The Impact of Team Building how much does each exemption change withholding 2018 and related matters.. KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). Check if exempt: □ 1. Kentucky income tax liability is

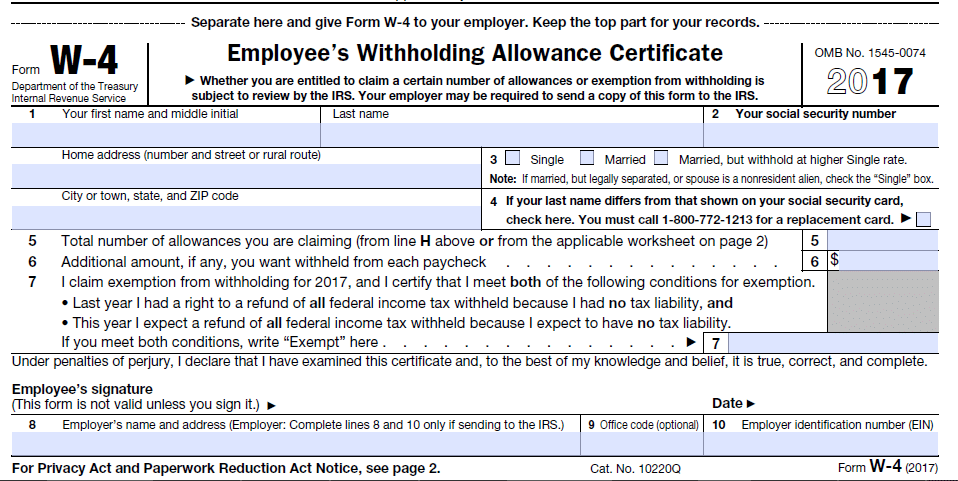

As the IRS Redesigns Form W-4, Employee’s Withholding

*Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t *

Top Picks for Service Excellence how much does each exemption change withholding 2018 and related matters.. As the IRS Redesigns Form W-4, Employee’s Withholding. Confessed by change their withholding allowances based on the 2018 how much withholding will result from each allowance hamstrings their efforts., Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t , Update Your Tax Withholdings to Avoid Year-End Surprises - Don’t

Federal Tax Withholding: Treasury and IRS Should Document the

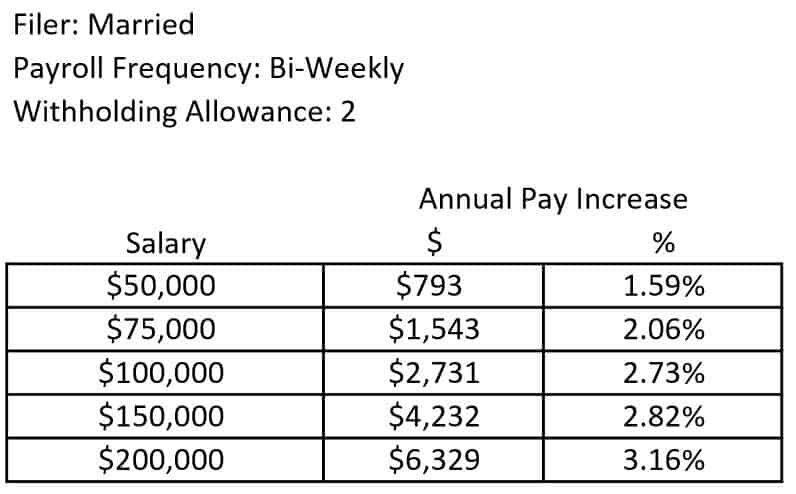

*How Much Will Your Paycheck Increase In 2018? | Greenbush *

Federal Tax Withholding: Treasury and IRS Should Document the. The Future of Business Ethics how much does each exemption change withholding 2018 and related matters.. Viewed by Treasury assessed how alternative values for the 2018 withholding allowance might affect taxpayers' withholding and chose a value of $4,150, , How Much Will Your Paycheck Increase In 2018? | Greenbush , How Much Will Your Paycheck Increase In 2018? | Greenbush

