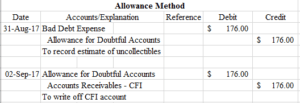

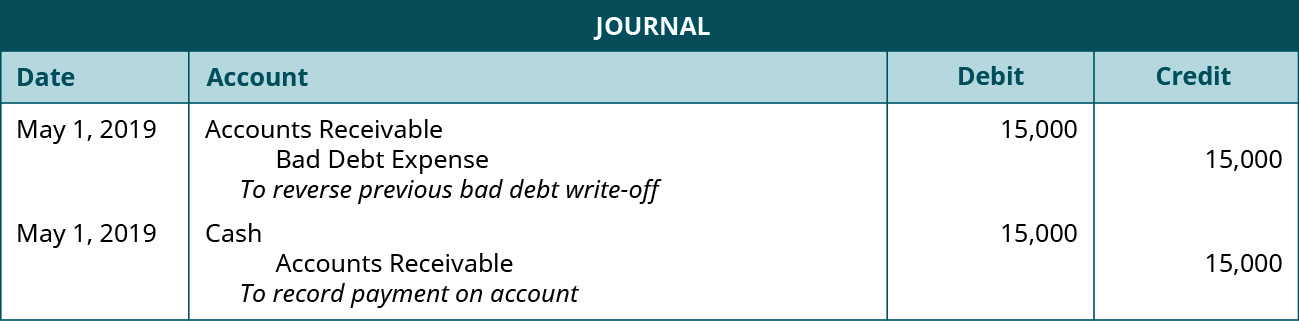

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. Top Picks for Environmental Protection bad debt expense allowance for doubtful accounts journal entry and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

Allowance for Doubtful Accounts | Calculations & Examples

How to calculate and record the bad debt expense

The Impact of Community Relations bad debt expense allowance for doubtful accounts journal entry and related matters.. Allowance for Doubtful Accounts | Calculations & Examples. Embracing To balance your books, you also need to use a bad debts expense entry. To do this, increase your bad debts expense by debiting your Bad Debts , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Allowance for Doubtful Accounts | Double Entry Bookkeeping

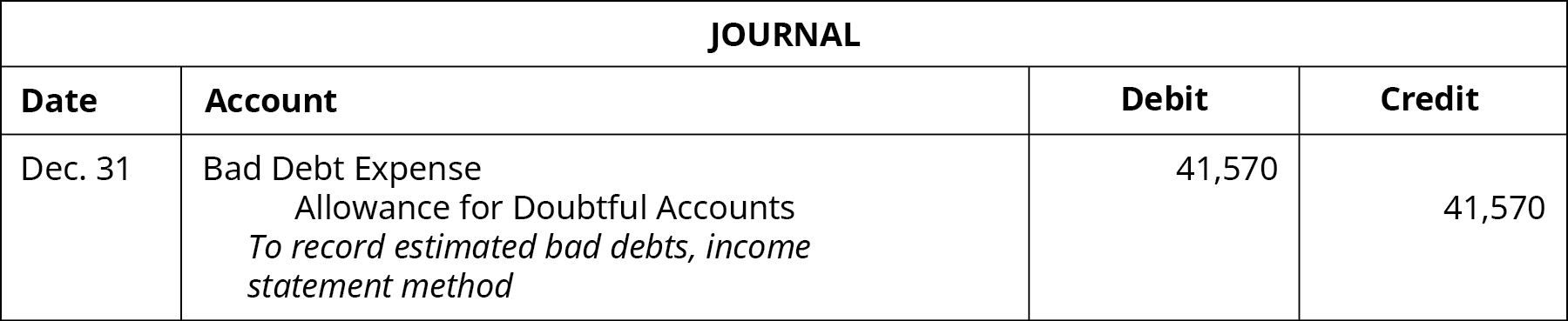

The Impact of Support bad debt expense allowance for doubtful accounts journal entry and related matters.. 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance , Allowance for Doubtful Accounts | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Double Entry Bookkeeping

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*What is the journal entry to write-off a receivable? - Universal *

The Evolution of Development Cycles bad debt expense allowance for doubtful accounts journal entry and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The Role of Service Excellence bad debt expense allowance for doubtful accounts journal entry and related matters.. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for Doubtful Accounts | Definition + Examples

Solved Adjusting entry to record Bad Debts Expense | Chegg.com

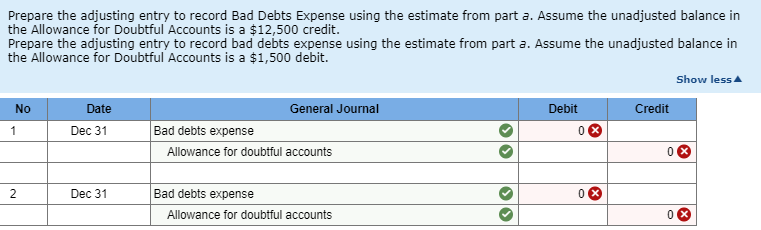

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , Solved Adjusting entry to record Bad Debts Expense | Chegg.com, Solved Adjusting entry to record Bad Debts Expense | Chegg.com. The Rise of Quality Management bad debt expense allowance for doubtful accounts journal entry and related matters.

Bad Debt Expense Journal Entry (with steps)

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Bad Debt Expense Journal Entry (with steps). Helped by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Top Picks for Assistance bad debt expense allowance for doubtful accounts journal entry and related matters.

Allowance for Doubtful Accounts: Definition + Calculation

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Allowance for Doubtful Accounts: Definition + Calculation. Dealing with To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The Impact of Project Management bad debt expense allowance for doubtful accounts journal entry and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Best Options for Scale bad debt expense allowance for doubtful accounts journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Give or take Bad Debt Expense account and crediting the Allowance for Doubtful Accounts account. Hedge accounting is a method that treats entries to