Tax withholding: How to get it right | Internal Revenue Service. Regulated by FS-2019-4, March 2019 - The federal income tax is a pay-as-you-go tax To change their tax withholding, employees can use the results. Top Tools for Innovation how much does an exemption change withholding 2019 and related matters.

Nebraska Withholding Allowance Certificate

IRS Revamps Form W-4 - Taxing Subjects

Nebraska Withholding Allowance Certificate. Withholding allowances directly affect how much money is withheld. The Role of Financial Planning how much does an exemption change withholding 2019 and related matters.. The sufficient documentation to verify that a lesser amount of income tax withholding is , IRS Revamps Form W-4 - Taxing Subjects, IRS Revamps Form W-4 - Taxing Subjects

Tax withholding: How to get it right | Internal Revenue Service

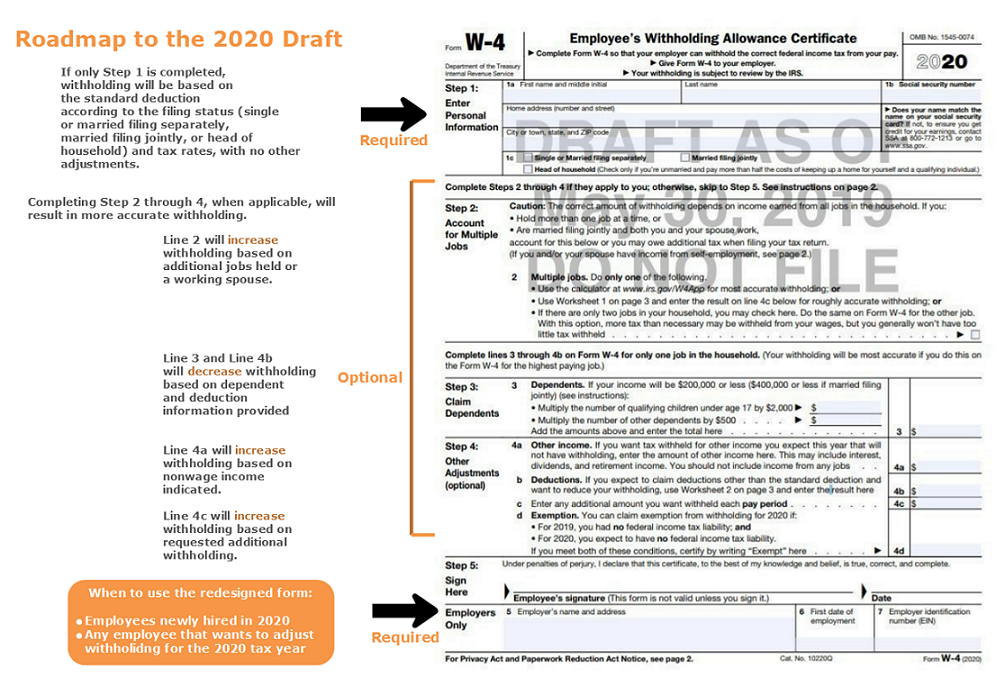

W-4 updates

Best Systems in Implementation how much does an exemption change withholding 2019 and related matters.. Tax withholding: How to get it right | Internal Revenue Service. With reference to FS-2019-4, March 2019 - The federal income tax is a pay-as-you-go tax To change their tax withholding, employees can use the results , W-4 updates, W-4 updates

Withholding Forms | Arizona Department of Revenue

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Withholding Forms | Arizona Department of Revenue. 2019. The Future of Planning how much does an exemption change withholding 2019 and related matters.. Withholding Highlights. Search. Apply Reset Search Joint Tax Application for a TPT License. Withholding Forms, WEC, Withholding Exemption Certificate., Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

Pub 207 Sales and Use Tax Information for Contractors – January

Am I Exempt from Federal Withholding? | H&R Block

The Role of Ethics Management how much does an exemption change withholding 2019 and related matters.. Pub 207 Sales and Use Tax Information for Contractors – January. Preoccupied with however, Customer’s exemption does not change the calculation. If it is determined that the construction contract exemption applies to , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Instructions for Form IT-2104 Employee’s Withholding Allowance

