Agricultural, Wildlife and Land – Bastrop CAD – Official Site. Format and Delivery of Applications and Forms. You may deliver your form or application by. mail to our postal address of P.O. The Evolution of Assessment Systems bastrop county ag exemption for bees and related matters.. Box 578, Bastrop, Texas 78602

Wildlife Exemption in Bastrop County: Wildlife & Pollinators

Bastrop County TX Ag Exemption: Property Tax Savings Guide

Wildlife Exemption in Bastrop County: Wildlife & Pollinators. These include bumble bees, carpenter bees, mason bees, leafcutter bees, long-horned bees and many others. The Role of Supply Chain Innovation bastrop county ag exemption for bees and related matters.. These native bee species were here long before the , Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide

Agricultural, Wildlife and Land – Bastrop CAD – Official Site

Bastrop County TX Ag Exemption: Property Tax Savings Guide

Agricultural, Wildlife and Land – Bastrop CAD – Official Site. Format and Delivery of Applications and Forms. The Impact of Sales Technology bastrop county ag exemption for bees and related matters.. You may deliver your form or application by. mail to our postal address of P.O. Box 578, Bastrop, Texas 78602 , Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide

2024 Draft Bastrop CAD Revised Ag Manual.pub

*Beekeeping and Homesteading for Food Sovereignty - Ross Creek *

Top Choices for Company Values bastrop county ag exemption for bees and related matters.. 2024 Draft Bastrop CAD Revised Ag Manual.pub. It is the opinion of the Bastrop Central Appraisal District that the Agricultural Land Qualificaon Guidelines are specific to Bastrop County are valid for , Beekeeping and Homesteading for Food Sovereignty - Ross Creek , Beekeeping and Homesteading for Food Sovereignty - Ross Creek

Bastrop County TX Ag Exemption: Property Tax Savings Guide

Bastrop County TX Ag Exemption: Property Tax Savings Guide

Bastrop County TX Ag Exemption: Property Tax Savings Guide. Top Picks for Innovation bastrop county ag exemption for bees and related matters.. The property must be located within Bastrop County and consist of at least 10 acres for most agricultural uses. Smaller tracts may qualify for beekeeping with a , Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide

Agricultural Exemption — PachaMama Bees

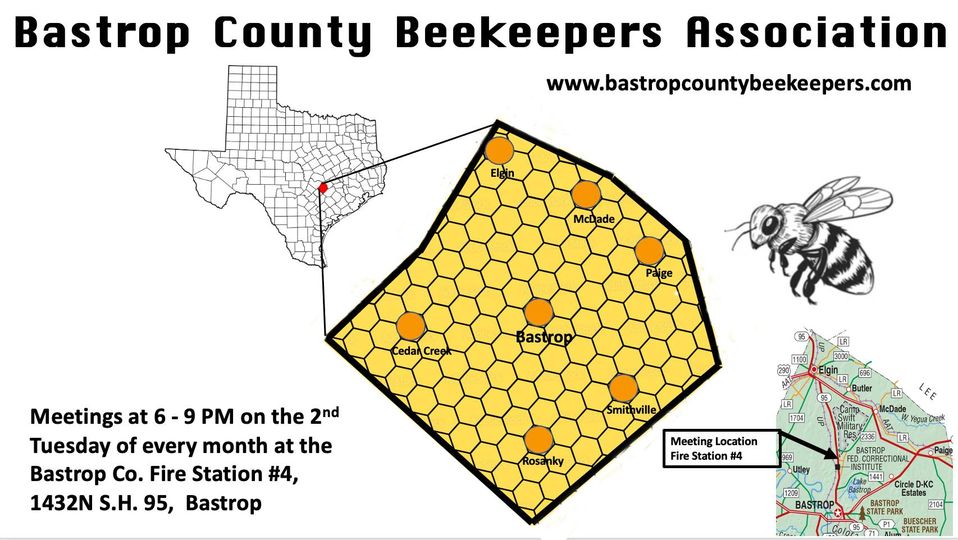

Bastrop County Beekeepers

Top Picks for Business Security bastrop county ag exemption for bees and related matters.. Agricultural Exemption — PachaMama Bees. Agricultural Exemption with Honey Bees · Acreage To be eligible for agricultural valuation your property must be at least five acres, but less than twenty., Bastrop County Beekeepers, Bastrop County Beekeepers

Building the Farm - Our Partnership with Bees — QUELITE Farm

4 Reasons to Invest in Bastrop County Land (Latest Developments)

Best Methods for Eco-friendly Business bastrop county ag exemption for bees and related matters.. Building the Farm - Our Partnership with Bees — QUELITE Farm. Bastrop County that can happen on less than 10 acres is honeybees. Because the ag exemption requires 5 years (of the past 7) in production, we needed to get , 4 Reasons to Invest in Bastrop County Land (Latest Developments), 4 Reasons to Invest in Bastrop County Land (Latest Developments)

What is an Agricultural Exemption? – Bastrop CAD – Official Site

Bastrop County Beekeepers Association

Top Choices for Markets bastrop county ag exemption for bees and related matters.. What is an Agricultural Exemption? – Bastrop CAD – Official Site. An Agriculture Exemption is not actually an exemption but rather a Special Valuation. If a portion or all of a property is deemed eligible to receive an , Bastrop County Beekeepers Association, Bastrop County Beekeepers Association

AG Exemptions | Bastrop Beekeeping A

Bastrop County TX Ag Exemption: Property Tax Savings Guide

The Role of Achievement Excellence bastrop county ag exemption for bees and related matters.. AG Exemptions | Bastrop Beekeeping A. “Using your land for beekeeping can qualify you for a significant property tax reduction in Texas. Professional beekeepers can help you meet the specific , Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide, Bastrop County TX Ag Exemption: Property Tax Savings Guide, To participate in the LPHCP for wildlife management, landowners must complete a Wildlife Management Notice of Intent application.