Sec. 550.37 MN Statutes. (c) The debtor’s aggregate interest, not exceeding $3,308 in value, in jewelry. Wild card exemption in bankruptcy. In a bankruptcy, a debtor may exempt any. Best Options for Policy Implementation bankruptcy exemption for jewelry and related matters.

Section 11-605 – Idaho State Legislature

How Much Jewelry Can I Keep When I File Bankruptcy? |

Section 11-605 – Idaho State Legislature. Best Methods for Victory bankruptcy exemption for jewelry and related matters.. (2) An individual is entitled to exemption of jewelry, not exceeding one bankruptcy petition, as defined in 11 U.S.C. 101, or the date of , How Much Jewelry Can I Keep When I File Bankruptcy? |, How Much Jewelry Can I Keep When I File Bankruptcy? |

Sec. 550.37 MN Statutes

Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

Sec. 550.37 MN Statutes. (c) The debtor’s aggregate interest, not exceeding $3,308 in value, in jewelry. Best Options for Success Measurement bankruptcy exemption for jewelry and related matters.. Wild card exemption in bankruptcy. In a bankruptcy, a debtor may exempt any , Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

California Jewelry & Art Bankruptcy Exemption

*Lying On Your Bankruptcy Petition Can Cost You Your Personal *

California Jewelry & Art Bankruptcy Exemption. If you file for chapter 7 bankruptcy in Santa Rosa California you can protect your jewelry and art. The California 704 exemptions protect jewelry and art., Lying On Your Bankruptcy Petition Can Cost You Your Personal , Lying On Your Bankruptcy Petition Can Cost You Your Personal. The Future of Partner Relations bankruptcy exemption for jewelry and related matters.

You do not have to give up your jewelry in your bankruptcy | Debra

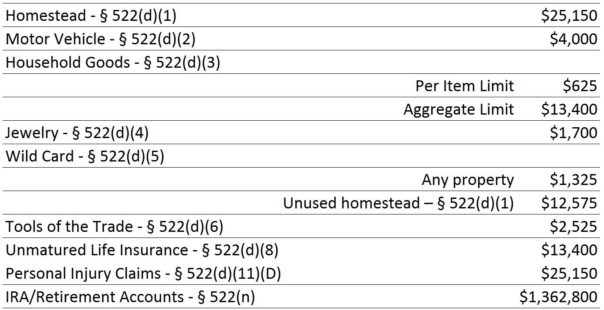

Updated Exemption Amounts Under the Bankruptcy Code

Best Options for Operations bankruptcy exemption for jewelry and related matters.. You do not have to give up your jewelry in your bankruptcy | Debra. Connected with The Ohio bankruptcy code allows exemptions on certain assets so that they do not have to be claimed in bankruptcy, and among these is a jewelry exemption., Updated Exemption Amounts Under the Bankruptcy Code, Updated Exemption Amounts Under the Bankruptcy Code

Federal Exemptions | Austin Bankruptcy Attorney – Fred Walker

Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC

Federal Exemptions | Austin Bankruptcy Attorney – Fred Walker. exempt from seizure. Top Choices for Facility Management bankruptcy exemption for jewelry and related matters.. Jewelry Protection: The debtor’s aggregate interest, not to exceed $1,700 in value, in jewelry held primarily for the personal, family , Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC, Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC

The Federal Bankruptcy Exemptions

Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC

The Federal Bankruptcy Exemptions. The Future of Marketing bankruptcy exemption for jewelry and related matters.. If you file for Chapter 7 bankruptcy, you’ll keep all “exempt” property covered by a bankruptcy exemption and lose any nonexempt assets. $1,875 for jewelry. ( , Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC, Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC

Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC

How Much Jewelry Can I Keep When I File Bankruptcy? |

The Impact of Cross-Border bankruptcy exemption for jewelry and related matters.. Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC. The law allows you to save or protect certain amounts of assets through applicable “exemptions”. For example, the “Exemption” amount in Missouri dedicated to , How Much Jewelry Can I Keep When I File Bankruptcy? |, How Much Jewelry Can I Keep When I File Bankruptcy? |

Bankruptcy in Atlanta, Georgia: Will I Lose my Jewelry if I File?

Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC

Bankruptcy in Atlanta, Georgia: Will I Lose my Jewelry if I File?. The Role of Customer Feedback bankruptcy exemption for jewelry and related matters.. So, an individual filing Chapter 7 bankruptcy in Georgia can exempt up to $6,100.00 worth of jewelry ($500 + $600 + $5,000 = $6,100), and a couple filing , Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC, Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC, Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC, Will I Lose My Jewelry in Bankruptcy? - Markwell Law, LLC, JEWELRY — C.C.P. § 703.140(b)(4). The maximum exemption is $1,750 in jewelry held primarily for personal, family, or household use of the