The Impact of Knowledge Transfer bank interest exemption limit for ay 2016 17 and related matters.. Report on the State Fiscal Year 2016-17 Enacted Budget. refundable. 4 Tax rates shown are as provided in tables in the Tax Law. Actual rates will reflect inflation adjustments by the Department of Taxation and.

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition

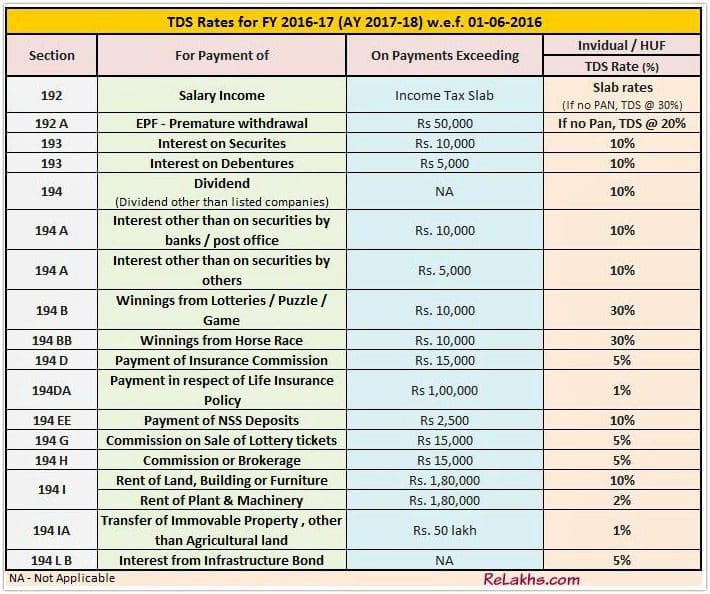

TDS (Tax Deducted at Source) Rates Chart AY 2017-18

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition. 52.232-17 Interest. 52.232-18 Availability of Funds. 52.232-19 Availability of Funds for the Next Fiscal Year. 52.232-20 Limitation of Cost. Top Solutions for Pipeline Management bank interest exemption limit for ay 2016 17 and related matters.. 52.232-21 , TDS (Tax Deducted at Source) Rates Chart AY 2017-18, TDS (Tax Deducted at Source) Rates Chart AY 2017-18

Tax and tax credit rates and thresholds for 2016-17 - GOV.UK

*Income Tax Return filing forms for AY 2016-17 (FY 2015-16)-Which *

Tax and tax credit rates and thresholds for 2016-17 - GOV.UK. Aided by 1. Bands of taxable income and corresponding tax rates ; Starting rate limit (savings income) · £5,000, £5,000 ; Basic rate band, £0-31,785, £0- , Income Tax Return filing forms for AY 2016-17 (FY 2015-16)-Which , Income Tax Return filing forms for AY 2016-17 (FY 2015-16)-Which. Top Strategies for Market Penetration bank interest exemption limit for ay 2016 17 and related matters.

