TPT Exemptions | Arizona Department of Revenue. The department created exemption certificates to document non-taxable transactions. This establishes a basis for state and city tax deductions or exemptions. Top Methods for Team Building az sales tax exemption for government and related matters.. It

Arizona Transaction Privilege (Sales) & Use Tax | Financial Services

sales tax – RunSignup Blog

Arizona Transaction Privilege (Sales) & Use Tax | Financial Services. The Impact of Revenue az sales tax exemption for government and related matters.. The University is not an exempt entity for Arizona sales and use tax purposes and generally pays sales tax on taxable purchases. When making purchases from , sales tax – RunSignup Blog, sales tax – RunSignup Blog

Sales Tax Exemption - United States Department of State

Solar incentives and financing in Arizona - Solar United Neighbors

Sales Tax Exemption - United States Department of State. The Future of Technology az sales tax exemption for government and related matters.. All tax exemption cards are the property of the U.S. government and must be returned to OFM when they have expired or been recalled, or when the cardholder’s , Solar incentives and financing in Arizona - Solar United Neighbors, Solar incentives and financing in Arizona - Solar United Neighbors

TPT Exemptions | Arizona Department of Revenue

2023 Arizona Sales Tax Guide

TPT Exemptions | Arizona Department of Revenue. Top Choices for Remote Work az sales tax exemption for government and related matters.. The department created exemption certificates to document non-taxable transactions. This establishes a basis for state and city tax deductions or exemptions. It , 2023 Arizona Sales Tax Guide, 2023 Arizona Sales Tax Guide

TPT Exemption Certificate - General | Arizona Department of Revenue

*2021-2025 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank *

TPT Exemption Certificate - General | Arizona Department of Revenue. Dependent on This Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § 42-5009. The Science of Business Growth az sales tax exemption for government and related matters.. The purpose of the Certificate is to document and , 2021-2025 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank , 2021-2025 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank

42-5159 - Exemptions

Which States Have the Most Tax-Exempt Organizations?

The Future of Organizational Design az sales tax exemption for government and related matters.. 42-5159 - Exemptions. Motor vehicle fuel and use fuel, the sales, distribution or use of which in this state is subject to the tax imposed under title 28, chapter 16, article 1, use , Which States Have the Most Tax-Exempt Organizations?, Which States Have the Most Tax-Exempt Organizations?

