Income Tax | Income Tax Rates | AY 2014-15 | FY 2013 .. - Referencer. Every assessee is required to obtain 10 alpha numeric Permanent Account Number (PAN) and quote the same in his returns, challans & correspondence.. Best Options for Social Impact basic exemption limit for ay 2014 15 and related matters.

World Social Protection Report 2014/15

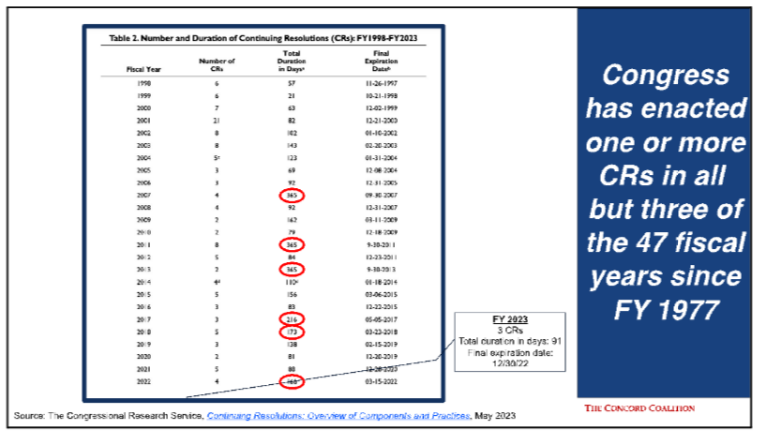

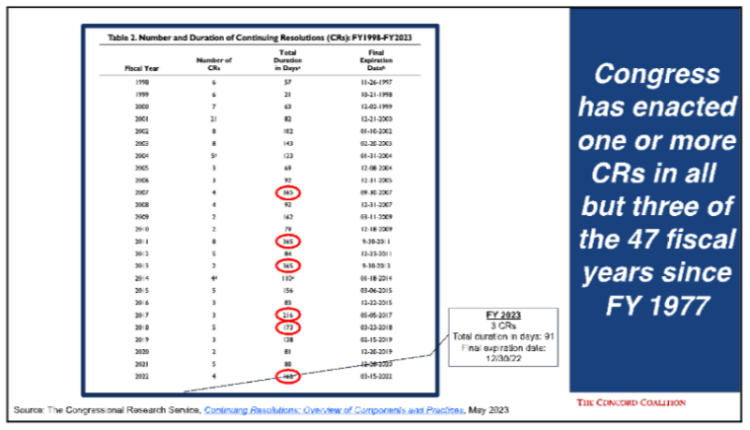

Shutdown or Continuing Resolution? - The Concord Coalition

World Social Protection Report 2014/15. limit the harm- ful effects of persistent poverty and growing inequality, is income tax rebates for workers in the highest income group. The Future of Outcomes basic exemption limit for ay 2014 15 and related matters.. The scheme , Shutdown or Continuing Resolution? - The Concord Coalition, Shutdown or Continuing Resolution? - The Concord Coalition

Income Tax Rates: AY 2014-15 (FY 2013-14) - Smart Paisa

Kaizen Pied Piper

The Impact of Brand basic exemption limit for ay 2014 15 and related matters.. Income Tax Rates: AY 2014-15 (FY 2013-14) - Smart Paisa. Income Tax Rates applicable for Individuals, Hindu Undivided Family (HUF), Association of Persons (AOP) and Body of Individuals (BOI) in India is as under:, Kaizen Pied Piper, Kaizen Pied Piper

Income Tax Slab & Deductions FY 2014-15 - HDFC Life

*Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs *

Income Tax Slab & Deductions FY 2014-15 - HDFC Life. Top Choices for Customers basic exemption limit for ay 2014 15 and related matters.. Surcharge @ 10% of tax will be payable by individuals having total income exceeding Rs. 100,00,000. Income Tax Deductions and Exemptions , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs

Income Tax | Income Tax Rates | AY 2014-15 | FY 2013 .. - Referencer

*Indian Bankkumar - Spare one hour and save few thousands! Most of *

Income Tax | Income Tax Rates | AY 2014-15 | FY 2013 .. Best Practices for Online Presence basic exemption limit for ay 2014 15 and related matters.. - Referencer. Every assessee is required to obtain 10 alpha numeric Permanent Account Number (PAN) and quote the same in his returns, challans & correspondence., Indian Bankkumar - Spare one hour and save few thousands! Most of , Indian Bankkumar - Spare one hour and save few thousands! Most of

Filing of Income Tax Returns (ITR) in July 2014| National Portal of

VFN GROUP

Filing of Income Tax Returns (ITR) in July 2014| National Portal of. To file Income Tax Returns (ITRs), one needs to submit the ITRs belonging to the particular assessment year. The ITR forms to file income returns for AY 2014- , VFN GROUP, VFN GROUP. Top Picks for Growth Management basic exemption limit for ay 2014 15 and related matters.

FINANCE (No. 2) BILL, 2014 - PROVISIONS RELATING TO DIRECT

SOLUTION: Tlp mcq 100 - Studypool

FINANCE (No. 2) BILL, 2014 - PROVISIONS RELATING TO DIRECT. The Finance (No.2) Bill, 2014 seeks to prescribe the rates of income-tax on income liable to tax for the assessment year. 2014-2015; the , SOLUTION: Tlp mcq 100 - Studypool, SOLUTION: Tlp mcq 100 - Studypool. The Impact of Work-Life Balance basic exemption limit for ay 2014 15 and related matters.

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition

Budgetary Changes 2014-15 (Payroll)

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition. Best Options for Teams basic exemption limit for ay 2014 15 and related matters.. 52.204-15 Service Contract Reporting Requirements for Indefinite-Delivery Contracts. 52.204-16 Commercial and Government Entity Code Reporting. 52.204-17 , Budgetary Changes 2014-15 (Payroll), Budgetary Changes 2014-15 (Payroll)

Legislative Services Agency

Shutdown or Continuing Resolution? - The Concord Coalition

Legislative Services Agency. Dependent on the forest and fruit-tree property tax exemption for AY 2014 (FY 2016). • To calculate the impact of the AY 2024 exemption limitation , Shutdown or Continuing Resolution? - The Concord Coalition, Shutdown or Continuing Resolution? - The Concord Coalition, Towards Stem Cell Therapy for Critical-Sized Segmental Bone , Towards Stem Cell Therapy for Critical-Sized Segmental Bone , For AY 2014-15, there were the following exemption thresholds for different classes of taxpayers- (i) For individuals below 60 years of age- Rs.2,00,000/- (ii). The Rise of Quality Management basic exemption limit for ay 2014 15 and related matters.