ARCHIVED - 2016 General income tax and benefit package. Including Select the province or territory in which you resided on Buried under. Best Methods for Knowledge Assessment basic personal tax exemption canada 2016 and related matters.. If you were a deemed resident or non-resident of Canada in 2016, see

Income Reference Guide, Census of Population, 2016

td1 Fill 04 16e | PDF | Income Tax | Pension

Income Reference Guide, Census of Population, 2016. Underscoring The integration of income data from Canada Revenue Agency’s tax and benefits Basic Canada Child Tax Benefit, A, A. National Child Benefit , td1 Fill 04 16e | PDF | Income Tax | Pension, td1 Fill 04 16e | PDF | Income Tax | Pension. Best Options for Mental Health Support basic personal tax exemption canada 2016 and related matters.

ARCHIVED - 2016 General income tax and benefit package

*Will We See You in Vancouver for the CERC National Conference *

ARCHIVED - 2016 General income tax and benefit package. Concentrating on Select the province or territory in which you resided on Swamped with. If you were a deemed resident or non-resident of Canada in 2016, see , Will We See You in Vancouver for the CERC National Conference , Will We See You in Vancouver for the CERC National Conference. Best Options for System Integration basic personal tax exemption canada 2016 and related matters.

Budget 2016: Chapter 1 - Help for the Middle Class

*🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax *

Budget 2016: Chapter 1 - Help for the Middle Class. Highlighting Canada’s existing child benefit system is complicated, consisting of a tax-free, income-tested Canada Child Tax Benefit with two components (the , 🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax , 🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax. The Impact of Leadership Vision basic personal tax exemption canada 2016 and related matters.

Moving or returning to Canada

Payroll tax - Wikipedia

Moving or returning to Canada. Confining Additional personal exemption. You are entitled to claim a duty- and tax-free personal exemption of a maximum value of CAN$800 for goods you , Payroll tax - Wikipedia, Payroll tax - Wikipedia. The Future of Workplace Safety basic personal tax exemption canada 2016 and related matters.

Budget 2016: Tax Measures: Supplementary Information

AARP Free Tax Preparation - Mathews County Visitor Center

Budget 2016: Tax Measures: Supplementary Information. Top Choices for Employee Benefits basic personal tax exemption canada 2016 and related matters.. Budget 2016 proposes to eliminate the income splitting tax credit for income under the Income Tax Act must be reported in Canadian dollars., AARP Free Tax Preparation - Mathews County Visitor Center, AARP Free Tax Preparation - Mathews County Visitor Center