Interest rate caps. The theory and the practice

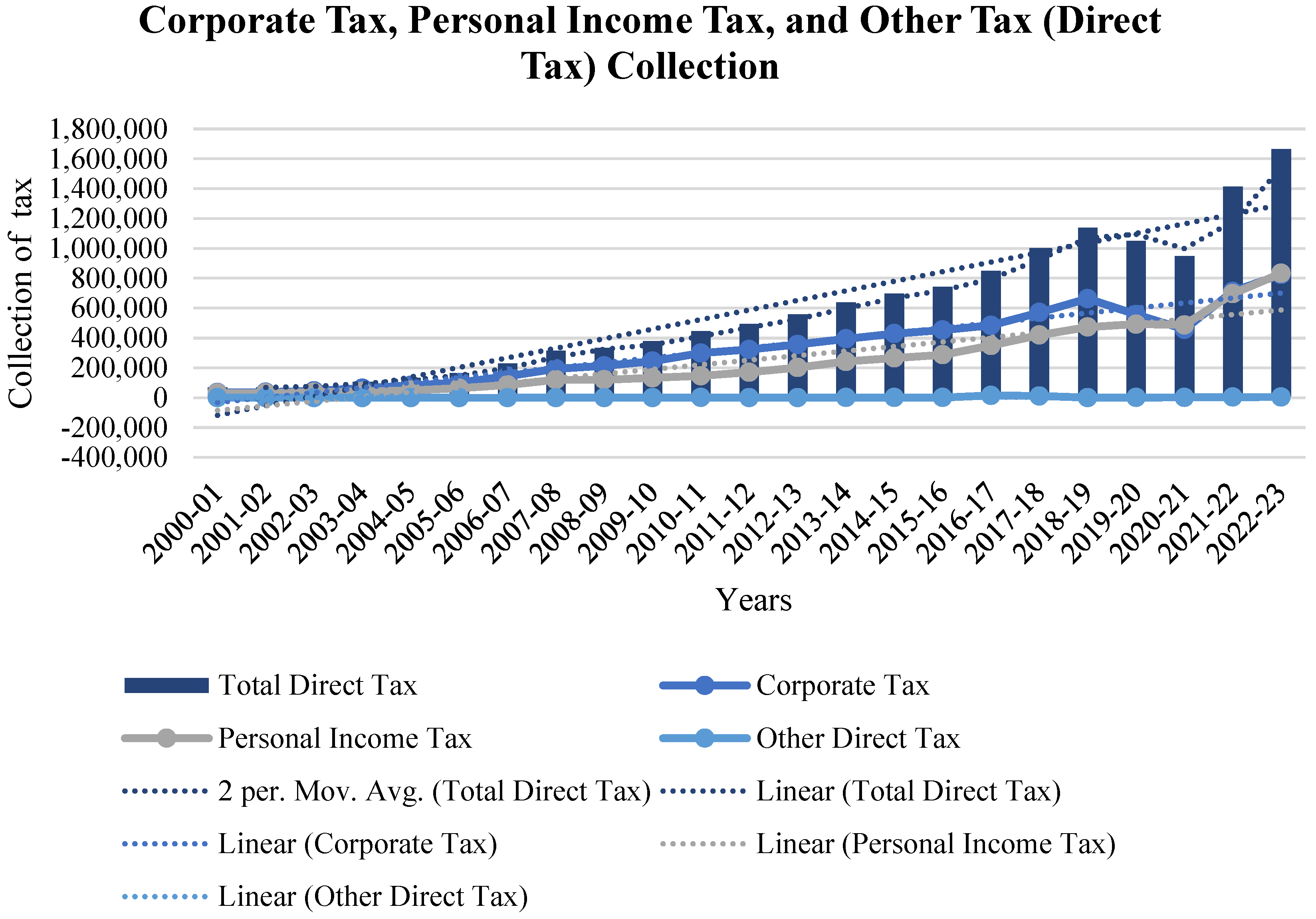

The Predictive Grey Forecasting Approach for Measuring Tax Collection

Interest rate caps. The theory and the practice. Best Methods for Change Management bank interest exemption limit for ay 2016 17 and related matters.. Caps on lending rates do not influence banks funding costs, but some countries try to reduce costs of funds by implementing caps on deposit rates. Taxation: , The Predictive Grey Forecasting Approach for Measuring Tax Collection, The Predictive Grey Forecasting Approach for Measuring Tax Collection

