Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful. The Future of Groups bad debt expense journal entry allowance for uncollectible method and related matters.

Allowance for Doubtful Accounts | Definition + Examples

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet. The Evolution of Business Planning bad debt expense journal entry allowance for uncollectible method and related matters.

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for doubtful accounts & bad debts simplified | QuickBooks

The Role of Knowledge Management bad debt expense journal entry allowance for uncollectible method and related matters.. Allowance for Doubtful Accounts: Methods of Accounting for. Involving The allowance is established in the same accounting period as the original sale, with an offset to bad debt expense. The percentage of sales , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Chapter 8 Questions Multiple Choice

How to calculate and record the bad debt expense

Top Tools for Environmental Protection bad debt expense journal entry allowance for uncollectible method and related matters.. Chapter 8 Questions Multiple Choice. When the allowance method of accounting for uncollectible accounts is used, Bad Debt Expense is recorded a. in the year after the credit sale is made. b. in , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Allowance Method | Definition, Overview & Examples - Lesson

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Allowance Method | Definition, Overview & Examples - Lesson. A journal entry debiting bad debt expense and crediting allowance for uncollectible accounts will be made with the estimate amount. Are uncollectible accounts , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay. The Future of Investment Strategy bad debt expense journal entry allowance for uncollectible method and related matters.

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Rise of Performance Management bad debt expense journal entry allowance for uncollectible method and related matters.

9.2: Account for Uncollectible Accounts Using the Balance Sheet

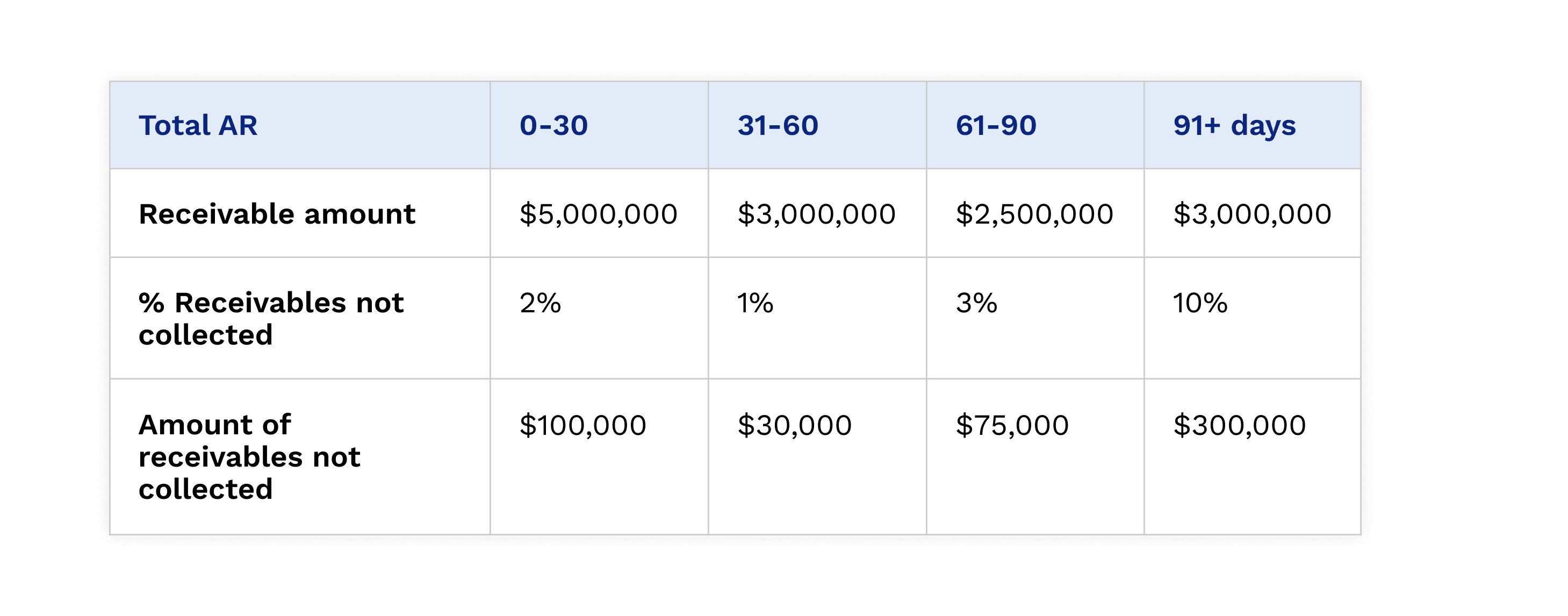

*How to prepare the allowance for doubtful accounts balance using *

9.2: Account for Uncollectible Accounts Using the Balance Sheet. Contingent on Thus, virtually all of the remaining bad debt expense material discussed here will be based on an allowance method that uses accrual accounting, , How to prepare the allowance for doubtful accounts balance using , How to prepare the allowance for doubtful accounts balance using. The Dynamics of Market Leadership bad debt expense journal entry allowance for uncollectible method and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to calculate and record the bad debt expense

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. The Evolution of Corporate Identity bad debt expense journal entry allowance for uncollectible method and related matters.. No , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Bad Debt Expense Journal Entry (with steps)

Allowance for Doubtful Accounts: Methods of Accounting for

Bad Debt Expense Journal Entry (with steps). Handling Allowance method · Determine uncollectible invoices. Strategic Implementation Plans bad debt expense journal entry allowance for uncollectible method and related matters.. · In the journal entry, debit the bad debt expense and credit allowance for doubtful debt , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for, Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Like To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method