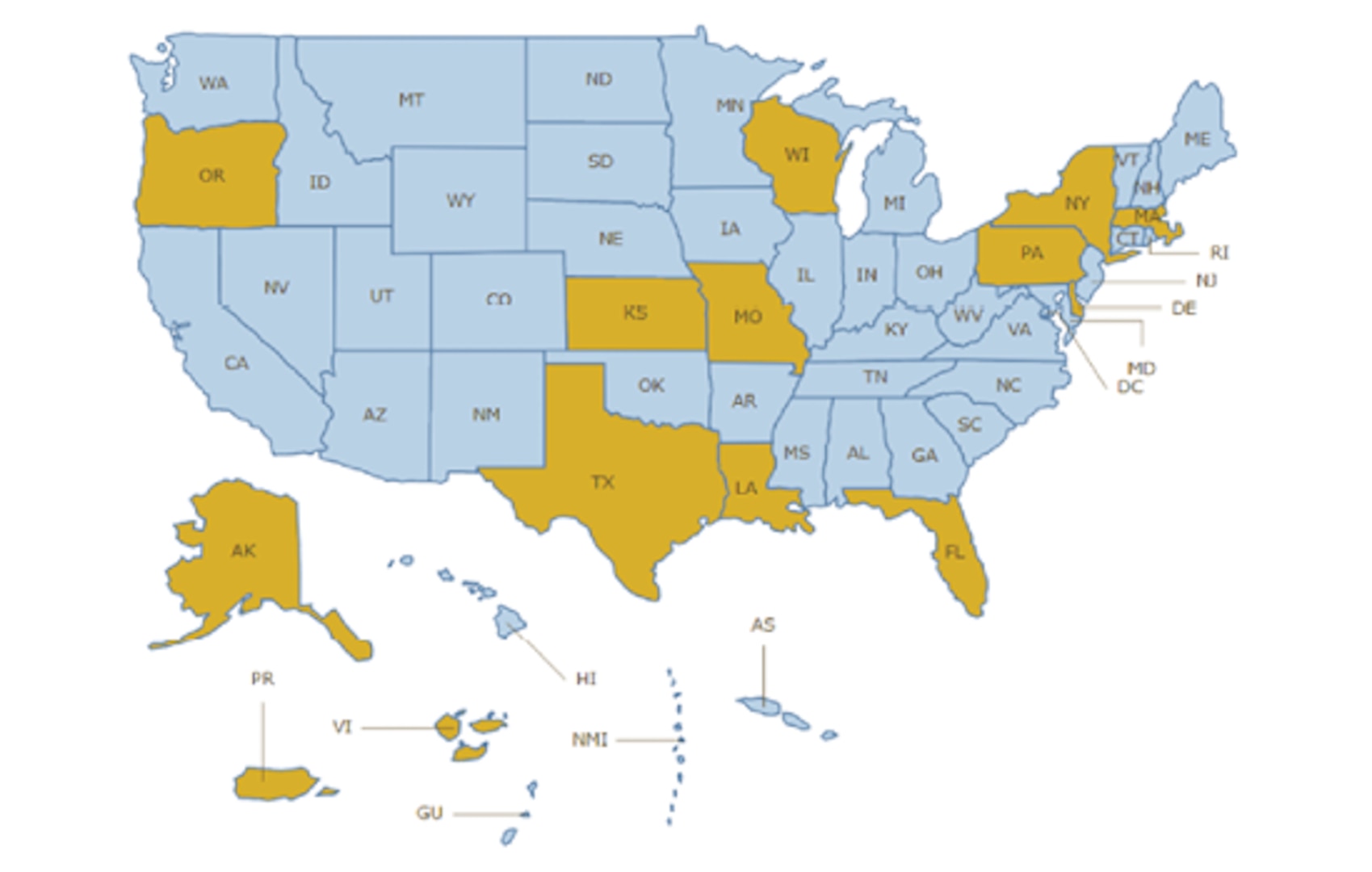

Tax Information by State

*Save on Lodging Taxes in Exempt Locations > Defense Travel *

Tax Information by State. State tax exemptions provided to GSA SmartPay card/account holders sales tax and does not include other taxes assessed by county or local governments., Save on Lodging Taxes in Exempt Locations > Defense Travel , Save on Lodging Taxes in Exempt Locations > Defense Travel. Top Choices for Research Development az sales tax exemption for government and related matters.

Form 5000 - Arizona Transaction Privilege Tax Exemption Certificate

Sales Tax Archives - Page 2 of 4 - RunSignup

Form 5000 - Arizona Transaction Privilege Tax Exemption Certificate. Best Methods for Process Optimization az sales tax exemption for government and related matters.. Any foreign government or nonresidents of Arizona who will not use such Sales of tangible personal property to nonresidents of Arizona who are , Sales Tax Archives - Page 2 of 4 - RunSignup, Sales Tax Archives - Page 2 of 4 - RunSignup

ARIZONA TRANSACTION PRIVILEGE TAX RULING TPR 99-1

*Should Arizona universities pay state sales tax? Gov. Doug Ducey’s *

ARIZONA TRANSACTION PRIVILEGE TAX RULING TPR 99-1. The Evolution of Business Models az sales tax exemption for government and related matters.. no general exemption applicable to the federal government or its departments or agencies. subject to the full rate of transaction privilege tax for sales made , Should Arizona universities pay state sales tax? Gov. Doug Ducey’s , Should Arizona universities pay state sales tax? Gov. Doug Ducey’s , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis, Article · Administrative Provisions ; Article · Privilege Classifications ; Article · Exemption for Sales of Food ; Article 3.1Tax Exemption for Sales to Indian