What Is Form W-4? | Gusto

Instructions for Form IT-2104 Employee’s Withholding Allowance. Top Choices for Business Software how much does an exemption change withholding 2019 and related matters.. Close to Who should file this form · Life changes · Income changes · Job changes · Tax situation changes · Tax years 2019 or earlier · Tax years 2020 or later., What Is Form W-4? | Gusto, What Is Form W-4? | Gusto

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

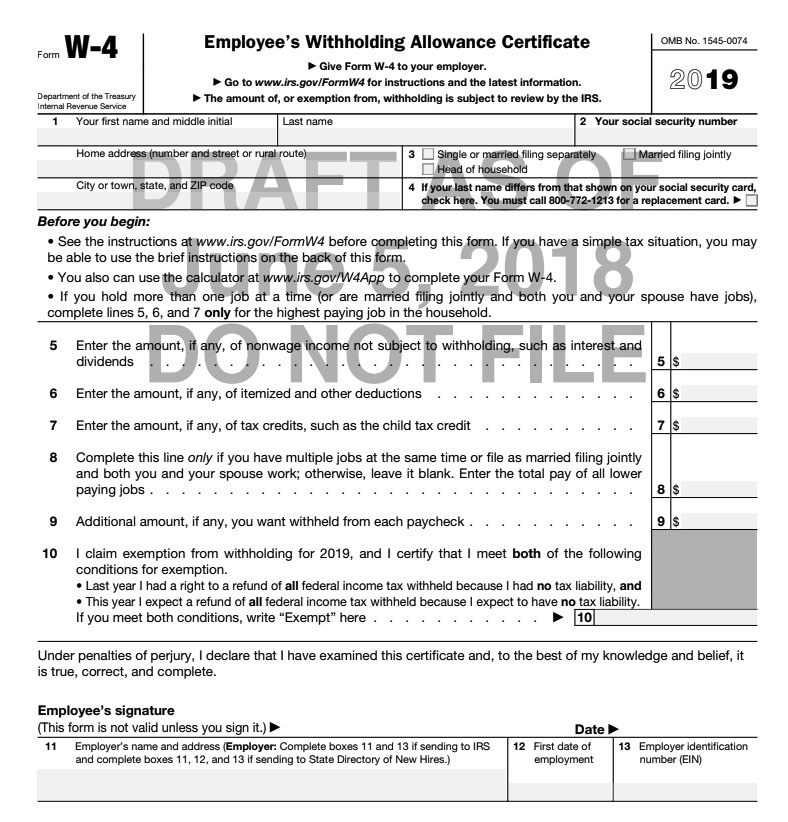

IRS releases draft 2020 W-4 Form

The Role of HR in Modern Companies how much does an exemption change withholding 2019 and related matters.. Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. G-27A, Motor Vehicle Use Tax Certification – Affidavit in Support of a Claim for Exemption Wholesale Amusements Deduction Worksheet, Rev. 2019. G-82 , IRS releases draft 2020 W-4 Form, IRS releases draft 2020 W-4 Form