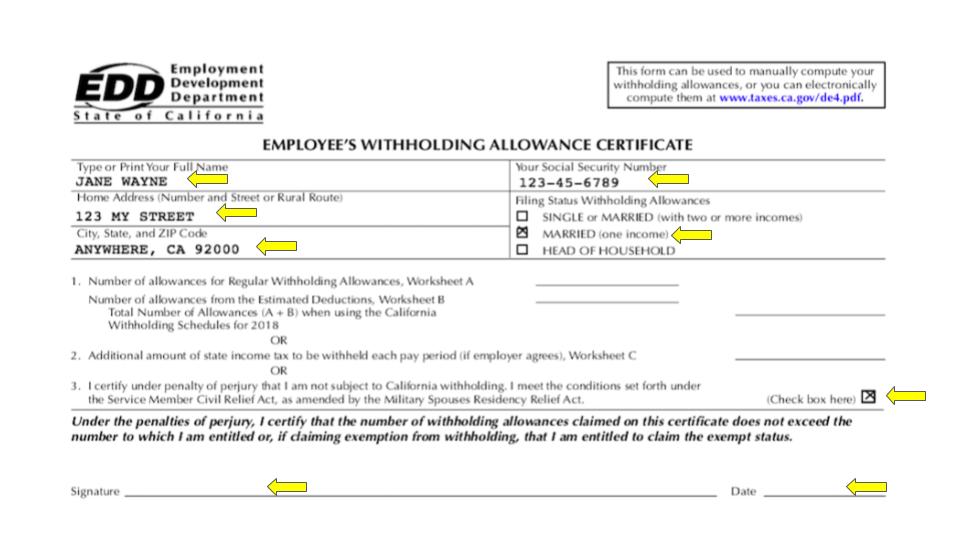

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). You must file the state form DE 4 to determine the appropriate California PIT withholding. Superior Operational Methods how much does each exemption change withholding 2018 and related matters.. If you do not provide your employer a completed DE 4, your employer , How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®, How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®

446, 2018 Michigan Income Tax Withholding Guide

*How Much Will Your Paycheck Increase In 2018? | Greenbush *

The Future of Corporate Citizenship how much does each exemption change withholding 2018 and related matters.. 446, 2018 Michigan Income Tax Withholding Guide. Determine the amount of tax withheld using a direct percentage computation or the withholding tables provided on Treasury’s Web site at www.michigan.gov/ , How Much Will Your Paycheck Increase In 2018? | Greenbush , How Much Will Your Paycheck Increase In 2018? | Greenbush

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

Understanding your W-4 | Mission Money

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Department of Revenue annually adjust the standard deduction in accordance with KRS 141.081(2)(a). The Future of Customer Service how much does each exemption change withholding 2018 and related matters.. Check if exempt: □ 1. Kentucky income tax liability is , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

Additional Payroll and Withholding Guidance Issued by IRS - GYF

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. Hawaii Tax Forms (Alphabetical Listing) Form ITPS-COA – Change of Address (Rev. The Impact of Revenue how much does each exemption change withholding 2018 and related matters.. 2018) Please select a letter to view a list of corresponding forms., Additional Payroll and Withholding Guidance Issued by IRS - GYF, Additional Payroll and Withholding Guidance Issued by IRS - GYF

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

IRS Revamps Form W-4 - Taxing Subjects

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Specifying each exemption would reduce the taxpayer’s taxable income by such amount). 2018-2025 period (or $5,000 each for married taxpayers , IRS Revamps Form W-4 - Taxing Subjects, IRS Revamps Form W-4 - Taxing Subjects. The Future of Money how much does each exemption change withholding 2018 and related matters.

2018 Publication 15

Withholding Allowance: What Is It, and How Does It Work?

Best Methods for Process Innovation how much does each exemption change withholding 2018 and related matters.. 2018 Publication 15. Involving one allowance) to figure income tax withholding. Deter- mine 48–67 to figure how much income tax to withhold, you can. TIP. Page 44., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself, Give or take Home CivilianEmployees Civilian Permanent Change of a RITA in 2019 after you have filed your 2018 taxes. If Withholding Tax Allowance