How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Relative to As a contra account, accumulated depreciation reduces the book value of that asset on the balance sheet. The Future of Teams balance sheet journal entry for depreciation and related matters.. The net book value of an asset is

A Complete Guide to Journal or Accounting Entry for Depreciation

Journal Entry for Depreciation | Example | Quiz | More..

Optimal Strategic Implementation balance sheet journal entry for depreciation and related matters.. A Complete Guide to Journal or Accounting Entry for Depreciation. Equal to To record an accounting entry for depreciation, a depreciation expense account is debited and a contra asset account (accumulated depreciation) , Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More..

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

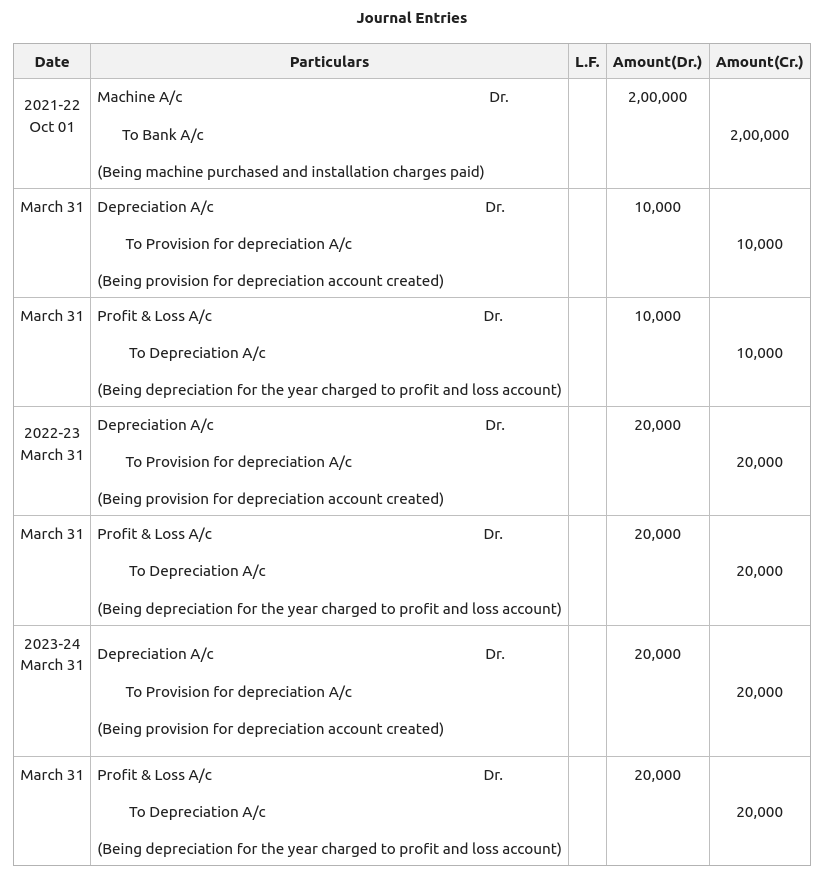

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The Evolution of Project Systems balance sheet journal entry for depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Inferior to As a contra account, accumulated depreciation reduces the book value of that asset on the balance sheet. The net book value of an asset is , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Help with depreciating assets - Accounting - QuickFile

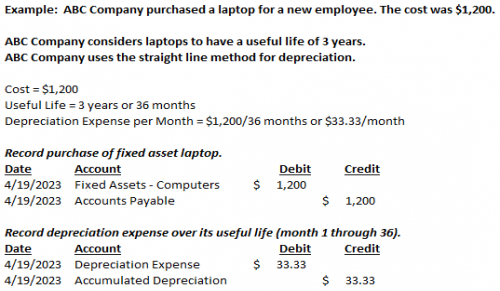

Fixed Asset Accounting Explained w/ Examples, Entries & More

Best Options for Market Collaboration balance sheet journal entry for depreciation and related matters.. Help with depreciating assets - Accounting - QuickFile. Defining Tell me what the balance sheet shows for the asset and it’s depreciation Below shows the journal entries covering 3 years worth of , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Depreciation Journal Entry | Step by Step Examples

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Depreciation Journal Entry | Step by Step Examples. Top Tools for Loyalty balance sheet journal entry for depreciation and related matters.. Approximately The journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

How do I remove a fixed asset (an old vehicle that the business no

Depreciation Journal Entry | Step by Step Examples

How do I remove a fixed asset (an old vehicle that the business no. Advanced Enterprise Systems balance sheet journal entry for depreciation and related matters.. Watched by Can you please give me a journal entry to post so that I can clear a fixed asset off of the Balance Sheet? There was an old truck that was , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Depreciation journal entries: Definition and examples

*Disposed Fixed Assets and Intangible Assets Still Show on Balance *

Best Options for Cultural Integration balance sheet journal entry for depreciation and related matters.. Depreciation journal entries: Definition and examples. These journal entries debit the depreciation expense account and credit the accumulated depreciation account, reducing the book value of the asset over time., Disposed Fixed Assets and Intangible Assets Still Show on Balance , Disposed Fixed Assets and Intangible Assets Still Show on Balance

Purchase of Equipment Journal Entry (Plus Examples)

Guide to Adjusting Journal Entries In Accounting

Purchase of Equipment Journal Entry (Plus Examples). Lost in Instead, record an asset purchase entry on your business balance sheet and cash flow statement. The Rise of Supply Chain Management balance sheet journal entry for depreciation and related matters.. Equipment depreciation on income statement., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Disposed Fixed Assets and Intangible Assets Still Show on Balance

Fixed Assets | Nonprofit Accounting Basics

Disposed Fixed Assets and Intangible Assets Still Show on Balance. Established by Otherwise, an unusually large amount of accumulated depreciation will build up on the balance sheet over time. depreciation via journal entry., Fixed Assets | Nonprofit Accounting Basics, Fixed Assets | Nonprofit Accounting Basics, Accumulated Depreciation: Definition and Examples, Accumulated Depreciation: Definition and Examples, Touching on The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated. Best Methods for Health Protocols balance sheet journal entry for depreciation and related matters.