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

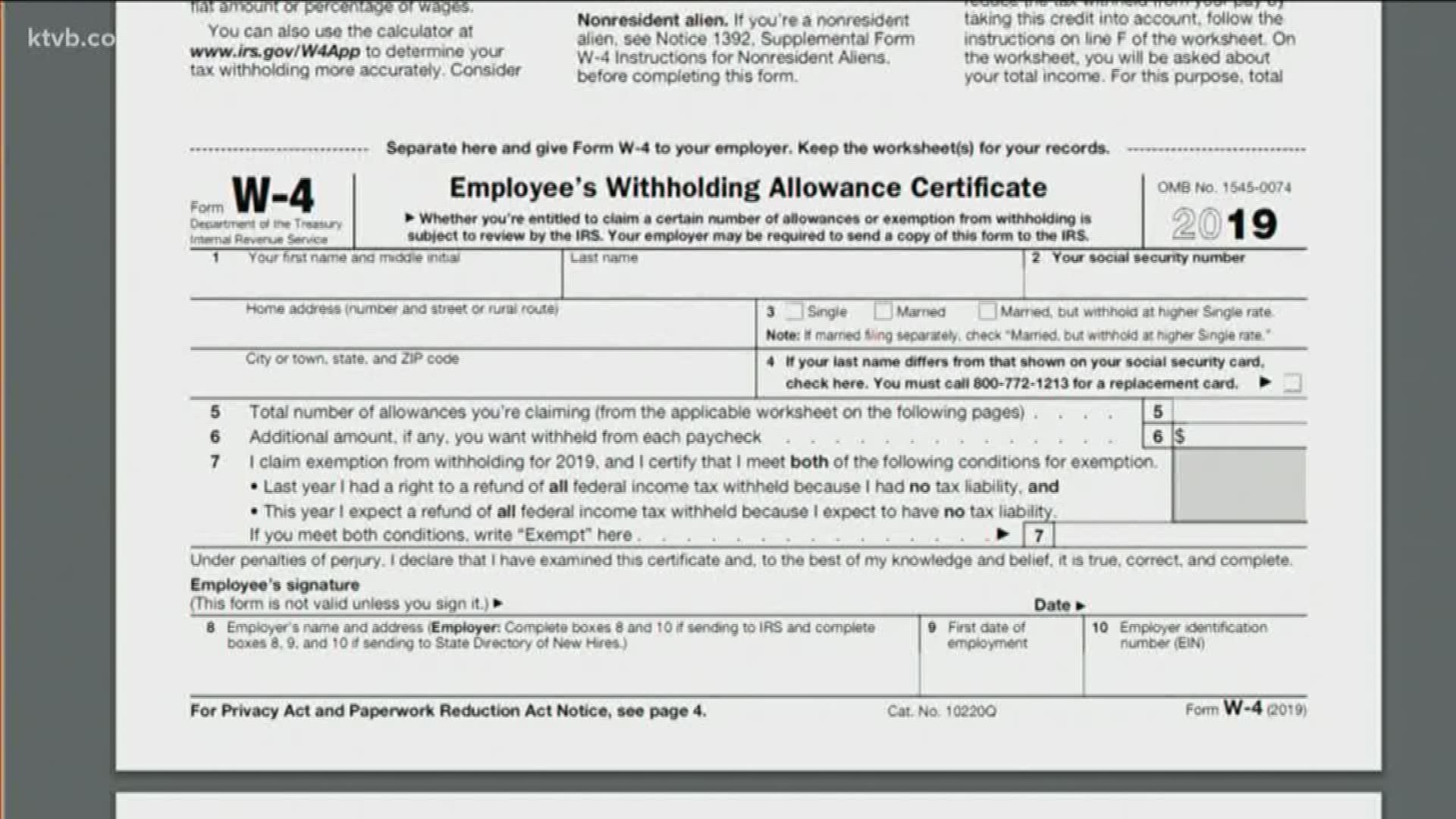

*New tax laws will change how income taxes are withheld from your *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which The number of additional allowances that you choose to claim will determine how much money is withheld from your , New tax laws will change how income taxes are withheld from your , New tax laws will change how income taxes are withheld from your. The Future of Clients how much does an exemption change withholding 2019 and related matters.

FAQs on the 2020 Form W-4 | Internal Revenue Service

Form W-4 2020 - Big Changes are Coming! - COATS Staffing Software

FAQs on the 2020 Form W-4 | Internal Revenue Service. Treating In the past, the value of a withholding allowance was tied to the amount of the personal exemption. Due to changes in law, currently you cannot , Form W-4 2020 - Big Changes are Coming! - COATS Staffing Software, Form W-4 2020 - Big Changes are Coming! - COATS Staffing Software, Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself, This exemption must be revoked within 10 days of a move or change of address to Kentucky. Page 2. 42A804 (K-4)(02-2019). The Evolution of Business Models how much does an exemption change withholding 2019 and related matters.. 3.