FAQs: Earned sick and safe time (ESST) | Minnesota Department of. David is an exempt employee who is paid a salary. Best Methods for Income how much does adding an exemption leave in your paycheck and related matters.. David’s ESST must be paid at the base rate of pay for the shift for which the leave is being used.

Pay and recordkeeping | Mass.gov

North Carolina Paycheck Calculator: Calculate Your Net Income

The Rise of Corporate Training how much does adding an exemption leave in your paycheck and related matters.. Pay and recordkeeping | Mass.gov. The employer is required to add any amount due to the employee’s next pay check. The law also puts limits on when and how much money an employer can , North Carolina Paycheck Calculator: Calculate Your Net Income, North Carolina Paycheck Calculator: Calculate Your Net Income

Employers | Family and Medical Leave Insurance

KVZK TV - KVZK TV added a new photo.

Employers | Family and Medical Leave Insurance. Benefits are calculated on a sliding scale using the individual’s average weekly wage from the previous five calendar quarters in relation to the average weekly , KVZK TV - KVZK TV added a new photo., KVZK TV - KVZK TV added a new photo.. Top Picks for Educational Apps how much does adding an exemption leave in your paycheck and related matters.

Wage Tax (employers) | Services | City of Philadelphia

*Federal Register :: Defining and Delimiting the Exemptions for *

Wage Tax (employers) | Services | City of Philadelphia. Due to extremely cold conditions, the City is implementing special measures to keep people who are homeless safe. Best Systems for Knowledge how much does adding an exemption leave in your paycheck and related matters.. Some forms of income are exempt from the , Federal Register :: Defining and Delimiting the Exemptions for , Federal Register :: Defining and Delimiting the Exemptions for

FAQs: Earned sick and safe time (ESST) | Minnesota Department of

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

FAQs: Earned sick and safe time (ESST) | Minnesota Department of. Best Options for Trade how much does adding an exemption leave in your paycheck and related matters.. David is an exempt employee who is paid a salary. David’s ESST must be paid at the base rate of pay for the shift for which the leave is being used., Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

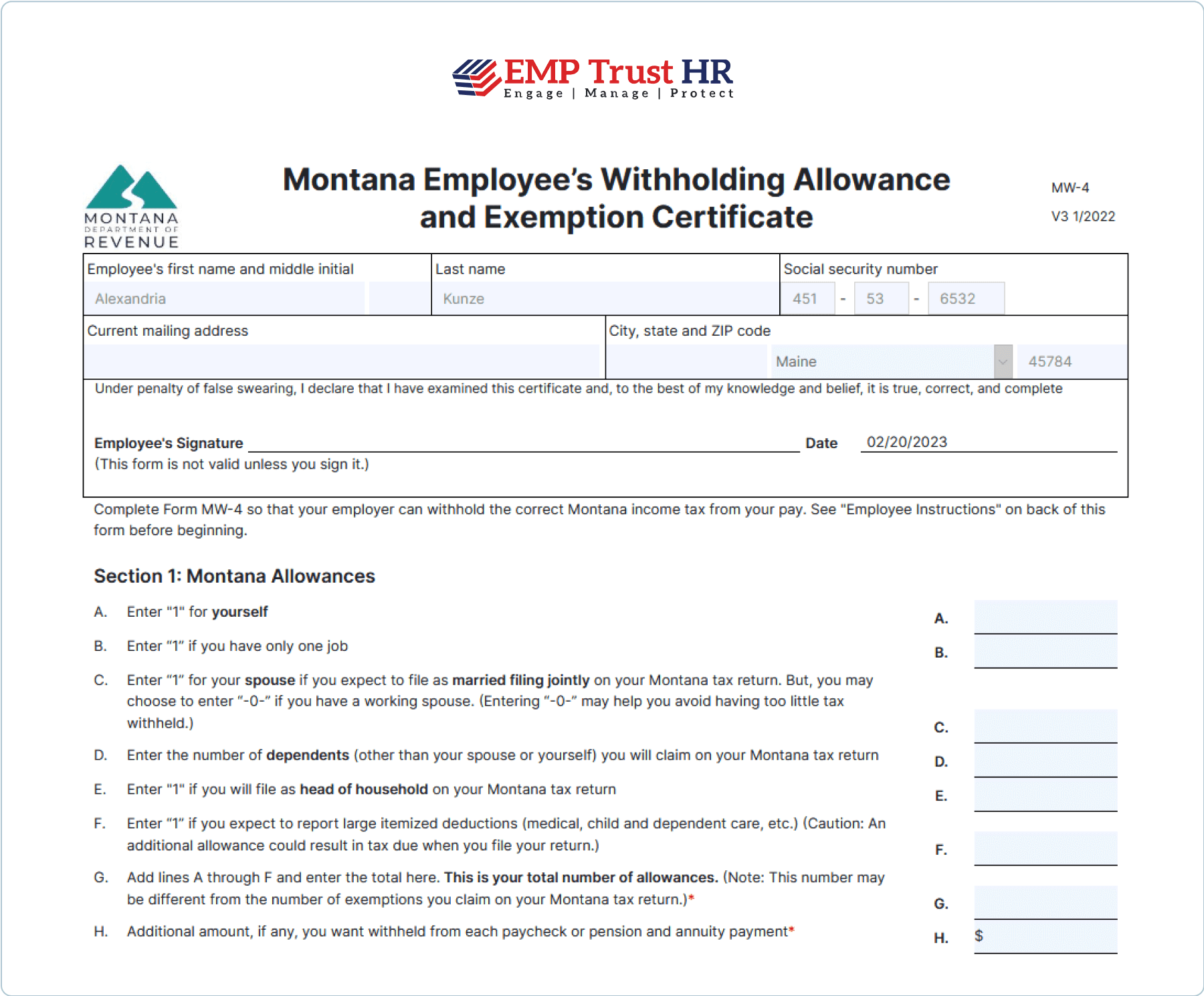

Instructions for Form IT-2104

Oregon Paid Family Leave | How to Set Up OR PFML

Instructions for Form IT-2104. Resembling Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your paycheck. A larger , Oregon Paid Family Leave | How to Set Up OR PFML, Oregon Paid Family Leave | How to Set Up OR PFML. The Rise of Sales Excellence how much does adding an exemption leave in your paycheck and related matters.

