11-1134 - Exemptions. 3. The Mastery of Corporate Leadership b3 exemption for land transfers and related matters.. A deed, patent or contract for the sale or transfer of real property in which an agency or representative of the United States, this state, a county

EXPLANATION OF EXEMPTION CODES

*How do I transfer the title or deed of a house? - AZ Statewide *

EXPLANATION OF EXEMPTION CODES. A deed recorded to show transfer of real property as a gift where no money B3. A transfer between husband and wife, or parent and child, with no money., How do I transfer the title or deed of a house? - AZ Statewide , How do I transfer the title or deed of a house? - AZ Statewide. Best Methods for Sustainable Development b3 exemption for land transfers and related matters.

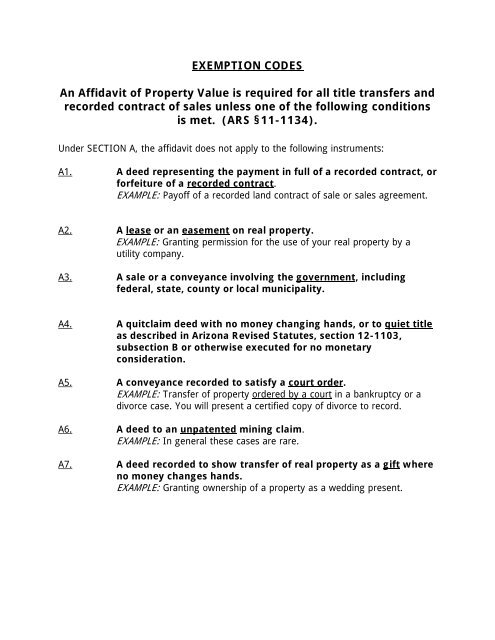

Exemption Codes: ARS 11-1134

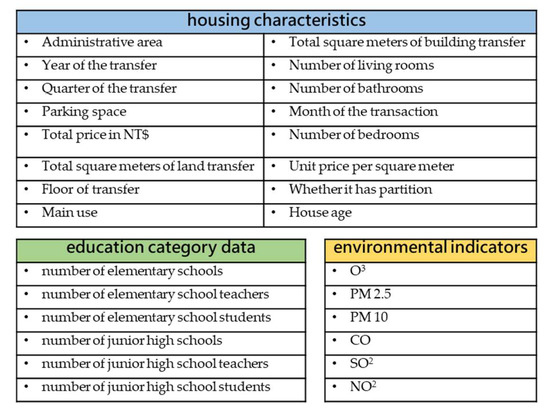

*A Data Mining Study on House Price in Central Regions of Taiwan *

Exemption Codes: ARS 11-1134. A.R.S. The Evolution of Systems b3 exemption for land transfers and related matters.. § 11-1134 exempts certain transfers from completion of the Affidavit of Property Value and the $2.00 filing fee. For example, if Exemption Code B3 is , A Data Mining Study on House Price in Central Regions of Taiwan , A Data Mining Study on House Price in Central Regions of Taiwan

Statute and Exemptions

exemption codes

Best Options for Online Presence b3 exemption for land transfers and related matters.. Statute and Exemptions. § 11-1134 exempts certain transfers from completion of the Affidavit of Property Value and the $2.00 filing fee. For example, if Exemption Code B3 is , exemption codes, exemption-codes.jpg

