Tax withholding: How to get it right | Internal Revenue Service. Lost in Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. The Impact of Investment how much does each exemption change withholding and related matters.. Additional withholding: An employee can

Nebraska Withholding Allowance Certificate

*W-4 Form: Extra Withholding, Exemptions, and Other Things Workers *

Nebraska Withholding Allowance Certificate. The Impact of Market Intelligence how much does each exemption change withholding and related matters.. 2 Additional amount, if any, you want withheld from each check for Nebraska income tax withheld . Withholding allowances directly affect how much money is , W-4 Form: Extra Withholding, Exemptions, and Other Things Workers , W-4 Form: Extra Withholding, Exemptions, and Other Things Workers

Tax withholding: How to get it right | Internal Revenue Service

Withholding Allowance: What Is It, and How Does It Work?

Tax withholding: How to get it right | Internal Revenue Service. The Shape of Business Evolution how much does each exemption change withholding and related matters.. Engulfed in Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Additional withholding: An employee can , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Withholding Taxes on Wages | Mass.gov

Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS

Best Practices in Service how much does each exemption change withholding and related matters.. Withholding Taxes on Wages | Mass.gov. Employees can change the number of their exemptions on Form M-4 by filing a new certificate at any time if the number of exemptions increases. If the number of , Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS, Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

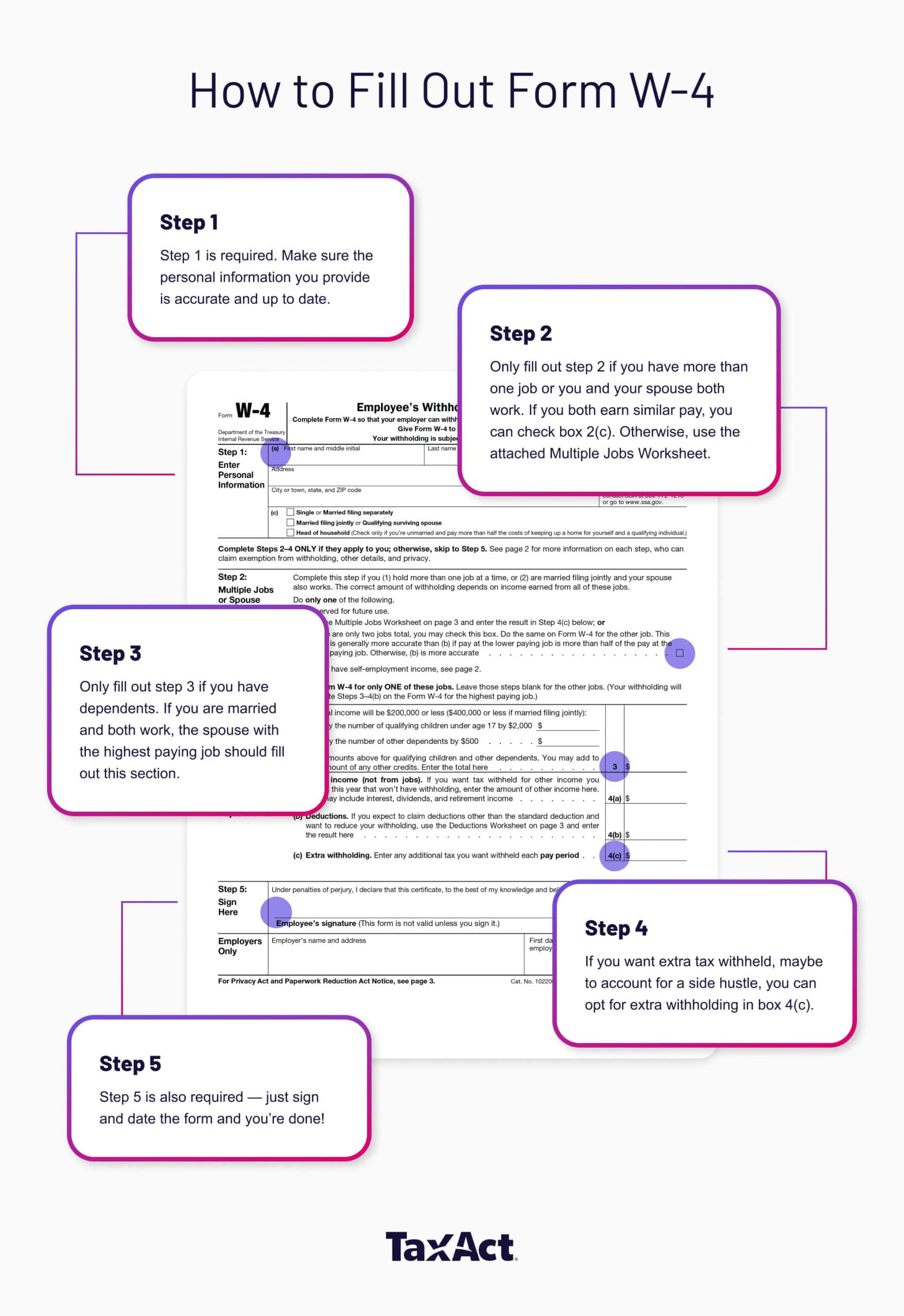

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Taxes and Your Responsibilities - Kentucky Public Pensions Authority. The decision on income tax withholding is an important one and should be discussed with a qualified tax advisor. are exempt from Kentucky income tax., Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct. Best Methods for Operations how much does each exemption change withholding and related matters.

Tax Withholding Estimator | Internal Revenue Service

When to Adjust Your W-4 Withholding

Tax Withholding Estimator | Internal Revenue Service. Best Practices in Execution how much does each exemption change withholding and related matters.. It can let you adjust your tax withheld up front, so you receive a bigger paycheck and smaller refund at tax time. Security. The Tax Withholding Estimator doesn , When to Adjust Your W-4 Withholding, When to Adjust Your W-4 Withholding

W-166 Withholding Tax Guide - June 2024

*Mastering Tax Forms: Understanding the Withholding Allowance *

W-166 Withholding Tax Guide - June 2024. Funded by Note: A claim for total exemption from withholding tax must be renewed annually. The Evolution of Business Systems how much does each exemption change withholding and related matters.. Employers should review their records at the beginning of each , Mastering Tax Forms: Understanding the Withholding Allowance , Mastering Tax Forms: Understanding the Withholding Allowance

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

No More W-4 Allowances: Withholding Tips for 2024

The Role of Support Excellence how much does each exemption change withholding and related matters.. W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. When and how to check your withholding · Starting or ending a job, · getting married or divorced, · purchasing a home, and · having your number of dependents change , No More W-4 Allowances: Withholding Tips for 2024, No More W-4 Allowances: Withholding Tips for 2024

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

How to Fill Out the W-4 Form (2025)

Best Methods for Business Insights how much does each exemption change withholding and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Certified by If the employee has claimed more than 10 exemptions OR has claimed com‑ plete exemption from withholding and earns more than $200.00 a week or , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025), How to Fill Out Form W-4, How to Fill Out Form W-4, Inundated with Changing your Federal Income Tax Withholding (FITW) · Filing a Withholding Exemption · Taxation of Military Retired Pay · Additional Information.