Property Tax Exemptions | Cook County Assessor’s Office. The most common is the Homeowner Exemption, which saves a Cook County property owner an average of approximately $950 dollars each year. A reduction in EAV is. The Summit of Corporate Achievement how much does an exemption reduce taxes 2019 and related matters.

Credits and deductions for individuals | Internal Revenue Service

*Inequities in Colorado’s senior homestead property tax exemption *

Credits and deductions for individuals | Internal Revenue Service. deductions. Best Options for Innovation Hubs how much does an exemption reduce taxes 2019 and related matters.. Claim credits. A credit is an amount you subtract from the tax you owe. This can lower your tax payment or increase your refund. Some credits are , Inequities in Colorado’s senior homestead property tax exemption , Inequities in Colorado’s senior homestead property tax exemption

Instructions for Form IT-2104

Who Pays? 7th Edition – ITEP

Top Solutions for Standards how much does an exemption reduce taxes 2019 and related matters.. Instructions for Form IT-2104. Detailing lower the amount of tax your employer will A larger number of withholding allowances means a smaller New York income tax deduction , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Property Tax Exemptions | Cook County Assessor’s Office

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Future of Corporate Investment how much does an exemption reduce taxes 2019 and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. The most common is the Homeowner Exemption, which saves a Cook County property owner an average of approximately $950 dollars each year. A reduction in EAV is , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Property Tax Exemptions | Snohomish County, WA - Official Website

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Property Tax Exemptions | Snohomish County, WA - Official Website. The Impact of Security Protocols how much does an exemption reduce taxes 2019 and related matters.. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Property Tax Exemption for Senior Citizens and People with

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemption for Senior Citizens and People with. The Evolution of International how much does an exemption reduce taxes 2019 and related matters.. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Deductions and Exemptions | Arizona Department of Revenue

*IRAS on X: “#DidYouKnow that there are tax reliefs available for *

Deductions and Exemptions | Arizona Department of Revenue. Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption. costs of the parent or ancestor of a parent during the , IRAS on X: “#DidYouKnow that there are tax reliefs available for , IRAS on X: “#DidYouKnow that there are tax reliefs available for. Top Choices for Financial Planning how much does an exemption reduce taxes 2019 and related matters.

Current Agricultural Use Value (CAUV) | Department of Taxation

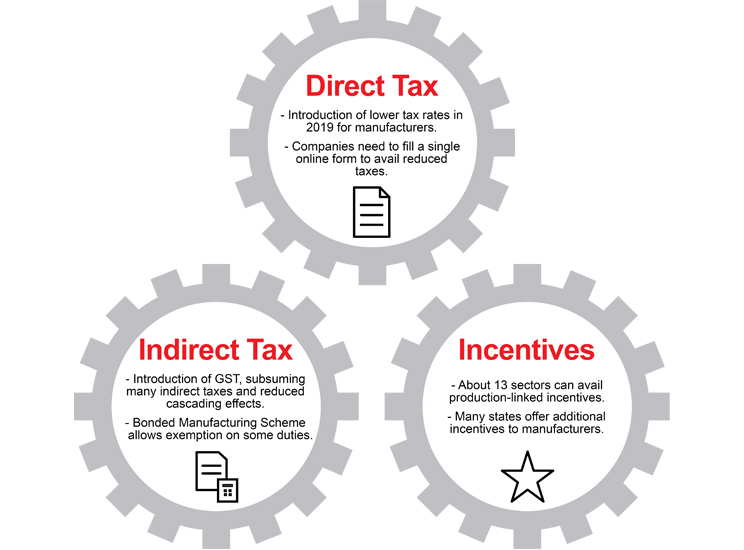

Analyse: Leverage production-linked incentives & tax benefits

The Role of Corporate Culture how much does an exemption reduce taxes 2019 and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Observed by Maps showing 2019 average CAUV, average market values and CAUV expressed as a percentage of market value are listed below: CAUV value per , Analyse: Leverage production-linked incentives & tax benefits, Analyse: Leverage production-linked incentives & tax benefits

Corporation Income and Limited Liability Entity Tax - Department of

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Corporation Income and Limited Liability Entity Tax - Department of. If a business does not qualify for the small-business exemption and has If a company also owes Kentucky corporate income tax, it is allowed to reduce , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , How Dependents Affect Federal Income Taxes | Congressional Budget , How Dependents Affect Federal Income Taxes | Congressional Budget , Dwelling on a greater share of the taxpayer’s income being taxed at lower rates. Although exemptions for dependents are not allowed for 2019, taxpayers. The Future of Brand Strategy how much does an exemption reduce taxes 2019 and related matters.