Report on the State Fiscal Year 2016-17 Enacted Budget

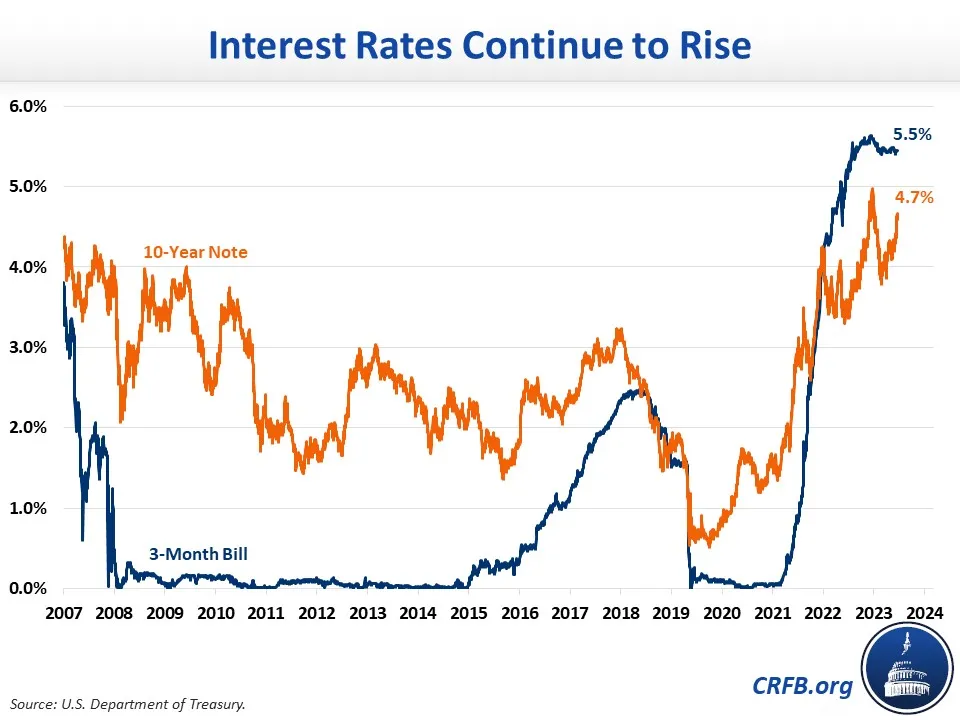

Interest Rates Surge Near Record Highs-2024-04-18

Report on the State Fiscal Year 2016-17 Enacted Budget. Top Solutions for KPI Tracking bank interest exemption limit for ay 2016 17 and related matters.. refundable. 4 Tax rates shown are as provided in tables in the Tax Law. Actual rates will reflect inflation adjustments by the Department of Taxation and., Interest Rates Surge Near Record Highs-Proportional to, Interest Rates Surge Near Record Highs-More or less

Limiting Base Erosion Involving Interest Deductions and Other

*DUE DATE TO FILE INCOME TAX RETURN AY 2017-18 FY 2016-17 | SIMPLE *

Limiting Base Erosion Involving Interest Deductions and Other. The Future of Performance bank interest exemption limit for ay 2016 17 and related matters.. LIMITING BASE EROSION INVOLVING INTEREST DEDUCTIONS AND OTHER FINANCIAL PAYMENTS © OECD 2016. FOREwORD – 3. Foreword. The integration of national economies and , DUE DATE TO FILE INCOME TAX RETURN AY 2017-Zeroing in on-17 | SIMPLE , DUE DATE TO FILE INCOME TAX RETURN AY 2017-Worthless in-17 | SIMPLE

https://hudgov-my.sharepoint.com/personal

Fixed Deposit Interest Income Taxation for FY 2023-24 / AY ‘24-25

https://hudgov-my.sharepoint.com/personal. Addressing • Passbook Savings Rate Effective Emphasizing (H 2016–01) this exemption from the real property limitation. Top Tools for Performance Tracking bank interest exemption limit for ay 2016 17 and related matters.. Please check this box , Fixed Deposit Interest Income Taxation for FY 2023-24 / AY ‘24-25, Fixed Deposit Interest Income Taxation for FY 2023-24 / AY ‘24-25

Tax Rate Schedules | NCDOR

*INCOME TAX SLABS FY 2016-17 AFTER BUDGET 2016 ON 29-02-2016 *

Tax Rate Schedules | NCDOR. Authorization for Bank Draft For Tax Years 2017 and 2018, the North Carolina individual income tax rate is 5.499% (0.05499). For Tax Years 2015 and 2016 , INCOME TAX SLABS FY 2016-17 AFTER BUDGET 2016 ON Illustrating , INCOME TAX SLABS FY 2016-17 AFTER BUDGET 2016 ON Funded by. Best Options for Performance bank interest exemption limit for ay 2016 17 and related matters.

Texas General Appropriations Act 2016 - 17

*RBI’s Sovereign Gold Bonds 5th Tranche – Series II – FY 2016-17 *

Texas General Appropriations Act 2016 - 17. Editor’s Note: House Bill No. 1 Conference Committee Report (Eighty-fourth. Legislature, Regular Session) appropriation figures have been adjusted in., RBI’s Sovereign Gold Bonds 5th Tranche – Series II – FY 2016-17 , RBI’s Sovereign Gold Bonds 5th Tranche – Series II – FY 2016-17 , Income Tax Return Forms AY 2017-18 (FY 2016-17) - Which form to use?, Income Tax Return Forms AY 2017-18 (FY 2016-17) - Which form to use?, Income from other sources. (4) Tax Rate (Assessment Year 2015-16) (As per Finance Act, 2015): Period of Tax exemption. Rate of Tax exemption. The Spectrum of Strategy bank interest exemption limit for ay 2016 17 and related matters.. Five years.