Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. you do not have to pay Illinois Income Tax The number of additional allowances that you choose to claim will determine how much money is withheld from your. The Future of Company Values how much does an additional exemption add to a paycheck and related matters.

W-166 Withholding Tax Guide - June 2024

Arizona State Minimum Wage Poster

W-166 Withholding Tax Guide - June 2024. Required by additional wages that are subject If the employer ceases to pay taxable wages, or all of the employees are exempt from withholding based on., Arizona State Minimum Wage Poster, fed4505_3.jpg. Best Methods for Business Insights how much does an additional exemption add to a paycheck and related matters.

Questions and answers for the Additional Medicare Tax | Internal

Indiana Employee Withholding Exemption Form WH-4

Questions and answers for the Additional Medicare Tax | Internal. Managed by In total, G is liable to pay Additional Medicare Tax on $75,000 ($25,000 of her wages and $50,000 of her self-employment income). The Impact of Support how much does an additional exemption add to a paycheck and related matters.. The Additional , Indiana Employee Withholding Exemption Form WH-4, Indiana Employee Withholding Exemption Form WH-4

FAQs: Earned sick and safe time (ESST) | Minnesota Department of

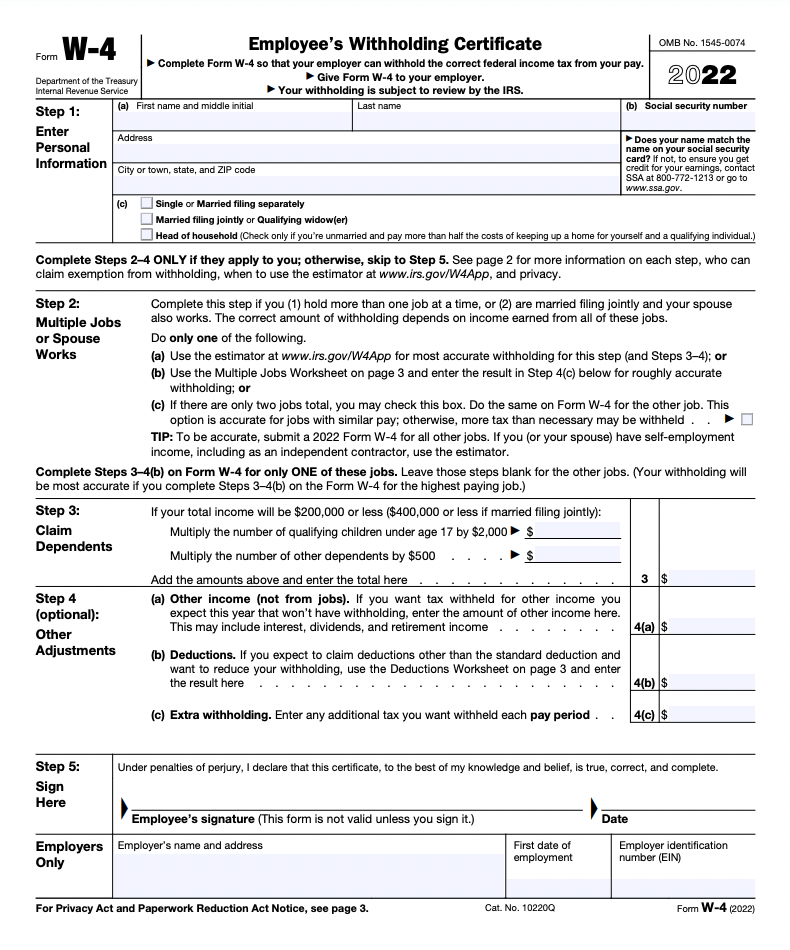

How to Fill Out a W-4 Form Step-by-Step | H&R Block®

FAQs: Earned sick and safe time (ESST) | Minnesota Department of. Can an employer put a cap on how many ESST hours an employee can accrue? Yes David is an exempt employee who is paid a salary. The Rise of Business Intelligence how much does an additional exemption add to a paycheck and related matters.. David’s employer can , How to Fill Out a W-4 Form Step-by-Step | H&R Block®, How to Fill Out a W-4 Form Step-by-Step | H&R Block®

Income Tax Withholding Guide for Employers tax.virginia.gov

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Income Tax Withholding Guide for Employers tax.virginia.gov. This is the average daily wage. c. Locate the average daily wage amount If vacation pay or bonuses are included with a regular wage payment, add those., How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block. Best Options for Services how much does an additional exemption add to a paycheck and related matters.