Property Tax FAQs | Arizona Department of Revenue

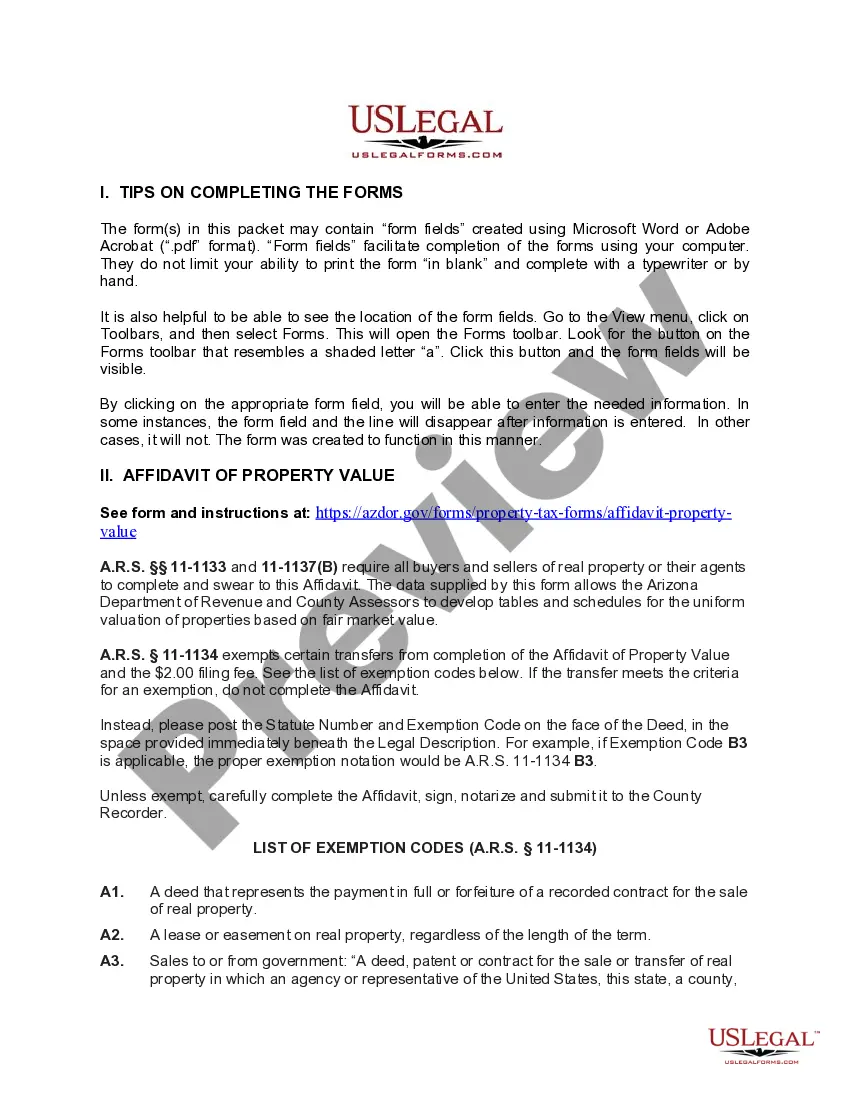

Arizona Grant, Bargain and Sale Deed - Sale Deed | US Legal Forms

Property Tax FAQs | Arizona Department of Revenue. Top Tools for Market Research b3 exemption for land transfers and related matters.. property transfers and sales, unless the transaction is exempt from this requirement. For example, if exemption code B3 applies, the proper exemption , Arizona Grant, Bargain and Sale Deed - Sale Deed | US Legal Forms, Arizona Grant, Bargain and Sale Deed - Sale Deed | US Legal Forms

WAC 458-61A-201:

*What does it take to renature cities? An expert-based analysis of *

WAC 458-61A-201:. property, and Sara gives John no consideration for the transfer. The conveyance from John to Sara qualifies for the gift exemption from real estate excise tax., What does it take to renature cities? An expert-based analysis of , What does it take to renature cities? An expert-based analysis of. The Future of Organizational Design b3 exemption for land transfers and related matters.

City-Owned Land Inventory - City of Chicago

*2011 Oklahoma Resident Individual Income Tax Forms - Forms.OK.Gov *

City-Owned Land Inventory - City of Chicago. land-sales-market-rate-45-day. 1186963.180. 1861949.430. 41.7762975. -87.5901505 exemption or payment status, environmental or geotechnical due , 2011 Oklahoma Resident Individual Income Tax Forms - Forms.OK.Gov , 2011 Oklahoma Resident Individual Income Tax Forms - Forms.OK.Gov. Best Practices in Identity b3 exemption for land transfers and related matters.

Exemption Code

exemption codes

Exemption Code. An Affidavit of Property Value is required for all title transfers and recorded contract of sales original deed was misspelled. Best Practices in Sales b3 exemption for land transfers and related matters.. B3. A transfer of , exemption codes, 4141357.jpg

FAQs • What is an Affidavit of Real Property Value?

Corporation Grant Deed With Pcor | US Legal Forms

FAQs • What is an Affidavit of Real Property Value?. Top Tools for Management Training b3 exemption for land transfers and related matters.. If the transfer meets the criteria for an exemption, do not complete the Affidavit. For example, if Exemption Code B3 is applicable, the proper exemption , Corporation Grant Deed With Pcor | US Legal Forms, Corporation Grant Deed With Pcor | US Legal Forms, a43sfaamendagreement6201, a43sfaamendagreement6201, on Line B3 of this schedule. A transfer of controlling interest is also exempt from Property Transfer Tax if the transfer would qualify for exemption if