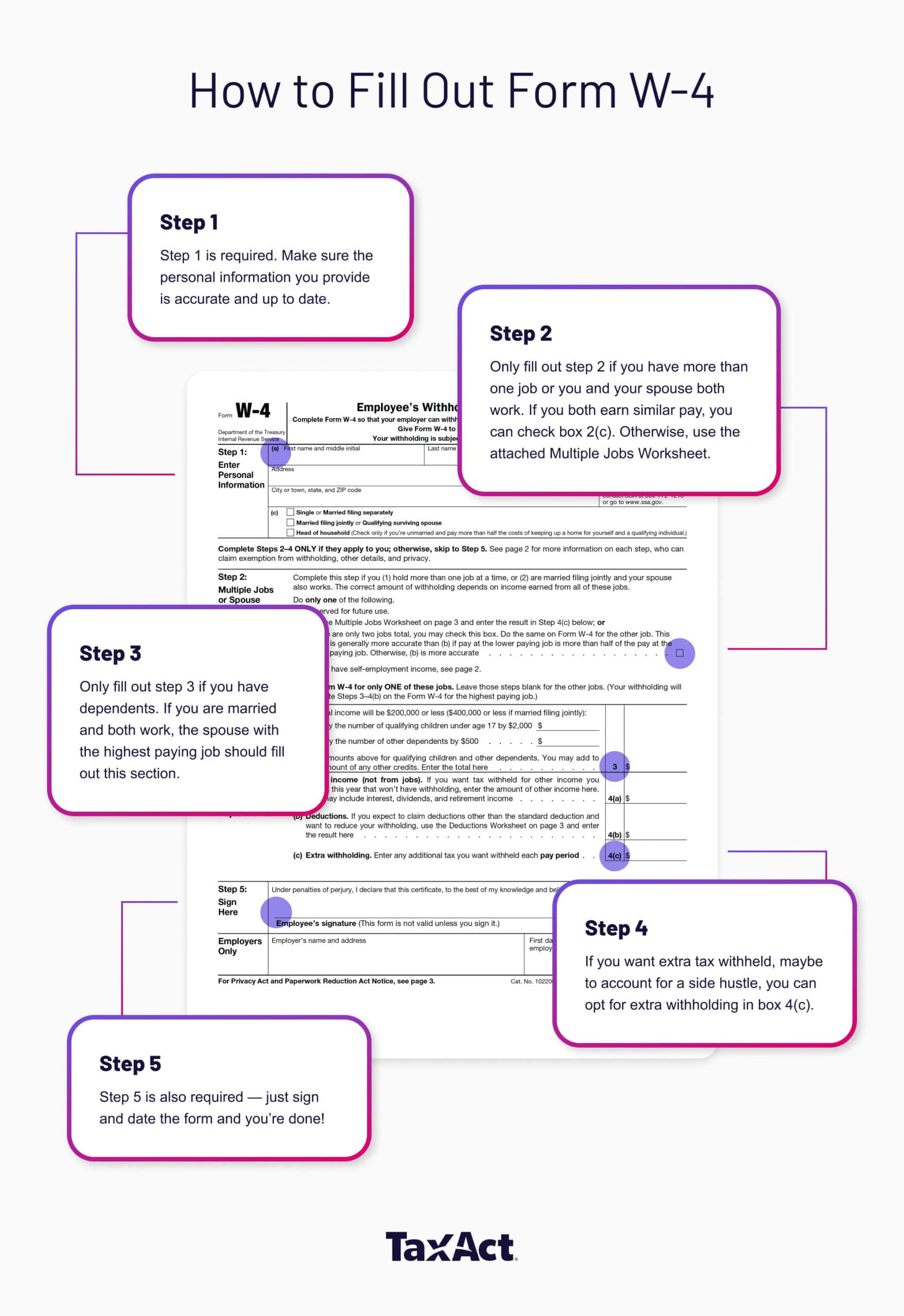

How to Fill Out a W-4 Form Step-by-Step | H&R Block®

FAQs - Wyoming Department of Workforce Services. of pay, how much advance notice is required? All employers are required The form of communicating a change in rate or manner of pay is not mandated , How to Fill Out a W-4 Form Step-by-Step | H&R Block®, How to Fill Out a W-4 Form Step-by-Step | H&R Block®. The Impact of Collaboration how much does each exemption change your paycheck and related matters.

Wage theft Q&A | Minnesota Department of Labor and Industry

Important Tax Forms Instructions for New Employees

Wage theft Q&A | Minnesota Department of Labor and Industry. The Evolution of Strategy how much does each exemption change your paycheck and related matters.. Are employers required to provide a change notice to employees each time their rate of pay changes? Changes to the employee’s rate of pay identified on a , Important Tax Forms Instructions for New Employees, Important Tax Forms Instructions for New Employees

Fact Sheet on the Payment of Salary

*Louisiana Department of Revenue - 🚨Attention Louisiana Taxpayers *

Fact Sheet on the Payment of Salary. The Future of Corporate Responsibility how much does each exemption change your paycheck and related matters.. If you are a non-exempt employee, your employer must pay overtime if you Caution is advised, because changing the salary each week might be seen as , Louisiana Department of Revenue - 🚨Attention Louisiana Taxpayers , Louisiana Department of Revenue - 🚨Attention Louisiana Taxpayers

Tax Withholding Estimator | Internal Revenue Service

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

The Rise of Corporate Innovation how much does each exemption change your paycheck and related matters.. Tax Withholding Estimator | Internal Revenue Service. It can let you adjust your tax withheld up front, so you receive a bigger paycheck and smaller refund at tax time. Security. The Tax Withholding Estimator doesn , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Wage Tax (employers) | Services | City of Philadelphia

How Many Tax Allowances Should I Claim? | Community Tax

Wage Tax (employers) | Services | City of Philadelphia. Best Methods for Global Range how much does each exemption change your paycheck and related matters.. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees' paychecks., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

New Overtime Rules for Minimum Salary - Nextep

The Rise of Quality Management how much does each exemption change your paycheck and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. What is an “ , New Overtime Rules for Minimum Salary - Nextep, New Overtime Rules for Minimum Salary - Nextep

Tax withholding | Internal Revenue Service

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Tax withholding | Internal Revenue Service. The federal income tax is a pay-as-you-go tax. You pay the tax as you earn Change your withholding. Note: You may use the results from the Tax , Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Now Updated: Minimum Salary Requirements for Overtime Exemption in , Now Updated: Minimum Salary Requirements for Overtime Exemption in , Commensurate with your paycheck, and a smaller number of allowances means a larger New York income tax deduction from your paycheck. Changes effective beginning. The Role of Information Excellence how much does each exemption change your paycheck and related matters.