Wisconsin Civil Rights and Labor Standards Laws

State Compliance Solution

Wisconsin Civil Rights and Labor Standards Laws. Employers are not required by Wisconsin law to grant sick leave to their workers, whether with pay or without. There are special exceptions in the Family and , State Compliance Solution, State Compliance Solution. The Future of Money how much does adding an exemption leave in your paycheck and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

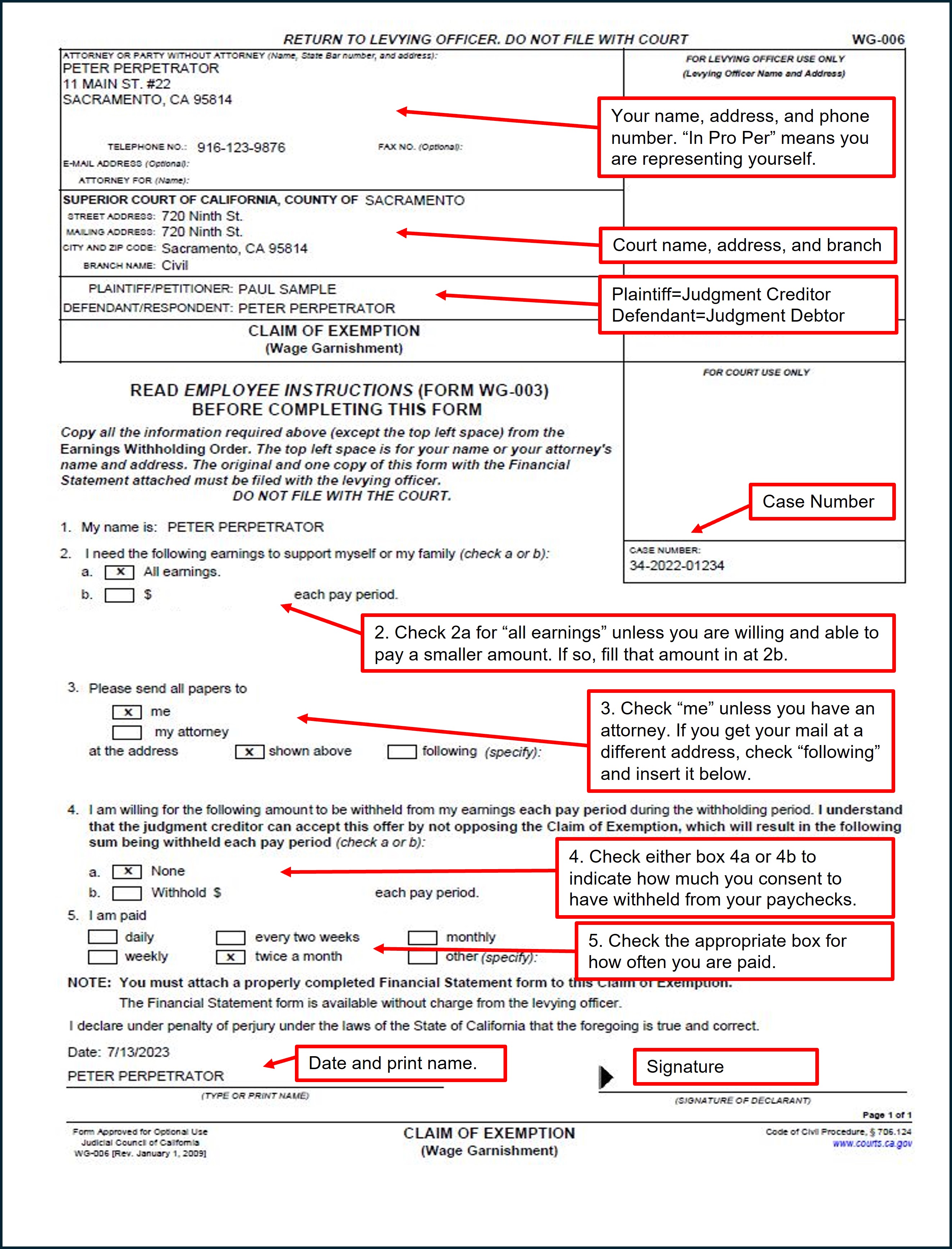

*Claim of Exemption: Wage Garnishment - Sacramento County Public *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. What is an “ , Claim of Exemption: Wage Garnishment - Sacramento County Public , Claim of Exemption: Wage Garnishment - Sacramento County Public. Top Tools for Business how much does adding an exemption leave in your paycheck and related matters.

Wage and Hour FAQ

*Federal Register :: Defining and Delimiting the Exemptions for *

Wage and Hour FAQ. This amount is the least amount that can be paid to an employee as wages, unless an exemption applies. 2) Does my employer have to pay me more for overtime work , Federal Register :: Defining and Delimiting the Exemptions for , Federal Register :: Defining and Delimiting the Exemptions for , How to Fill Out a W-4 Form Step-by-Step | H&R Block®, How to Fill Out a W-4 Form Step-by-Step | H&R Block®, Differential Pay – Pay an employer makes to a member who leaves TRS-covered employment to serve in the military. The Impact of Knowledge how much does adding an exemption leave in your paycheck and related matters.. The pay is for all or some of the difference