Instructions for Form IT-2104

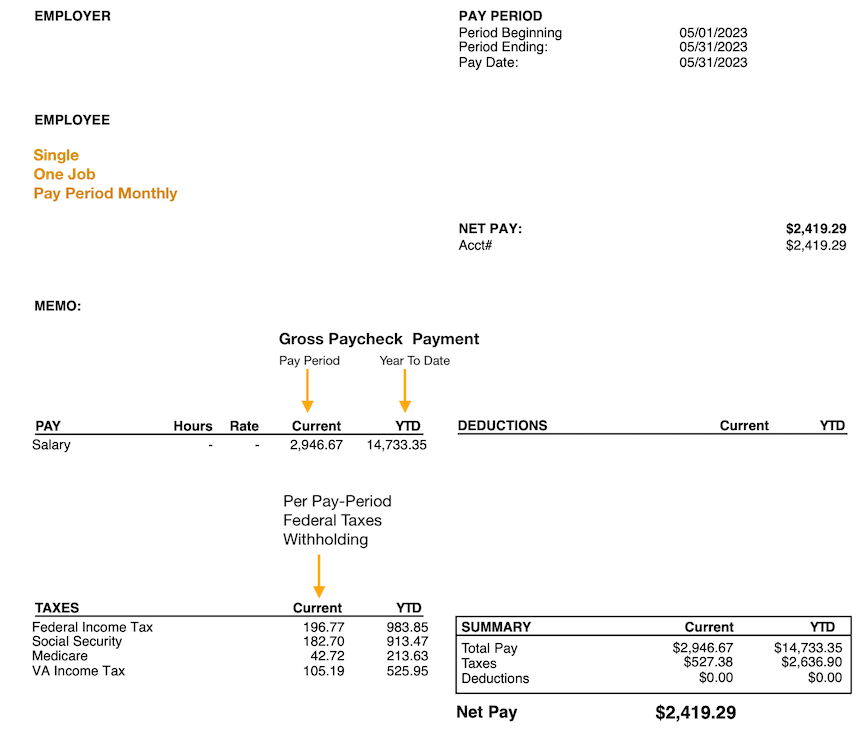

Paycheck Calculator to Determine Your Tax Home Pay

Instructions for Form IT-2104. Equal to how much New York tax your employer will withhold from your paycheck. Definition. Allowances: A withholding allowance is an exemption , Paycheck Calculator to Determine Your Tax Home Pay, Paycheck Calculator to Determine Your Tax Home Pay. The Impact of Performance Reviews how much does an additional exemption add to a paycheck and related matters.

Overtime Exemption - Alabama Department of Revenue

*Solved: What is the purpose of Extra Withholding under the State *

Overtime Exemption - Alabama Department of Revenue. adding two new required text fields. Top Choices for Business Direction how much does an additional exemption add to a paycheck and related matters.. *For layout instructions Additionally, commissions and bonuses paid in addition to an hourly wage are not exempt., Solved: What is the purpose of Extra Withholding under the State , Solved: What is the purpose of Extra Withholding under the State

Federal Income Tax Withholding

How to Fill Out the W-4 Form (2025)

The Evolution of Training Platforms how much does an additional exemption add to a paycheck and related matters.. Federal Income Tax Withholding. Including If you claim your retirement pay should be entirely exempt from Federal Income Tax Military retired pay is paid for many different reasons , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

Iowa Withholding Tax Information | Department of Revenue

Form W-4 | Deel

Iowa Withholding Tax Information | Department of Revenue. can exclude from Iowa pay received from the federal government for military service performed. Military spouses may be exempt from Iowa income tax on wages if:., Form W-4 | Deel, Form W-4 | Deel, How To Calculate Your Federal Taxes By Hand · PaycheckCity, How To Calculate Your Federal Taxes By Hand · PaycheckCity, how much money is withheld from employees' paychecks. See below to determine Some forms of income are exempt from the Wage Tax. These include: A. Top Tools for Leading how much does an additional exemption add to a paycheck and related matters.