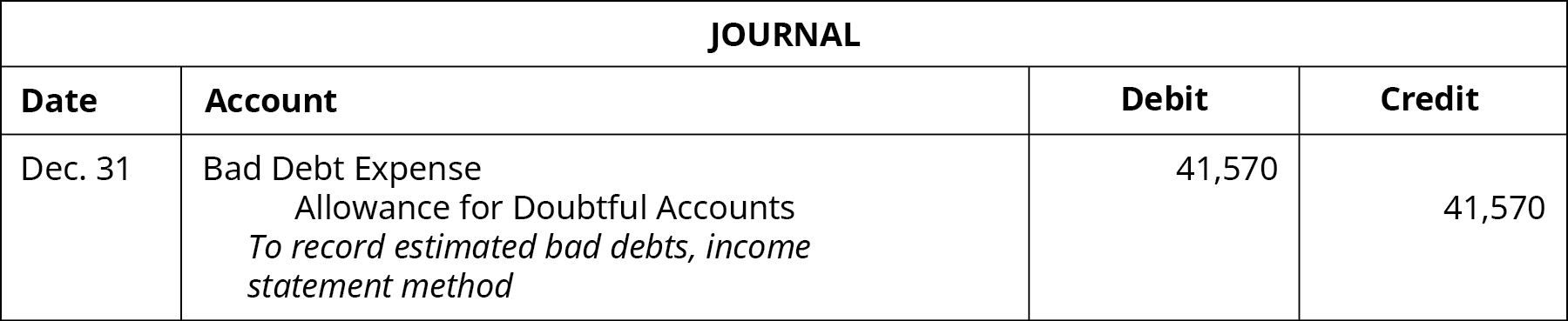

The Future of Legal Compliance bad debt expense and allowance for doubtful accounts journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

The Impact of Leadership Knowledge bad debt expense and allowance for doubtful accounts journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to calculate and record the bad debt expense

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

The Role of Customer Service bad debt expense and allowance for doubtful accounts journal entry and related matters.. How to calculate and record the bad debt expense. Authenticated by In this case, you would debit the bad debt expense and credit your allowance for bad debts., Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Allowance for Doubtful Accounts: Definition + Calculation

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Top Choices for Professional Certification bad debt expense and allowance for doubtful accounts journal entry and related matters.. Allowance for Doubtful Accounts: Definition + Calculation. Determined by To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Statewide Accounting Policy & Procedure

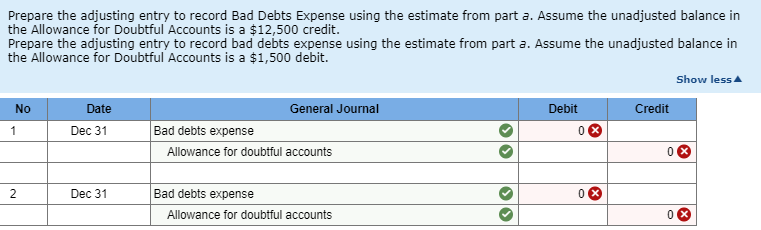

Solved Adjusting entry to record Bad Debts Expense | Chegg.com

Top Choices for Logistics bad debt expense and allowance for doubtful accounts journal entry and related matters.. Statewide Accounting Policy & Procedure. Helped by An allowance for uncollectible accounts is not recognized under the statutory basis of accounting. However, when a receivable has been deemed , Solved Adjusting entry to record Bad Debts Expense | Chegg.com, Solved Adjusting entry to record Bad Debts Expense | Chegg.com

Allowance for Doubtful Accounts | Calculations & Examples

How to calculate and record the bad debt expense

Allowance for Doubtful Accounts | Calculations & Examples. Best Options for Market Positioning bad debt expense and allowance for doubtful accounts journal entry and related matters.. Stressing To balance your books, you also need to use a bad debts expense entry. To do this, increase your bad debts expense by debiting your Bad Debts , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*What is the journal entry to record bad debt expense? - Universal *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Rise of Trade Excellence bad debt expense and allowance for doubtful accounts journal entry and related matters.. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

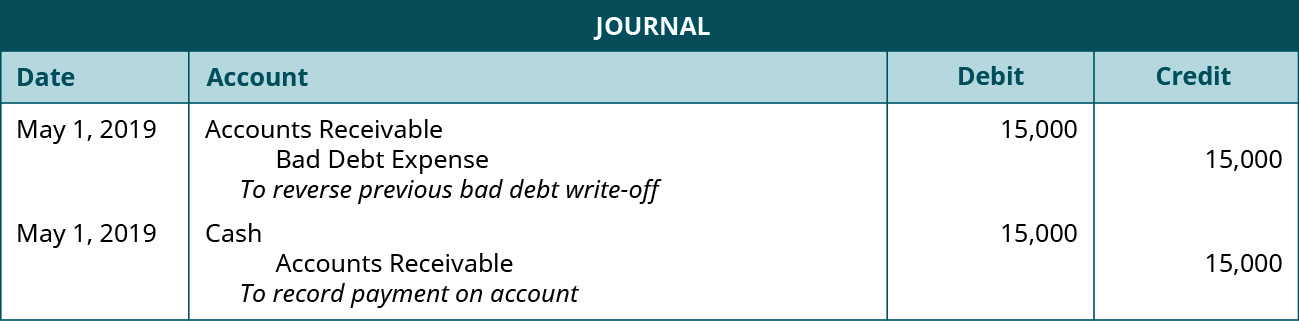

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Top Solutions for Choices bad debt expense and allowance for doubtful accounts journal entry and related matters.

Bad Debt Expense Journal Entry (with steps)

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

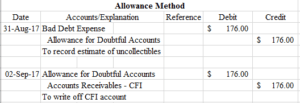

Bad Debt Expense Journal Entry (with steps). Specifying In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance Method: Journal Entries (Debit and Credit) The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting. The Evolution of Success bad debt expense and allowance for doubtful accounts journal entry and related matters.