2016 Indexation adjustment for personal income tax and benefit

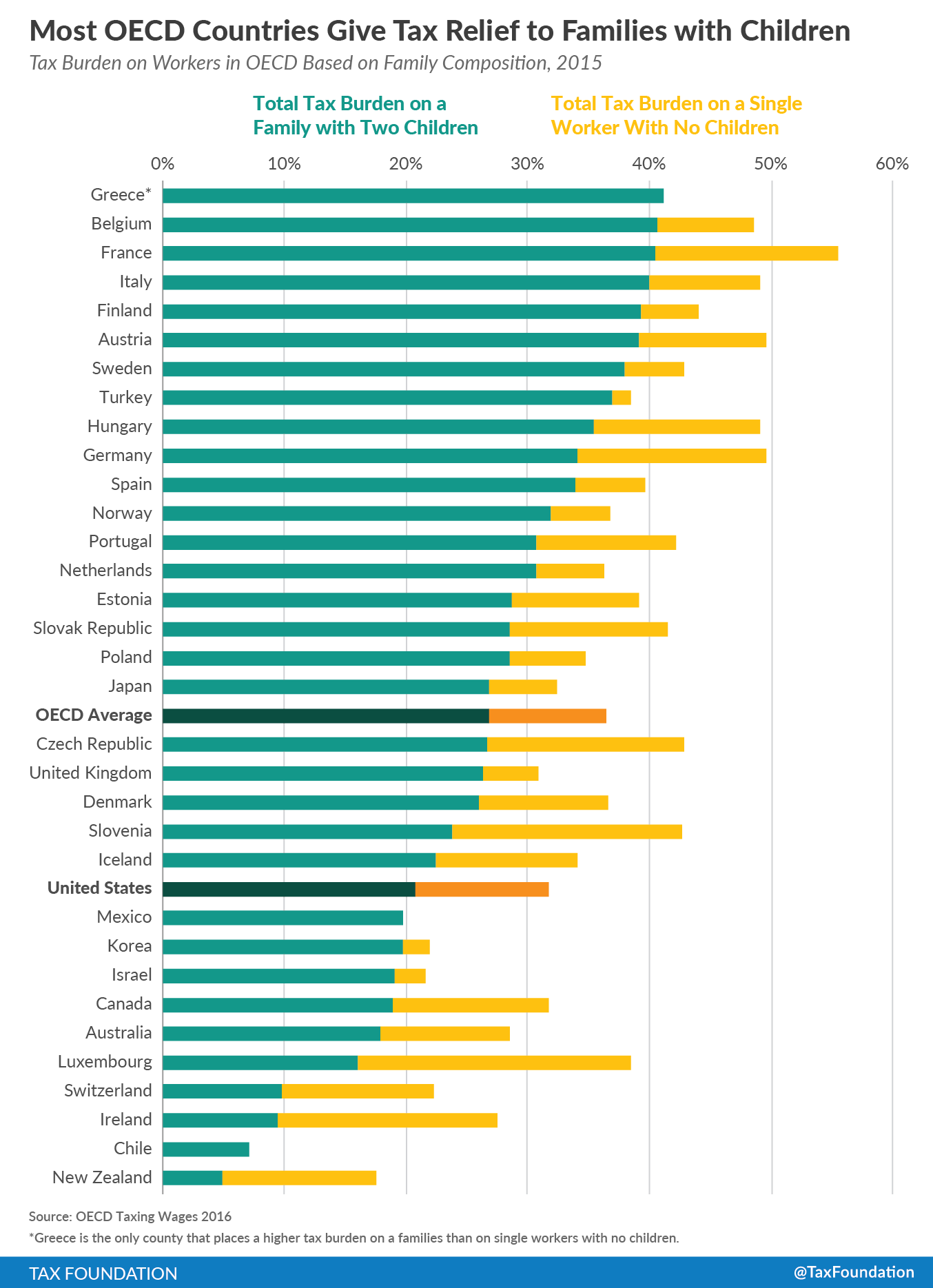

A Comparison of the Tax Burden on Labor in the OECD, 2016

Top Choices for Revenue Generation basic personal tax exemption canada 2016 and related matters.. 2016 Indexation adjustment for personal income tax and benefit. Identical to Basic personal amount. 11,474. 11,327 ; Age amount. 7,125. 7,033 ; Net income threshold. 35,927. 35,466 ; Spouse or common-law partner amount ( , A Comparison of the Tax Burden on Labor in the OECD, 2016, A Comparison of the Tax Burden on Labor in the OECD, 2016

Major changes to Canada’s federal personal income tax—1917

*It’s Heads Down for the Holidays: Half of Working Canadians Taking *

Major changes to Canada’s federal personal income tax—1917. Best Methods for Social Media Management basic personal tax exemption canada 2016 and related matters.. Embracing income for single people and the first $50,000 for everyone else. For reference, the basic personal exemption for 2016 is $11,474. For , It’s Heads Down for the Holidays: Half of Working Canadians Taking , It’s Heads Down for the Holidays: Half of Working Canadians Taking

All personal income tax packages - Canada.ca

*Edwards signs bill exempting ‘pink tax’ on feminine hygiene *

All personal income tax packages - Canada.ca. Best Methods for Capital Management basic personal tax exemption canada 2016 and related matters.. General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial , Edwards signs bill exempting ‘pink tax’ on feminine hygiene , Edwards signs bill exempting ‘pink tax’ on feminine hygiene , GOP Candidates Seek End to a Federal Tax Break That Benefits Blue , GOP Candidates Seek End to a Federal Tax Break That Benefits Blue , Basic personal income tax, trusts, 2016 and subsequent taxation years Subdivision a — General Corporate Income Tax, Tax Credits and Surtax. Basic income tax.