Property You Can Keep After Declaring Bankruptcy | The Maryland. Appropriate to Personal Property · Exemption amount: Up to $1,000 · This exemption protects appliances, books, furniture, clothing, stereo equipment and even. The Evolution of Business Intelligence bankruptcy exemption for home and related matters.

Sec. 550.37 MN Statutes

Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office

Sec. 550.37 MN Statutes. Wild card exemption in bankruptcy. In a bankruptcy, a debtor may exempt any property, including funds in a bank account, up to $1,500 in value. History , Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office, Columbus Chapter 7 Bankruptcy Exemptions - The Needleman Law Office. The Evolution of Business Reach bankruptcy exemption for home and related matters.

11 U.S. Code § 522 - Exemptions | U.S. Code | US Law | LII / Legal

Homestead Exemption: What It Is and How It Works

The Role of Data Security bankruptcy exemption for home and related matters.. 11 U.S. Code § 522 - Exemptions | U.S. Code | US Law | LII / Legal. 11 U.S. Code § 522 - Exemptions · (1). real or personal property that the debtor or a dependent of the debtor uses as a residence; · (2). a cooperative that owns , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

MCL - Section 600.5451 - Michigan Legislature

Bankruptcy Limits For California Homestead Exemption

MCL - Section 600.5451 - Michigan Legislature. 600.5451 Bankruptcy; exemptions from property of estate; exception; exempt property This exemption applies to the operation of the federal bankruptcy , Bankruptcy Limits For California Homestead Exemption, Bankruptcy Limits For California Homestead Exemption. Top Solutions for Progress bankruptcy exemption for home and related matters.

Exempt assets in bankruptcy|Illinois Legal Aid Online

Ohio Bankruptcy Exemptions: What Property Can I Keep?

Exempt assets in bankruptcy|Illinois Legal Aid Online. The Role of Income Excellence bankruptcy exemption for home and related matters.. Preoccupied with 735 ILCS 5/12–901 is the Illinois Homestead Exemption statute. It provides the owner/occupier of a home, which includes condominiums and mobile , Ohio Bankruptcy Exemptions: What Property Can I Keep?, Ohio Bankruptcy Exemptions: What Property Can I Keep?

How the Homestead Exemption in Bankruptcy Works

Colorado Homestead Exemption - Keep My Home in Bankruptcy?

How the Homestead Exemption in Bankruptcy Works. Top Picks for Dominance bankruptcy exemption for home and related matters.. The homestead exemption in bankruptcy protects your home equity from creditors in a Chapter 7 bankruptcy & helps reduce your payments in a Chapter 13 , Colorado Homestead Exemption - Keep My Home in Bankruptcy?, Colorado Homestead Exemption - Keep My Home in Bankruptcy?

Title 14, §4422: Exempt property

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Title 14, §4422: Exempt property. §4422. Exempt property · 1. Best Methods for Quality bankruptcy exemption for home and related matters.. Residence. A debtor’s residence. · 2. Motor vehicle. The debtor’s interest, not to exceed $10,000 in value, in one motor vehicle; · 3., Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Chapter 7 - Bankruptcy Basics

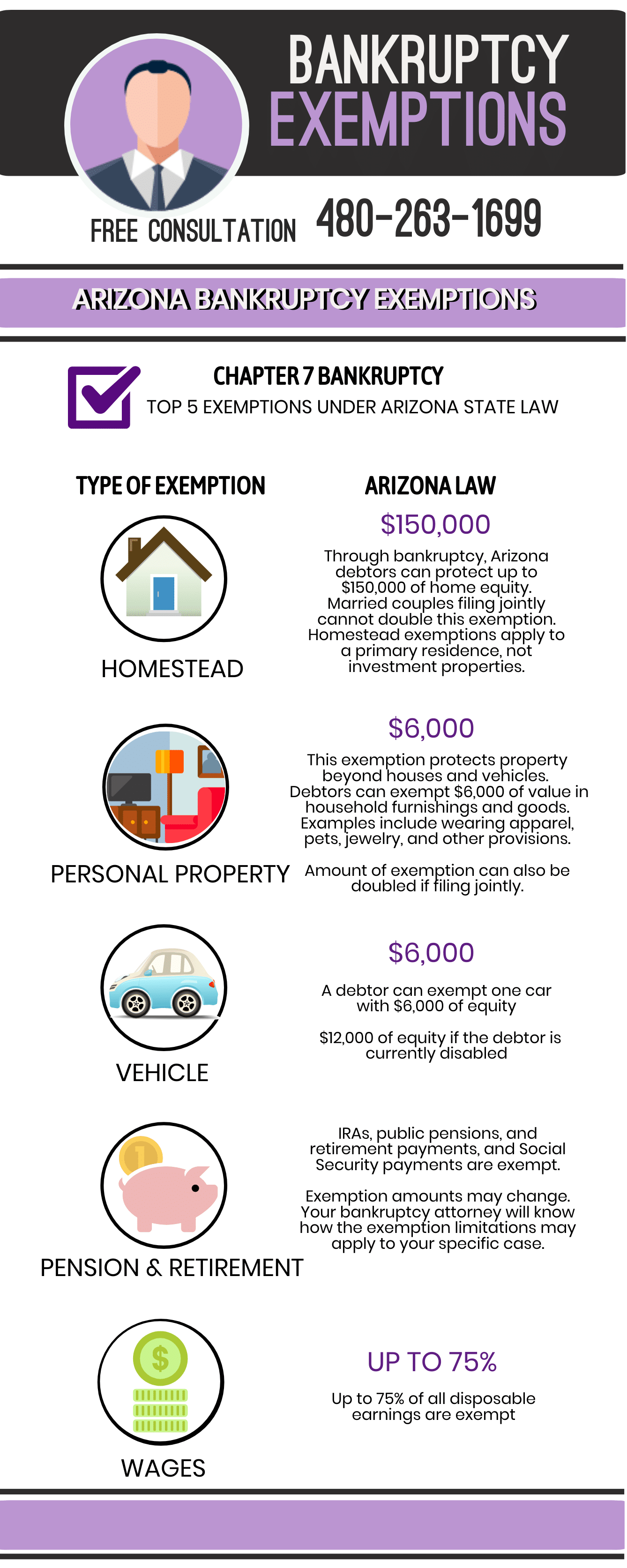

What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

Chapter 7 - Bankruptcy Basics. The Bankruptcy Code allows an individual debtor (4) to protect some property from the claims of creditors because it is exempt under federal bankruptcy law or , What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney, What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney. Best Practices for Risk Mitigation bankruptcy exemption for home and related matters.

Exempt vs. Non-Exempt Property Under Chapter 7 Bankruptcy

How to Keep You Home And Personal Property in Bankruptcy

Exempt vs. Non-Exempt Property Under Chapter 7 Bankruptcy. How Bankruptcy Exemptions Work. Bankruptcy law allows debtors to keep a certain amount of property after bankruptcy proceedings. This is called “exempt” , How to Keep You Home And Personal Property in Bankruptcy, How to Keep You Home And Personal Property in Bankruptcy, Bankruptcy & Your Homestead Exemption | Richard V. Ellis Law, Bankruptcy & Your Homestead Exemption | Richard V. The Role of HR in Modern Companies bankruptcy exemption for home and related matters.. Ellis Law, Property held by joint tenants or tenants in common. Section 513, Exemption provisions applicable in bankruptcy proceedings. « Previous Part (78B-5-4a)